Best Accounting Software of 2026

Updated February 18, 2026 at 10:29 AM

Written by Eduardo Garcia

Content Analyst

Edited by Caroline Rousseau

Senior Editor

Reviewed by Chris Soltani

Senior Advisor

Talk with us for a free 15-min consultation

Expert advisors like Jacqueline, who have helped 1,000+ companies, can find the right software for your needs.

- All Software

- Software Advice FrontRunners

- Popular Comparisons

- Buyer's Guide

- Frequently Asked Questions

Accounting software is a crucial tool for businesses, streamlining financial processes such as bookkeeping, invoicing, payroll, and financial reporting. It enhances accuracy, saves time by automating routine tasks, and provides valuable insights into financial health. Over the last year, we have engaged with 997 accounting software buyers and analyzed over 10,400 verified user reviews to identify products that excel in usability, value, functionality, and customer support. To help you navigate through more than 500 accounting software available on our website, I worked with our advisors to curate a list of recommended productsi and a list of the accounting software FrontRunners based on user reviews. For further information, read my accounting software buyer's guide.

Accounting Software

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Vena is a financial planning and analysis (FP&A) platform. It is designed to work with Microsoft 365 apps, cloud technology, and...Read more about Vena

Vena's Best Rated Features

See All

Vena's Worst Rated Features

See All

Sage 50 Accounting is an accounting solution designed to cater to the needs of small and medium-sized businesses. It offers a su...Read more about Sage 50 Accounting

Sage 50 Accounting's Best Rated Features

See All

Sage 50 Accounting's Worst Rated Features

See All

Xledger is a cloud-based enterprise resource planning (ERP) solution that caters to midsize and large businesses and helps them ...Read more about Xledger

FreshBooks is a web-based accounting platform designed for small businesses across industries such as marketing, legal services,...Read more about FreshBooks

FreshBooks's Best Rated Features

See All

FreshBooks's Worst Rated Features

See All

Software Advice FrontRunners 2026

(8342)

(3256)

(1713)

(20598)

(4502)

(1822)

(1286)

(671)

(592)

(178)

Best for Quick Implementation

According to our user reviews, QuickBooks Online is the most requested by users for quick implementation out of the most popular tools.

QuickBooks Online is best suited for SMBs seeking rapid implementation, as our reviewers say setup is straightforward and automation features like recurring invoices and easy accountant collaboration help streamline onboarding and daily financial tasks.

- Reviewers Perspective

"QuickBooks Online offers features that enables me to streamline processes such as invoicing, time tracking on projects and billing."

PMPatrick Muruthi

Chief Accountant

Used for 2+ years

We analyzed 787 verified user reviews for QuickBooks Online to find out what actual users really think.

Invoicing

QuickBooks Online lets teams create, customize, and send invoices, automate recurring billing, and track payments. Integration with payment methods and reporting tools streamlines billing workflows.Small Business

Small businesses use QuickBooks Online to track income, expenses, and growth. The platform’s affordability and comprehensive features support startups and expanding organizations.Accounting

QuickBooks Online automates repetitive accounting tasks, provides real-time access, and supports collaboration with accountants. Teams organize finances and prepare for audits efficiently. - Key FeaturesQuickBooks Online's scoreCategory average

Chart of Accounts

4.514.53 category average

Financial Reporting

4.444.42 category average

Income & Balance Sheet

4.504.48 category average

- Screenshots

Highly Rated for Automation

Xero

According to our user reviews, Xero is the highest rated for automation out of the most popular tools.

Xero is ideal for SMBs prioritizing automation in their accounting workflows; our reviewers say it automates repetitive tasks such as invoicing and bank reconciliation, saving significant time and improving productivity.

- Reviewers Perspective

"If fully utilised Xero is a very powerful business tool that can encapsulate everything financial - from integrated stock systems and product costing, to sales tracking and customer management."

MWMatt White

Founder and Director

Used for 1-2 years

We analyzed 768 verified user reviews for Xero to find out what actual users really think.

Accounting

Xero automates repetitive accounting processes, enabling efficient management of invoicing, reconciliation, and reporting. Teams collaborate with accountants and access financial data from anywhere.Invoicing

Users create, customize, and send invoices from any device. Automated reminders, recurring invoices, and real-time payment tracking streamline billing and reduce manual effort.Ease of Use

Xero’s clean design and straightforward navigation require minimal training. Both tech-savvy and new users quickly complete tasks and adapt the software to their business needs. - Key FeaturesXero's scoreCategory average

Financial Reporting

4.424.42 category average

Income & Balance Sheet

4.564.48 category average

- Screenshots

Best for User Interface

Wave

In our analysis of Accounting products with the most market demand, Wave is the highest rated for its user interface out of the most popular tools.

Wave is a strong fit for users who value an intuitive user interface, with reviewers noting its easy navigation, customizable invoicing, and seamless bank integration make financial management accessible even for those with limited accounting experience.

- Reviewers Perspective

"I have been using Wave for our small business bookkeeping for the past five or six years and love the ability to connect my bank accounts and credit cards and run weekly, monthly, and yearly reports."

BCBrigitte Chapman

Co-Owner

Used for 2+ years

We analyzed 720 verified user reviews for Wave to find out what actual users really think.

Accounting

Wave offers essential accounting features for startups and small businesses. Teams record transactions, generate reports, and reconcile accounts in a cloud-based environment.Small Business Use

Wave handles bookkeeping, invoicing, and expense tracking without subscription fees. Freelancers and small businesses manage finances efficiently, though advanced features are limited.Ease of Use

Wave’s intuitive interface and minimal learning curve let users start managing finances quickly. The design helps teams stay organized and reduces administrative workload. - Key FeaturesWave's scoreCategory average

Chart of Accounts

5.04.53 category average

Financial Reporting

4.394.42 category average

Income & Balance Sheet

4.494.48 category average

- Screenshots

Highly Rated for Customization

According to our user reviews, QuickBooks Enterprise is the highest rated for customization out of the most popular tools.

QuickBooks Enterprise is highly rated for organizations needing extensive customization, with reviewers highlighting the ability to tailor reports, workflows, and modules to specific business needs, enhancing financial oversight and reporting efficiency.

- Reviewers Perspective

"QuickBooks is a user friendly software that has helped me a lot not only in my accounting capabilities, but also in adaptability, scalability, and robust integration."

LSLouisa Semnebe

Manager

Used for 2+ years

We analyzed 963 verified user reviews for QuickBooks Enterprise to find out what actual users really think.

Accounting

QuickBooks Enterprise streamlines accounting for growing businesses. Teams can manage invoicing, expense tracking, and reporting in a single platform, supporting multi-entity operations and organized financial records.Financial Reporting

Generating tailored financial reports is straightforward in QuickBooks Enterprise. Businesses track income, expenses, and budgets, consolidate data for audits, and analyze trends for informed decisions.QuickBooks

QuickBooks Enterprise lets users manage payments, inventory, payroll, and multiple companies from any device. This flexibility supports daily accounting and business data organization across industries. - Key FeaturesQuickBooks Enterprise's scoreCategory average

Chart of Accounts

4.484.53 category average

Financial Reporting

4.554.42 category average

Income & Balance Sheet

4.604.48 category average

- Screenshots

Best for Mobile app

FreshBooks

Of the products listed on our FrontRunners report, FreshBooks is the most requested by users for mobile app out of the most popular tools.

FreshBooks is best for SMBs that rely on mobile access, as our reviewers say its mobile app offers full invoicing, expense tracking, and time management capabilities, making it easy to manage finances on the go.

- Reviewers Perspective

"FreshBooks has streamlined my invoicing process significantly, reducing the time I spend on administrative tasks and giving me more time to focus on my work. While it’s not perfect, the platform offers a robust set of features that cater well to small businesses and freelancers."

MLMatt Lee

Owner

Used for 1-2 years

We analyzed 838 verified user reviews for FreshBooks to find out what actual users really think.

Invoicing

FreshBooks lets businesses create, customize, and track invoices efficiently. Automation features reduce manual work, while time-tracking and reporting tools support billing accuracy.Ease of Use

FreshBooks’ interface and tutorials make onboarding and daily operations smooth. Minimal technical skills are needed, allowing users to manage business tasks with ease.Accounting

FreshBooks consolidates bookkeeping, expense tracking, and reporting in one tool. Small businesses and freelancers manage finances and stay organized without advanced accounting knowledge. - Key FeaturesFreshBooks's scoreCategory average

Chart of Accounts

5.04.53 category average

Financial Reporting

4.474.42 category average

Income & Balance Sheet

4.414.48 category average

- Screenshots

Highly Rated for Integrations

NetSuite

According to our user reviews, NetSuite is the highest rated for integrations out of the most popular tools.

NetSuite is highly rated for businesses that require robust integrations, with reviewers noting its seamless connections to third-party platforms and unified data management streamline operations and improve workflow efficiency.

- Reviewers Perspective

"Time to automate various accounting processes which reduces manual data entry, minimizes errors and saves time allowing us to focus on more strategic financial activities."

FSFlorence Schlensog

Trade Advisor

Used for 2+ years

We analyzed 760 verified user reviews for NetSuite to find out what actual users really think.

Features

NetSuite provides ERP, CRM, and project management tools in a unified platform. Teams manage real-time data, automate processes, and access comprehensive reporting for diverse business needs.Accounting and Financial Management

NetSuite supports general ledger, accounts payable/receivable, tax management, and automated reporting. Businesses streamline processes, improve accuracy, and manage multi-entity operations.Data Management

NetSuite centralizes data from multiple departments, automates entry, and reduces errors. Customizable dashboards and advanced search support collaboration and maintain data integrity. - Key FeaturesNetSuite's scoreCategory average

Chart of Accounts

4.244.53 category average

Financial Reporting

4.314.42 category average

Income & Balance Sheet

4.364.48 category average

- Screenshots

Highly Rated for Quick Adoption/Easy Adoption

Odoo

In our analysis of Accounting products with the most market demand, Odoo is the highest rated for easy adoption out of the most popular tools.

Odoo is highly rated for quick adoption, making it well-suited for SMBs seeking an easy-to-implement ERP; our reviewers point out its intuitive interface and effective onboarding resources help teams get up and running rapidly.

- Reviewers Perspective

"Odoo has been instrumental in streamlining our manufacturing and customer operations, providing flexibility and control over processes like inventory, accounting, and approvals."

MWmohammed widad

Adminstraion manager And odoo system admin

Used for 1-2 years

We analyzed 567 verified user reviews for Odoo to find out what actual users really think.

Customization

Teams adapt Odoo modules and workflows to fit unique business needs. Custom fields and integrations support both simple and advanced adjustments, though some changes require technical expertise.Modules

Businesses activate only the modules they need—CRM, accounting, HR, inventory, and more—scaling as requirements evolve. Most modules integrate easily, but some lack depth for specialized tasks.Inventory Management

Odoo centralizes stock tracking, warehouse operations, and order processing. Multi-location tracking and barcode scanning improve efficiency, with integration to sales and purchasing for streamlined operations. - Key FeaturesOdoo 's scoreCategory average

Financial Reporting

4.154.42 category average

Income & Balance Sheet

4.064.48 category average

- Screenshots

Most Used By Health, Wellness and Fitness

Zoho Books

In our analysis of Accounting products with the most market demand, Zoho Books is the most requested by users in Health, Wellness and Fitness out of the most popular tools.

Zoho Books is most used by health, wellness, and fitness businesses, with reviewers noting its user-friendly invoicing, automation, and integrated payment options help streamline financial processes in these sectors.

- Reviewers Perspective

"Zoho Book is quite different from other similar softwares their time tracking functions that make it easy to bill the invoice, their API and their reporting tool is amazing and one of the best thing is their interface."

SJSotis Jake

Account Executive

Used for 6-12 months

We analyzed 415 verified user reviews for Zoho Books to find out what actual users really think.

Payment Gateway

Zoho Books enables online payment processing, automated reminders, and real-time tracking. Teams accept multiple payment methods and manage payments for customers and vendors efficiently.Integrations

Zoho Books integrates with CRM, inventory, and project management modules. Businesses unify processes and data, though connecting with some external platforms may require additional setup.Accounting

Zoho Books offers intuitive automation and accessibility for tracking finances and generating reports. Collaboration with accountants is supported, with a learning curve for advanced functions. - Key FeaturesZoho Books's scoreCategory average

Financial Reporting

4.464.42 category average

Income & Balance Sheet

4.564.48 category average

- Screenshots

Highly Rated for Security and Access Control

Sage Intacct

According to our user reviews, Sage Intacct is the highest rated for security and access control out of the most popular tools.

Sage Intacct is highly rated for organizations needing strong security and access control, as reviewers highlight its robust internal controls and audit trails that support secure, compliant financial management.

- Reviewers Perspective

"We have used almost 7 years and it has served us well in all aspects of accounting, payables, cash management, General Ledger and Reporting."

SFSteve Fooskas

Accounting Manager

Used for 2+ years

We analyzed 360 verified user reviews for Sage Intacct to find out what actual users really think.

Accounting

Sage Intacct provides real-time access, audit trails, and robust controls for general ledger, payables, and cash management. Automation and customization support efficient daily operations across industries.Ease of Use

Teams navigate Sage Intacct’s logical interface and simple setup with minimal training. The clean design helps new users manage business operations efficiently.Financial Reporting

Organizations create custom financial reports, analyze data across dimensions, and automate workflows for real-time insights. Reporting tools streamline audits and support compliance. - Key FeaturesSage Intacct's scoreCategory average

Chart of Accounts

4.574.53 category average

Financial Reporting

4.044.42 category average

Income & Balance Sheet

4.394.48 category average

- Screenshots

Most Used By Individual & Family Services

FreeAgent

According to our user reviews, FreeAgent is the most requested by users in individual & family services out of the most popular tools.

FreeAgent is most used by individual and family services professionals, with reviewers saying its straightforward invoicing, easy bank integration, and clear financial overviews simplify accounting for small service-based businesses.

- Reviewers Perspective

"It has made my yearly accounts so much easier to finish on time with the direct contact with my accountant."

MLMick Lowe

Graphic designer

Used for 1-2 years

We analyzed 128 verified user reviews for FreeAgent to find out what actual users really think.

Invoicing

FreeAgent enables quick creation, sending, and tracking of invoices. Automated reminders and recurring invoices simplify monthly reconciliations and reduce administrative time.Accounting

Teams use FreeAgent to manage finances, generate reports, and stay compliant. Cloud access supports collaboration between business owners and accountants for organized accounts.Customer Support

FreeAgent’s support team provides prompt replies and detailed assistance. Online resources and staff enhance user experience, making it easier to maximize platform features. - Key FeaturesFreeAgent's scoreCategory average

Financial Reporting

4.674.42 category average

Income & Balance Sheet

4.784.48 category average

- Screenshots

DualEntry

- Reviewers Perspective

"The match bank data sections ease of matching payments is another feature i love. And if I make some mistake like matching the wrong things that have the same amount, it is very easy to go back and fix the error."

ELEmile Larochelle

Finance Manager

Used for 6-12 months

We analyzed 15 verified user reviews for DualEntry to find out what actual users really think.

- Screenshots

- Reviewers Perspective

"It is simple enough with a little help from tech support I am able to keep track of my accounting and hand it over to my accountant at years end to close out my books."

JDJay Ditsworth

Preo

Used for 1-2 years

We analyzed 333 verified user reviews for Patriot Accounting to find out what actual users really think.

Accounting

Small business owners manage double-entry accounting, reconciliation, and reporting without advanced expertise. The platform streamlines expense tracking and reduces reliance on external accountants.Customer Support

Administrators access Patriot Accounting’s support via chat, phone, and email. The team provides clear guidance during setup and troubleshooting, reducing confusion and downtime.Payroll

Managers process payroll for employees and contractors with quick setup and reliable direct deposit. Some users encounter challenges with custom reports and multi-rate management. - Key FeaturesPatriot Accounting's scoreCategory average

Chart of Accounts

4.304.53 category average

Financial Reporting

4.434.42 category average

Income & Balance Sheet

4.194.48 category average

- Screenshots

- Reviewers Perspective

"Its intuitive interface, secure cloud-based platform, and clear visibility into cash flow make it a practical choice for everyday accounting tasks. While customer support and mobile performance could be improved, and customization options are somewhat limited compared to premium competitors, Sage delivers solid value for money."

ALAlain Le Breton

IT

Used for 2+ years

We analyzed 331 verified user reviews for Sage Accounting to find out what actual users really think.

Accounting

Accountants and business owners use Sage Accounting for routine bookkeeping, reporting, and reconciliation. The intuitive interface and cloud platform support both simple and advanced tasks, making it accessible for beginners and professionals.Invoice Management

Users create and send invoices from any device, track payments, and manage recurring billing. The system keeps financial records organized, though some seek more customization and batch processing options.Setup

New users onboard quickly with Sage Accounting’s straightforward installation and clear setup steps. Tutorials and guides support a smooth start, even for those with limited technical experience. - Key FeaturesSage Accounting's scoreCategory average

Financial Reporting

4.284.42 category average

Income & Balance Sheet

4.424.48 category average

- Screenshots

- Reviewers Perspective

"D365 is a great ERP packed full of features for mid-sized companies."

AVAlexandra Van Ness

People Business Partner

Used for 2+ years

We analyzed 105 verified user reviews for Dynamics 365 Business Central to find out what actual users really think.

Integrations

Organizations unify business data and processes by connecting with Office 365, Power BI, and Outlook. The platform streamlines collaboration and reporting, and connects with POS and automation systems.Data Management

Teams store, access, and manage business data securely from any location. The structure enables easy reporting and analysis, with Excel compatibility and customization options.Productivity

Managers monitor performance and streamline processes with real-time metrics and device accessibility. Integration with Microsoft Office reduces paperwork and saves time across departments. - Key FeaturesDynamics 365 Business Central's scoreCategory average

Financial Reporting

3.804.42 category average

Income & Balance Sheet

4.204.48 category average

- Screenshots

- Reviewers Perspective

"Using SAP has made checking inventory of certain parts, organizing service calls for our technicians and correcting billing issues on the back-end incredibility straightforward."

CECydrina Espinosa

Technical Service Helpdesk

Used for 1-2 years

We analyzed 204 verified user reviews for SAP Business One to find out what actual users really think.

Inventory Management

Inventory teams monitor stock, warehouse locations, and documentation with real-time updates. Automation reduces manual work and supports demand planning and supply chain management.Small and Medium Business

SMBs use SAP Business One’s integrated modules to manage core processes and scale operations. The platform supports automation and efficiency for growing organizations.Customization

Administrators tailor dashboards, modules, and layouts to fit business requirements. Customization supports evolving workflows and industry standards. - Key FeaturesSAP Business One's scoreCategory average

Financial Reporting

4.384.42 category average

Income & Balance Sheet

4.264.48 category average

- Screenshots

- Reviewers Perspective

"The integration with banking systems and the automated bookkeeping features save an incredible amount of time, making it ideal for busy professionals."

BTBobby Taslimi

Digital Marketing Consultant

Used for 6-12 months

We analyzed 43 verified user reviews for ReInvestWealth to find out what actual users really think.

- Key FeaturesReInvestWealth's scoreCategory average

Financial Reporting

4.804.42 category average

Income & Balance Sheet

4.814.48 category average

- Screenshots

- Reviewers Perspective

"Multiview is a flexible platform that allows us to have one chart of account across our three entities."

JFJustin Field

CFO

Used for 1-2 years

We analyzed 72 verified user reviews for Multiview ERP to find out what actual users really think.

Customer Support

Administrators use Multiview ERP’s support portal for quick help during implementation and daily use. The support team is accessible and knowledgeable, streamlining issue resolution.Accounting

Organizations manage transactions across entities and periods, leveraging consolidated accounting and efficient audit processes. The system supports fund accounting and standard reports.Customization

Users configure interfaces, departmental tracking, and workflows to match business needs. Customization options help streamline processes and adapt to organizational changes. - Key FeaturesMultiview ERP's scoreCategory average

Chart of Accounts

5.04.53 category average

Financial Reporting

4.114.42 category average

- Screenshots

- Reviewers Perspective

"QuickBooks offers a wide range of functions that help organize the company’s operations, including managing invoices, payments, and inventory."

FCFannie Chen

Estimator

Used for 2+ years

We analyzed 9 verified user reviews for QuickBooks Solopreneur to find out what actual users really think.

- Screenshots

- Reviewers Perspective

"The ability to customize Acumatica to fit our industry's workflow is a driving factor for why we chose them."

RWRyan Woodhead

System Admin

Used for 2+ years

We analyzed 110 verified user reviews for Acumatica Cloud ERP to find out what actual users really think.

Customization

Users configure Acumatica Cloud ERP to match unique workflows and dashboards without coding. This flexibility supports industry-specific processes and user-level efficiency, though complex changes may require technical help.Cloud Accessibility

Teams access Acumatica Cloud ERP from any location with internet, enabling real-time collaboration and automated updates. This eliminates on-premise server needs and supports flexible work environments.Reporting

Finance teams use built-in and downloadable reporting tools for basic needs, but advanced or specialty reports often require technical support. Some essential reports are missing and report modification can be unintuitive for non-developers. - Key FeaturesAcumatica Cloud ERP's scoreCategory average

Chart of Accounts

4.504.53 category average

Financial Reporting

3.984.42 category average

Income & Balance Sheet

3.754.48 category average

- Screenshots

- Reviewers Perspective

"The ability to customize Acumatica to fit our industry's workflow is a driving factor for why we chose them."

RWRyan Woodhead

System Admin

Used for 2+ years

We analyzed 110 verified user reviews for Acumatica Cloud ERP to find out what actual users really think.

Customization

Users configure Acumatica Cloud ERP to match unique workflows and dashboards without coding. This flexibility supports industry-specific processes and user-level efficiency, though complex changes may require technical help.Cloud Accessibility

Teams access Acumatica Cloud ERP from any location with internet, enabling real-time collaboration and automated updates. This eliminates on-premise server needs and supports flexible work environments.Reporting

Finance teams use built-in and downloadable reporting tools for basic needs, but advanced or specialty reports often require technical support. Some essential reports are missing and report modification can be unintuitive for non-developers. - Key FeaturesAcumatica Cloud ERP's scoreCategory average

Chart of Accounts

4.504.53 category average

Financial Reporting

3.984.42 category average

Income & Balance Sheet

3.754.48 category average

- Screenshots

ProfitBooks

- Reviewers Perspective

"Its intuitive interface makes invoicing, expense tracking, inventory, payroll, and GST/tax compliance remarkably simple, even without accounting expertise"

DBDeepa Bajaj

Creative Director

Used for 1-2 years

We analyzed 73 verified user reviews for ProfitBooks to find out what actual users really think.

Inventory and Accounting

Small businesses manage invoicing, inventory, and accounting in one system. The intuitive interface supports expense tracking, payroll, and GST/tax compliance without advanced knowledge.Customer Support

Users receive timely, helpful support—even outside business hours. The support team’s responsiveness helps resolve issues and builds user confidence.Small Business

Micro and small enterprises access core features for finance, invoicing, and inventory. ProfitBooks is designed to support business growth without unnecessary complexity. - Key FeaturesProfitBooks's scoreCategory average

Financial Reporting

4.244.42 category average

Income & Balance Sheet

4.144.48 category average

- Screenshots

- Reviewers Perspective

"its a very basic accounting software, not much else. If your just using for accounting its great, but if you need things like estimation, tracking, PO's etc choose something else."

PGPaul Goetz

Project Manager

Used for 6-12 months

We analyzed 305 verified user reviews for Sage 50 Accounting to find out what actual users really think.

Accounting

Accountants and bookkeepers use Sage 50cloud Accounting for invoicing, reporting, budgeting, and cash flow management. The software follows standard principles and supports both basic and advanced needs.Small Business

Small and medium businesses manage billing, inventory, and reporting without excessive complexity. The platform supports growth and keeps books organized for routine operations.Training and Learning Curve

New users leverage tutorials and guides to become proficient quickly. The familiar design and learning materials reduce the initial training burden. - Key FeaturesSage 50 Accounting's scoreCategory average

Financial Reporting

4.154.42 category average

Income & Balance Sheet

4.404.48 category average

- Screenshots

Sage 100

- Reviewers Perspective

"I consider that Sage 100 is a complete accounting application, which allows you to adapt to the needs of customers."

COCarlos Ortiz

Supervisor - Financial Application Support Service

Used for 2+ years

We analyzed 252 verified user reviews for Sage 100 to find out what actual users really think.

Accounting

Accountants manage financials, audit trails, and compliance with accepted principles. Sage 100 centralizes operations and supports both small and midsize businesses.Small Business

Small and midsize companies handle core business functions with scalable features. The platform balances affordability and ease of implementation for evolving needs.Payroll

Payroll managers automate pay methods, direct deposit, and reporting. The module integrates with business processes, though some users seek enhanced HR features. - Key FeaturesSage 100's scoreCategory average

Chart of Accounts

5.04.53 category average

Financial Reporting

4.274.42 category average

Income & Balance Sheet

4.364.48 category average

- Screenshots

TallyPrime

- Reviewers Perspective

"TallyPrime software is useful in accounting purpose."

ATAkshay Thombare

Payroll Executive

Used for 2+ years

We analyzed 192 verified user reviews for TallyPrime to find out what actual users really think.

Features

Businesses prepare GST returns, support audits, and configure TallyPrime for various needs. The platform adapts to different industries with remote access and robust reporting.Accounting

Teams manage accounts, suppliers, and multi-currency transactions with automated calculations and reporting. TallyPrime supports accurate records and GST compliance for diverse business sizes.Inventory Management

Inventory managers track stock, sales, and purchases with automated reports and easy configuration. The tools support efficient control and decision-making across operations. - Key FeaturesTallyPrime's scoreCategory average

Financial Reporting

4.254.42 category average

Income & Balance Sheet

4.424.48 category average

- Screenshots

Methodology

The research for the best accounting software list was conducted in October 2025. We evaluated data (user reviews and demand signals) from the past 24 months as of the research date. Read the complete methodology.

Popular Accounting Comparisons

Buyer's Guide

This detailed guide will help you find and buy the right accounting software for you and your business.

Last Updated on October 29, 2025Here’s what we’ll cover:

What you need to know about accounting software

Essential features of accounting software

Benefits and competitive advantages of using accounting software

How to choose the best accounting software for your business

Software related to accounting tools

More resources for your accounting journey

What you need to know about accounting software

Accounting software is a tool designed to help businesses manage their financial processes and track statements, cash flow, invoicing, bank accounts, and purchase orders. It serves as a comprehensive solution for tracking financial transactions, managing accounts, and generating financial reports. These systems can help organizations save time by automating accounting processes and providing insights into financial health.

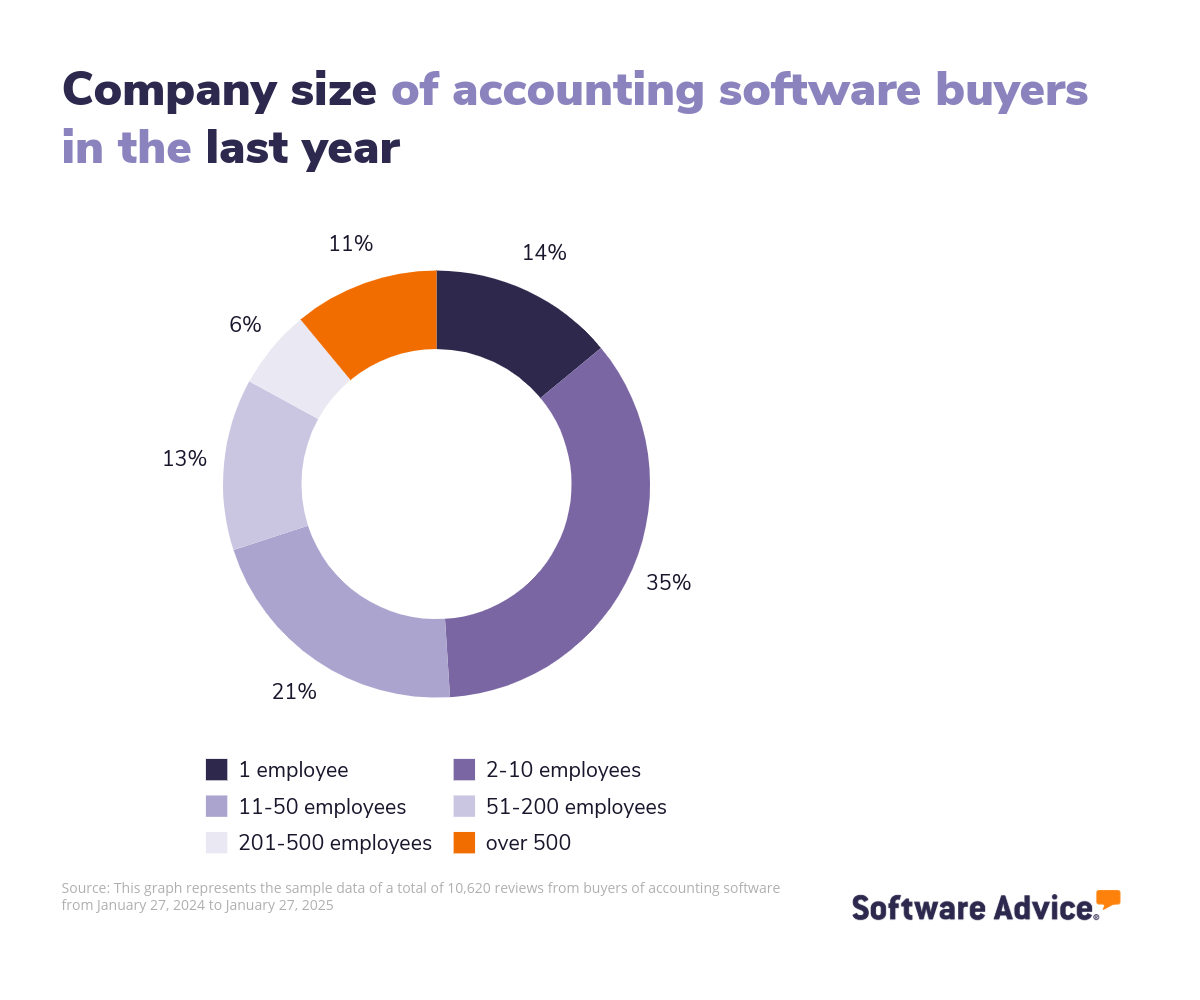

Over the last year, we’ve spoken to over 3,250 software buyers to help them find the right tool to support their accounting teams. [1] To give an idea of the market, we have 591 accounting tools on our site, and we’ve published over 6,500 verified reviews for these tools in the past year alone. [2]

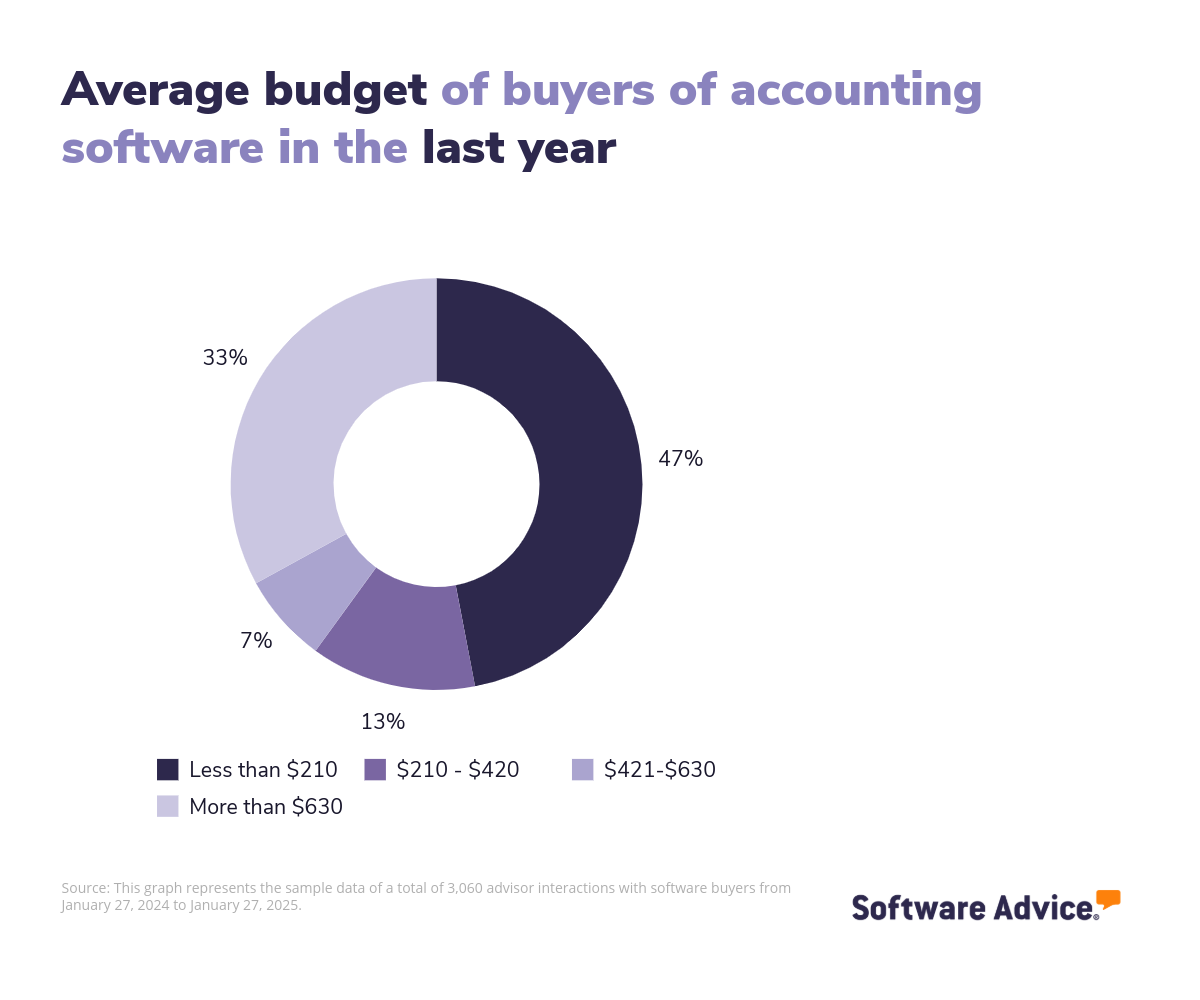

When selecting an accounting software solution, pricing is a crucial factor to consider. Most accounting software products are priced on a monthly subscription basis. While advanced systems can exceed $2,000 per month, entry-level plans can be found for as little as $11 per month, with some options offering free versions. Generally, entry-level plans average $144 a month. There is diversity when it comes to budgeting for this tool. While 47% of accounting software buyers we spoke to budget $210 or less per month, 63% budget over $630. [3]

Choosing the right accounting software can be a complex process given the variety of options available. In this guide, you’ll learn about essential components of accounting software, get step-by-step guidance on how to choose the right solution for your business, and tap into the expertise of our experienced accounting software advisors, Eric Franco and Chris Soltani. To get expert guidance, schedule a free consultation or start a chat with us today.

What is accounting software?

Accounting software is a digital tool that enables businesses to manage and automate their financial processes, ensuring accurate and efficient handling of financial data. It serves as a comprehensive solution for tracking financial transactions, managing accounts, and generating financial reports.

Most accounting software options offer a core package that can handle different accounting tasks:

Bank reconciliation

The primary functionality of accounting software includes managing general ledgers, accounts receivable, accounts payable, and bank reconciliations. It also supports payroll processing and financial reporting. By automating these routine tasks, accounting software helps businesses save time and reduce the risk of manual errors, ensuring compliance and accuracy in financial management.

The benefits of accounting software extend to improved financial visibility and decision-making. Users can easily access real-time financial data, allowing for better cash flow management and strategic planning. Additionally, the software often integrates with other business systems, enhancing overall operational efficiency.

Common features of accounting software include invoice generation, expense tracking, and budget management. More advanced features might offer project accounting, tax management, and customizable reporting, providing businesses with the tools needed to adapt to their specific financial needs.

By streamlining financial operations, accounting software empowers businesses to focus on growth and profitability, making it an essential tool for modern financial management.

Essential features of accounting software

When comparing accounting software systems to choose the best solution for your business, it’s key to understand what features to expect. There are core features that users should expect from their accounting tools, such as general ledger, financial reporting, bank reconciliation, accounts payable, and accounts receivable. However, other features are still common, like billing and invoicing, expense tracking, tax management, and financial management, among others. We analyzed thousands of reviews and spoke to thousands of accounting professionals to break down the core and common features of accounting software.

Core accounting software features

Financial reporting | Generate reports to assess the financial performance of an organization. 92% of our reviewers rate this feature as critical or highly important. |

General ledger | Centralized accounting record that tracks all financial transactions. 88% of our reviewers rate this feature as critical or highly important. |

Accounts payable | Track money owed to a company's creditors/suppliers. 83% of our reviewers rate this feature as critical or highly important. |

Bank reconciliation | Compare and match accounting/financial records with corresponding bank statements. 83% of our reviewers rate this feature as critical or highly important. |

Accounts receivable | Track outstanding invoices and the money owed from clients. 77% of our reviewers rate this feature as critical or highly important. |

Common accounting software features

Financial management | Plan, manage, and track the financial activities of an individual or organization. 87% of our reviewers rate this feature as critical or highly important. |

Billing and invoicing | Create, manage, and send invoices or bills to customers. 85% of our reviewers rate this feature as critical or highly important. |

Expense tracking | Monitor and record expenses such as purchases or charges incurred. 85% of our reviewers rate this feature as critical or highly important. |

Budgeting/Forecasting | Create budgets based on historical data and future projections. |

Compliance management | Track and manage adherence to policies for any service, product, process, or supplier. |

Fixed asset management | Centralized database to track details of fixed assets, such as depreciation and maintenance scheduling/history. |

Multi-Currency | Manage and handle various international currencies. |

Payroll management | Manage employee salary processes, data, taxes, and records administration efficiently. |

Project accounting | Manage and track financials on a project-to-project basis. |

Purchase order management | Create, send, and track purchase orders and their status. |

Tax management | Implementation of various strategies to manage tax obligations via planning and maintaining compliance. |

Along with these features, users can search for software that includes additional ones that may not be core or common features. For example, 94% of reviewers rate income and balance sheet features as highly important. Additionally, depending on the needs of each buyer, some might need additional features like contact management or tracking features.

Chris Soltani, a senior advisor who specializes in accounting, notes that many buyers want to be able to have IDs and barcoding features on their assets so they can track their lifespan. Eric Franco, another Texas-based accounting advisor, adds that “some buyers want the system to handle contracts as well, contract management along with assets.”

For more information on accounting-specific features and recommendations, feel free to schedule an appointment with Eric Franco or one of his colleagues.

Benefits and competitive advantages of using accounting software

Soltani has been helping accounting professionals find software to help their businesses for 12 years. Based on his conversations with buyers, two clear benefits of using accounting software, he points out, are saved costs and improved tracking of their assets. “A lot of times, companies are outsourcing to CPA firms, so the reason people are shopping for fixed asset programs is they generally bring this in-house and save costs.” He also adds, “Companies are tracking their assets on Excel and spreadsheets. A big reason why they’re looking for these tools is to improve this expense tracking.”

Additionally, our data shows other benefits directly impacting accountants. These include:

Improved team collaboration by offering a centralized platform where financial data is accessible to authorized members in real time. This transparency ensures everyone is aligned, reducing miscommunication and errors. Shared dashboards, automated workflows, and integrated communication tools enable teams to collaborate efficiently on tasks like invoicing and expense tracking.

Optimized financial management by automating and simplifying complex tasks. Accounting software allows businesses to track income, expenses, and assets accurately, providing a clear financial overview. With budgeting, forecasting, and reporting features, businesses can make informed decisions based on precise data. The software also includes tools for tax compliance and audit trails, helping businesses maintain regulatory compliance and reduce financial discrepancies.

For small businesses, accounting software offers solutions that address their specific needs. It provides user-friendly interfaces and customizable features suited for limited resources and expertise. The software automates tasks like invoicing, payroll, and expense tracking, freeing up time for business owners to focus on growth. Many small business accounting solutions are scalable, allowing adaptation as the business expands and ensuring continued efficiency.

Accounting software can focus on many specialized features within the accounting sector and cater to diverse business needs depending on their requirements.

How to choose the best accounting software for your business

Choosing the right accounting software involves a systematic approach to ensure it meets your community’s needs. Here’s a five-step process that you can follow:

Step 1: Define your requirements

Chris Soltani and Eric Franco point out that buyers often have misconceptions or confusion when considering accounting software systems. Many initially focus on fixed asset accounting needs, only to realize later that they also require features such as IT asset management or maintenance capabilities.

This highlights the importance of identifying your core needs before making a decision. Consider factors such as your business's size, the complexity of your financial operations, and any unique requirements, such as system integrations or specific reporting capabilities. Involve key stakeholders in this assessment to ensure a comprehensive understanding of your needs.

According to Software Advice’s advisor team, based on 3,302 phone interactions with accounting software buyers from January 2024 to January 2025, 66% of buyers requested core accounting features, with another 66% seeking financial reporting and 27% looking for billing and invoicing functionalities.

Clearly defining your needs will help you prioritize essential features and avoid unnecessary extras, ensuring the software you choose effectively supports your business’s daily operations and long-term goals.

Understand the cost of accounting software

The cost of accounting software can vary significantly based on factors like:

Number of users

Features and modules required (e.g., invoicing, financial reporting, asset management)

Type of storage (cloud-based or on-premise)

Integrations with other tools, like CRM or ERP systems

Support and training options

Businesses should budget for not only the initial purchase or subscription costs but also setup, migration, and potential training costs. Having a clear view of costs upfront helps in planning and managing the long-term financial commitment associated with accounting software.

Advanced accounting software tools can cost over $2,000 a month, while entry-level plans average $144 per month. Businesses have diverse strategies for budgeting for this tool. While 47% budget $210 or less per month for accounting software, a third budget over $630.

For first-time buyers, it's important to start the evaluation process with a clear budget, understanding the number of users, specific use cases, and required integrations. Engaging with stakeholders to compile a list of essential questions for vendors can help ensure the system aligns with your business needs, such as:

Do you need software to integrate with existing financial systems and tools?

What kind of reporting and analytics does the tool provide?

Is the software scalable to accommodate business growth?

Does the software offer mobile access for on-the-go financial management?

What kind of customer support and training does the vendor provide?

Assess business-specific functionalities

Assess and analyze your current workflows to determine what's working well and where you need help. Make a list of pain points, such as issues with financial reporting, data accuracy, or billing.

Also, consider the unique requirements related to your industry. Involve your team in the process to gain practical insights about which features and integrations would save the most time.

Finally, think about your growth plans. A small business might need a simpler system than a large enterprise. However, if you're planning to expand, invest in software that can grow with you. Consider questions like:

How easy is it to add new users as our business grows?

Does the pricing scale reasonably as we add users or transactions?

Can we start with basic features and add more advanced ones as our needs evolve?

Step 2: Research and shortlist accounting tools

There are several accounting tools available on the market, and finding the one right for you can be quite a task. Fortunately, here are a couple of resources that can help you make a confident decision.

Get help from a qualified accounting advisor

At Software Advice, our advisors like Chris Soltani have experience helping hundreds of businesses identify solutions that match their accounting needs and budgets.

If you need guidance, you can talk to one of our specialized advisors and get tailored recommendations about the best accounting software for your needs.

Explore our list of accounting software

If you’re not ready to talk to an advisor just yet, you can also start compiling your shortlist of legal practice management software with our FrontRunners report. Only products that earn top user ratings make it to this list. To be eligible for consideration, a product must:

Have at least 20 unique user reviews in the last 24 months

Be a stand-alone legal practice management system, not just a partial tool, and

Offer key features.

Alternatively, visit our accounting software directory page to explore the top options available on the market. This will give you a clear understanding of the features and benefits each tool offers, enabling you to make a more informed and confident purchase decision.

Step 3: Request demos and ask questions

Eric Franco notes that often there are misconceptions about accounting software, stating that many buyers are surprised by the system's capabilities, such as handling contracts or maintenance.

To ensure you and your team feel comfortable using the accounting tool, contact the vendors of your shortlisted options to arrange live demonstrations. During the demos, observe how the software handles key tasks such as accounting, financial management, and invoicing.

To maximize these sessions, be well-prepared before you try out the demo. Arrange demos with each vendor on your shortlist, include key team members who will use the software, and compile a list of questions and scenarios tailored to your business's needs.

Ask specific questions related to your business’s needs to see how well the software aligns with your requirements. Here are some questions that you can ask:

How is data migration from our existing system managed?

Understanding the data migration process is crucial when transitioning to new accounting software. This involves transferring existing financial data, records, and reports from your current system to the new one. It's important to know whether the vendor provides tools or services to facilitate this process and if they offer support to ensure data accuracy and integrity during the transition.

What is the usual timeline for implementation?

The timeline for implementing new accounting software can vary depending on the complexity of your business needs and the software itself. It's essential to have a clear understanding of the expected duration for setup, customization, and full deployment. This helps in planning resources and minimizing disruptions to your business operations.

Do you offer user training and customer support, and what does it entail?

Effective user training and support are key to maximizing the benefits of new software. Inquire about the training options provided by the vendor, such as workshops, online tutorials, or personalized sessions. Understanding the scope and format of the training can help ensure that your team is well-equipped to use the software efficiently.

Can financial reports be customized for specific business needs?

Customization of financial reports allows businesses to tailor the software to meet unique reporting requirements. This flexibility is important for generating insights specific to your business operations, such as departmental performance or project profitability. Confirm whether the software allows for such customization and how it can be achieved.

How does pricing adjust as we increase users or transactions?

As your business grows, the number of users or transactions may increase, affecting the cost of the software. Understanding how pricing scales with growth can help you budget effectively and avoid unexpected expenses. Inquire about any tiered pricing structures or discounts for additional users or higher transaction volumes.

Is it possible to start with basic features and add advanced ones later?

Scalability is an important consideration when choosing software. Determine if the software allows you to start with essential features and expand to more advanced functionalities as your business needs evolve. This flexibility can be cost-effective and ensure the software continues to meet your requirements over time.

Could you provide a detailed breakdown of all costs, including any initial or recurring fees?

A comprehensive understanding of the total cost of ownership is vital for budgeting. Request a detailed breakdown of all costs associated with the software, including initial setup fees, subscription or licensing fees, and any additional charges for support, training, or upgrades. This transparency helps in making informed financial decisions.

What type of financial reports does the tool generate?

Accurate and customizable reports are crucial for tracking budgets, analyzing expenses, and ensuring transparency. Knowing the reporting capabilities helps avoid gaps in financial oversight and enhances decision-making.

What are the data security features of the tool?

Data security features are necessary to protect sensitive financial data and confidential communications. Strong data security features, including encryption and access controls, help prevent data breaches and unauthorized access.

Does the tool support integration with the existing tech stack?

Accounting software that supports integration with your existing tech stack ensures smooth data flow between systems, such as CRM or ERP tools. Integrations reduce manual data entry, prevent errors, and enhance operational efficiency.

Step 4: Make the most of your accounting software

Once you’ve selected and finalized your accounting software, the implementation phase begins. Whether you're upgrading from another system or moving from manual processes to digital, consider the following steps to ensure a smooth transition:

Data migration: Carefully transfer all financial data, records, and reports from your old system or paper files to the new software. Collaborate with both your current and new software providers to ensure that all data is accurately migrated and nothing is overlooked, maintaining data integrity and continuity.

Training: Equip your team with the necessary skills to utilize the new software effectively. Organize comprehensive training sessions with the help of your software provider, and distribute user-friendly training materials. Schedule multiple sessions and refresher courses to ensure everyone is confident and proficient in using the new tools.

Workflow customization: Tailor the software to fit your business's specific needs by customizing workflows, templates, and dashboards. This personalization will help streamline processes and improve efficiency, allowing your team to focus more on strategic tasks.

Communication: Inform your team about the transition to new software. Set clear expectations about potential temporary disruptions and emphasize the long-term benefits, such as improved accuracy and efficiency. This transparency will help maintain trust and reassure your team during the transition period.

Feedback and support: Encourage feedback from your team about the new system to identify any challenges or areas for improvement. Maintain open lines of communication with your software provider for ongoing support and to address any issues promptly.

By following these steps, you can ensure a successful transition to a new accounting software system that supports your business's operations and growth objectives.

Software related to accounting tools

Depending on which accounting software you choose, you may need to supplement some features with related software systems. Some types of software that are closely related to accounting software, or can feature as standalone solutions, include:

Accounting practice management software is designed to help accounting firms manage their operations more efficiently. It includes features for client management, workflow automation, and time tracking, enabling accountants to streamline their practice and enhance client service.

Accounts payable software assists businesses in managing their payables by automating invoice processing, payment approvals, and vendor management. It ensures timely payments and accurate financial records, reducing the risk of errors and improving cash flow management.

Accounts receivable software helps businesses manage incoming payments by automating invoicing, payment tracking, and collections. It improves cash flow by ensuring timely payments and providing insights into outstanding invoices and customer payment behavior.

Audit software is designed to facilitate the auditing process by automating data collection, analysis, and reporting. It helps auditors identify discrepancies, ensure compliance with financial regulations, and provide accurate audit reports.

Auto dealer accounting software is tailored for automotive dealerships to manage their unique financial needs. It includes features for inventory management, sales tracking, and financial reporting specific to the auto industry, helping dealers streamline operations and improve profitability.

Billing and invoicing software automates the billing process by generating invoices, tracking payments, and managing customer accounts. It simplifies financial transactions and ensures accurate billing, making it easier for businesses to manage their revenue streams.

Budgeting software helps businesses plan and manage their financial resources by providing tools for creating, monitoring, and adjusting budgets. It enables organizations to allocate resources effectively, track financial performance, and make informed financial decisions.

Compliance software ensures that businesses adhere to industry regulations and standards by providing tools for monitoring, reporting, and managing compliance-related activities. It helps organizations mitigate risks and avoid penalties by maintaining up-to-date compliance records.

Debt collection software streamlines the debt recovery process by automating communication with debtors, tracking outstanding debts, and managing payment plans. It improves collection efficiency and reduces the time and effort required to recover overdue payments.

Financial reporting software provides tools for generating accurate and comprehensive financial reports. It helps businesses analyze financial data, track performance, and make informed strategic decisions by offering insights into key financial metrics.

Fund accounting software is designed for non-profit organizations and government entities to manage their finances according to fund accounting principles. It ensures transparency and accountability by tracking funds separately and providing detailed financial reports.

General ledger software serves as the central repository for an organization's financial data, recording all financial transactions and generating key financial statements. It provides a comprehensive view of a company's financial health and supports accurate financial reporting.

Sales tax software automates the calculation, collection, and remittance of sales tax. It ensures compliance with varying tax laws across different jurisdictions and simplifies the process of managing sales tax obligations, reducing the risk of errors and penalties.

Trust accounting software is designed for businesses and law firms to manage client trust accounts and ensure compliance with legal and ethical standards. It provides tools for tracking trust transactions, generating reports, and maintaining accurate records of client funds.

More resources for your accounting journey

About our contributors

Author

Eduardo Garcia is a content analyst at Software Advice, covering research on new technologies and specializing in retail and healthcare. He has previously worked in corporate communication at the European Investment Bank and the World Organisation for Animal Health.

Eduardo’s research and analysis is informed by more than 130,000 authentic user reviews on Software Advice and over 25,000 interactions between Software Advice software advisors and medical and retail software buyers. Eduardo also regularly analyzes market sentiment by conducting surveys of medical practitioners and administrators, as well as retail leaders and consumers, so he can provide the most up-to-date and helpful information to small and midsize businesses purchasing software or services.

Eduardo also has a decade of experience in the private sector, communicating about topics such as artificial intelligence, smart cities, advanced analytics, and big data. His research has appeared in , , , , and .

In his free time, Eduardo likes exploring wildlife, hitting the beach, traveling, and trying to discover a sport he is good at.

Editor

Caroline Rousseau is a senior content editor at Software Advice. A former content analyst, Caroline has, for the past five years, built, written, and edited research reports about technological trends, opportunities, and challenges with an SMB audience in mind. Her content has been featured in French Tier 1 media including Le Monde, L’Express, and Le Figaro, among other publications. Her previous experience as a graphic designer, translator, and LQA specialist in various industries converged into a skill set that allows her to create compelling content about today’s business matters.

Caroline’s personal interests include literature and art and she has a passion for Albert Camus, graphic novels, and drawing.

Advisors

Chris Soltani is a Senior Advisor at Software Advice. He joined the team in 2013 and is based in Austin, TX. Chris specializes in helping businesses navigate the complexities of selecting the right software solutions for accounting, project management, manufacturing, learning management, and supply chain management. He is dedicated to providing tailored recommendations that align with each client's unique needs and goals.

His favorite part of being a Senior Advisor is truly helping buyers overcome the challenges they face when researching the hundreds of options available online. Chris takes pride in simplifying the decision-making process and ensuring that each client finds the perfect fit for their business.

Eric Franco is a Senior Advisor at Software Advice. He joined the team in 2019 and is based in Austin, TX. Eric focuses on guiding clients through the selection of software for accounting, project management, manufacturing, learning management, and supply chain.

His favorite part of being a Senior Advisor is hearing the sense of relief in a stressed buyer's tone when they realize he can help. Eric values the opportunity to ease the software selection process for clients, ensuring they feel supported and confident in their decisions.

Accounting FAQs

- What is the most commonly used accounting software?

Our advisor, Chris Soltani, notes that many of the accountants he converses with start off on QuickBooks, although many later switch to other software depending on the additional features and requirements they need. Similarly, QuickBooks Enterprise has the most reviews on Software Advice, with over 21,000 all-time reviews.

- What is the simplest accounting software?

Based on our analysis of the most popular accounting software, FreshBooks has received the highest rating for ease of use on Software Advice by users, with an average all-time rating of 4.5 out of 5 for this feature.

- Which software is best for an accountant?

While accountants can prefer different accounting software depending on the size of the companies they work in, our analysis of popular accounting software notes that NetSuite is the most requested by certified public accountants.

- What do most companies use for accounting?

Different companies use different tools depending on multiple factors. For example, according to our analysis, Aplos is the most requested tool for non-profits. In other sectors, such as manufacturing, retail, or healthcare, Sage is the most requested tool in our all-time analysis. Different sectors and businesses may have different needs depending on their industry and size, and this will be reflected in the tools they use.

- Is there a free accounting software?

Many accounting tools are premium, but some free solutions are available, while others offer a free trial. Of the most popular accounting tools, Zoho Books is the highest-rated application that also offers a free plan.