Best Financial Reporting Software of 2026

Updated February 18, 2026 at 9:01 AM

Written by Amita Jain

Senior Content Writer

Edited by Parul Sharma

Editor

Reviewed by Cameron Pugh

Senior Advisor

Talk with us for a free 15-min consultation

Expert advisors like Jacqueline, who have helped 1,000+ companies, can find the right software for your needs.

- All Software

- Software Advice FrontRunners

- Popular Comparisons

- Buyer's Guide

- Frequently Asked Questions

Financial reporting software helps finance teams and business managers track, analyze, and present data for audits, budgeting, and compliance. With 400 products built for different workflows and regulations, the market can be overwhelming. To help you narrow it down, I worked with our financial reporting software advisors to curate a list of recommended productsi and a list of the financial reporting software FrontRunners based on user reviews. For further information, read my financial reporting software buyer's guide.

Financial Reporting Software

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Vena is a financial planning and analysis (FP&A) platform. It is designed to work with Microsoft 365 apps, cloud technology, and...Read more about Vena

Vena's Best Rated Features

See All

Vena's Worst Rated Features

See All

Sage 50 Accounting is an accounting solution designed to cater to the needs of small and medium-sized businesses. It offers a su...Read more about Sage 50 Accounting

Sage 50 Accounting's Best Rated Features

See All

Sage 50 Accounting's Worst Rated Features

See All

Xledger is a cloud-based enterprise resource planning (ERP) solution that caters to midsize and large businesses and helps them ...Read more about Xledger

NetSuite is an AI-powered cloud-based business management suite that incorporates ERP, financial management, CRM and eCommerce f...Read more about NetSuite

NetSuite's Best Rated Features

See All

NetSuite's Worst Rated Features

See All

Software Advice FrontRunners 2026

(8328)

(3253)

(1711)

(20593)

(4502)

(1817)

(2535)

(671)

(105)

(143)

Best for Quick Implementation

Of the products listed on our FrontRunners report, QuickBooks Online is the most requested by users for quick implementation out of the most popular tools.

QuickBooks Online is best suited for SMBs seeking rapid implementation, as our reviewers say setup is straightforward and automation features like recurring invoicing and real-time collaboration with accountants make onboarding and daily workflows efficient.

- Reviewers Perspective

"QuickBooks Online offers features that enables me to streamline processes such as invoicing, time tracking on projects and billing."

PMPatrick Muruthi

Chief Accountant

Used for 2+ years

We analyzed 787 verified user reviews for QuickBooks Online to find out what actual users really think.

Invoicing

QuickBooks Online lets businesses automate invoicing, set up recurring bills, and sync with bank accounts. Customizable templates and mobile access support efficient billing and payment tracking.Accounting

Teams use QuickBooks Online for payroll, expenses, and real-time collaboration. Automation reduces manual tasks, though some advanced processes may require additional training or workarounds.Customer Support

Users access chat, phone, and email support, but often face long wait times and inconsistent service for complex issues. Tutorials help with basic problems, but timely expert assistance can be a challenge. - Key FeaturesQuickBooks Online's scoreCategory average

Accounting

4.524.57 category average

Income & Balance Sheet

4.504.59 category average

Reporting/Analytics

4.464.53 category average

- Screenshots

Highly Rated for Automation

Xero

Xero is the highest rated for automation out of the most popular tools, based on our analysis of Financial Reporting products with the most market demand.

Xero is highly rated for automation and is ideal for small businesses aiming to streamline repetitive accounting tasks; our reviewers say automated invoicing, bank feeds, and reminders save significant time and reduce manual errors.

- Reviewers Perspective

"Xero has become a standard tool I use to understand my business performance since incorporation and a tool I believe I will continue to use at least until my business scales to the next level and I need to put other plans in place in terms of managing my business accounts and reporting."

JLJohn Lawlor

CEO

Used for 6-12 months

We analyzed 768 verified user reviews for Xero to find out what actual users really think.

Accounting

Teams use Xero to manage general ledger, invoicing, and payroll in one cloud-based platform. This reduces manual work and improves productivity for SMBs and organizations with limited accounting resources.Invoicing

Xero’s invoicing tools let businesses create, customize, and track invoices with automated reminders and recurring billing. This helps organizations reduce errors, save time, and monitor payments from anywhere.Ease of Use

Staff with varying accounting backgrounds can quickly learn Xero’s interface. The system’s clear layouts and accessible tools simplify daily accounting, making it suitable for both professionals and non-specialists. - Key FeaturesXero's scoreCategory average

Accounting

4.594.57 category average

Income & Balance Sheet

4.564.59 category average

Reporting/Analytics

4.484.53 category average

- Screenshots

Best for User Interface

Wave

In our analysis of Financial Reporting products with the most market demand, Wave is the highest rated for its user interface out of the most popular tools.

Wave is best for those prioritizing user interface, especially freelancers and small business owners; our reviewers say the intuitive design, easy invoice customization, and seamless bank integration simplify bookkeeping and invoicing.

- Reviewers Perspective

"I have been using Wave for our small business bookkeeping for the past five or six years and love the ability to connect my bank accounts and credit cards and run weekly, monthly, and yearly reports."

BCBrigitte Chapman

Co-Owner

Used for 2+ years

We analyzed 720 verified user reviews for Wave to find out what actual users really think.

Small Business Use

Small business owners use Wave for bookkeeping, invoicing, and expense tracking without a subscription fee. The platform covers essential operations, helping keep overhead low as companies grow.Invoicing

Wave provides tools for creating, customizing, and tracking invoices. Users automate reminders, manage recurring billing, and monitor payment status, all within an intuitive interface.Accounting

Wave offers free tools for tracking expenses, reconciling accounts, and generating reports. Automation and real-time reporting simplify bookkeeping for those without an accounting background. - Key FeaturesWave's scoreCategory average

Accounting

4.494.57 category average

Income & Balance Sheet

4.484.59 category average

Reporting/Analytics

4.864.53 category average

- Screenshots

Highly Rated for Customization

QuickBooks Enterprise is the highest rated for customization out of the most popular tools, based on our analysis of Financial Reporting products with the most market demand.

QuickBooks Enterprise is highly rated for customization and suits organizations needing tailored financial workflows; our reviewers say customizable reports and flexible setup options help adapt the system to diverse business needs.

- Reviewers Perspective

"The ability to customize reports and dashboards has been invaluable in keeping detailed control over our finances and making decisions based on accurate data."

MBMarina Banu

Real Estate Broker

Used for 6-12 months

We analyzed 964 verified user reviews for QuickBooks Enterprise to find out what actual users really think.

Accounting

Organizations use QuickBooks Enterprise to manage intricate financial operations, from bookkeeping to tax preparation. The platform supports both experienced accountants and those with less financial expertise, centralizing financial management for growing businesses.Financial Reporting

Users generate a wide range of financial reports and track key metrics with QuickBooks Enterprise. Custom dashboards and consolidated data support budgeting, forecasting, and compliance across departments.QuickBooks

QuickBooks Enterprise enables teams to manage payments, payroll, inventory, and reporting from one platform. This flexibility helps streamline daily operations and reduces manual errors for businesses of various sizes. - Key FeaturesQuickBooks Enterprise's scoreCategory average

Accounting

4.554.57 category average

Income & Balance Sheet

4.604.59 category average

Reporting/Analytics

4.474.53 category average

- Screenshots

Best for Mobile app

FreshBooks

In our analysis of Financial Reporting products with the most market demand, FreshBooks is the most requested by users for mobile app out of the most popular tools.

FreshBooks is best for mobile app functionality and is ideal for SMBs and freelancers who need to manage finances on the go; our reviewers point out that the mobile app streamlines invoicing, expense tracking, and time management from anywhere.

- Reviewers Perspective

"FreshBooks has streamlined my invoicing process significantly, reducing the time I spend on administrative tasks and giving me more time to focus on my work. While it’s not perfect, the platform offers a robust set of features that cater well to small businesses and freelancers."

MLMatt Lee

Owner

Used for 1-2 years

We analyzed 838 verified user reviews for FreshBooks to find out what actual users really think.

Invoicing

Small businesses use FreshBooks to create, send, and track invoices with customizable templates and recurring billing. Automated reminders and mobile access help manage payments and reduce administrative workload.Ease of Use

Users set up and navigate FreshBooks quickly, even without technical expertise. The platform’s intuitive design and tutorials allow staff to focus on business tasks rather than software training.Accounting

FreshBooks supports bookkeeping, expense tracking, and financial reporting for small businesses and freelancers. Automation and mobile access help maintain organization and reduce errors, though advanced features may be limited. - Key FeaturesFreshBooks's scoreCategory average

Accounting

4.524.57 category average

Income & Balance Sheet

4.414.59 category average

Reporting/Analytics

4.604.53 category average

- Screenshots

Highly Rated for Integrations

NetSuite

According to our user reviews, NetSuite is the highest rated for integrations out of the most popular tools.

NetSuite is highly rated for integrations and is well-suited for businesses requiring seamless connectivity across multiple systems; our reviewers say integrations with ERP, CRM, and third-party apps improve data consistency and workflow efficiency.

- Reviewers Perspective

"NetSuite allowed our business to reevaluate process and streamline existing ones, while serving as a single location to house our financial, banking, and CRM data."

SCSydney Clouatre

Controller

Used for 2+ years

We analyzed 761 verified user reviews for NetSuite to find out what actual users really think.

Data Management

Organizations use NetSuite to consolidate data from multiple departments into a single platform. Real-time dashboards and reporting tools support accurate decision-making and reduce manual entry.Reporting

NetSuite enables custom report generation and real-time analysis. While the system offers broad options, building or modifying reports can be challenging and may require additional training.Features

NetSuite supports ERP, CRM, project management, and HR in one system. Its scalability and modular design allow businesses to adapt as they grow, though mastering advanced features takes time. - Key FeaturesNetSuite's scoreCategory average

Accounting

4.414.57 category average

Income & Balance Sheet

4.354.59 category average

Reporting/Analytics

4.104.53 category average

- Screenshots

Highly Rated for Quick Adoption/Easy Adoption

In our analysis of Financial Reporting products with the most market demand, QuickBooks Desktop is the highest rated for quick adoption out of the most popular tools.

QuickBooks Desktop is highly rated for quick adoption and is a strong fit for SMBs needing easy onboarding; our reviewers say the platform’s user-friendly interface and helpful tutorials enable fast setup and efficient daily accounting tasks.

- Reviewers Perspective

"My overall experience with the accounts payable, accounts receivable and customizing of invoices helps to make invoicing, tracking payments a breeze."

CBCarol Brazil

Office Manager

Used for 2+ years

We analyzed 843 verified user reviews for QuickBooks Desktop to find out what actual users really think.

Invoicing

QuickBooks Desktop enables businesses to create, customize, and track invoices, automating recurring billing and integrating with accounts receivable. This streamlines workflow and supports professional client communications.Reporting

Users generate and tailor a variety of reports for planning and compliance. The ability to track metrics and export data supports business analysis, though some advanced customizations may require extra steps.Accounting

QuickBooks Desktop covers bookkeeping, tax prep, and collaboration with accountants. The platform is accessible for both beginners and experienced users, supporting accurate records and streamlined processes. - Key FeaturesQuickBooks Desktop's scoreCategory average

Accounting

5.04.57 category average

Income & Balance Sheet

4.624.59 category average

- Screenshots

Most Rated for SMBs

Zoho Books

Zoho Books is the most requested by small businesses out of the most popular tools.

Zoho Books is most rated for SMBs and is ideal for small and midsize businesses seeking an all-in-one accounting platform; our reviewers say features like automated invoicing, expense tracking, and a user-friendly interface support efficient financial management.

- Reviewers Perspective

"Zoho Book is quite different from other similar softwares their time tracking functions that make it easy to bill the invoice, their API and their reporting tool is amazing and one of the best thing is their interface."

SJSotis Jake

Account Executive

Used for 6-12 months

We analyzed 415 verified user reviews for Zoho Books to find out what actual users really think.

Invoicing

Zoho Books streamlines invoicing with automated billing, payment reminders, and customizable templates. Users create, track, and convert estimates to invoices, supporting efficient cash flow management.Accounting

Businesses rely on Zoho Books for managing finances, compliance, and reporting. The intuitive interface supports both experienced accountants and those with limited knowledge, though advanced needs may require more options.Customer Support

Users access chat and online resources for support, but some report slow response times and challenges with complex issues. Inconsistent service can impact time-sensitive financial matters. - Key FeaturesZoho Books's scoreCategory average

Accounting

4.464.57 category average

Income & Balance Sheet

4.564.59 category average

Reporting/Analytics

4.644.53 category average

- Screenshots

Best for Usability

FloQast

According to our user reviews, FloQast is the highest rated for its usability out of the most popular tools.

FloQast is best for usability and is suited to accounting teams aiming to streamline month-end close processes; our reviewers say the intuitive dashboard, checklist tracking, and clear visibility into close status enhance workflow efficiency.

- Reviewers Perspective

"FloQast has been instrumental in improving close workflow and managing all the supplementary processes (Compliance, Variance analysis etc)."

GSGretchen Stout

VP Accounting

Used for 2+ years

We analyzed 71 verified user reviews for FloQast to find out what actual users really think.

Close Process

FloQast enables finance teams to track close progress and manage deadlines across multiple entities. The dashboard provides visibility for managers to monitor status and prioritize tasks, reducing unnecessary communication and manual errors.Customer Support

FloQast’s customer support team addresses user needs with ongoing communication and a willingness to implement feedback. Customer success managers help organizations navigate implementation and continuous improvement.Improvements and Additions

FloQast frequently updates features based on customer feedback, allowing organizations to adapt checklists and workflows. The platform’s flexibility supports evolving compliance and analysis requirements. - Screenshots

Most Used By Wholesale

Datarails

Of the products listed on our FrontRunners report, Datarails is the most requested by users in wholesale out of the most popular tools.

Datarails is most used by wholesale organizations needing flexible financial data management; our reviewers say the ease of mapping data, Excel integration, and quick report generation support efficient consolidation and analysis.

- Reviewers Perspective

"We integrated two EHR/ERP systems, Paycom for HCM, and two other applications, and Datarails was able to crosswalk our chart of accounts historically to connect financials and aggregate data without losing anything."

SCStephen Clemetson

Corporate Controller

Used for 6-12 months

We analyzed 118 verified user reviews for Datarails to find out what actual users really think.

Financial Data Management

Finance teams use Datarails to automate aggregation and standardization of financial data from multiple systems. This streamlines reporting and analysis, supporting version control and real-time updates for organizations with complex data environments.Customer Support

Companies benefit from dedicated Customer Success Managers who guide implementation and resolve issues. The support team proactively addresses bugs and communicates solutions, aiding smooth onboarding and ongoing use.Excel Formulas

Teams maintain existing spreadsheets while leveraging Datarails automation and connectivity. While integration with Excel is valued, Datarails-specific formulas may require additional learning for complex workflows. - Key FeaturesDatarails's scoreCategory average

Income & Balance Sheet

4.604.59 category average

Reporting/Analytics

4.604.53 category average

- Screenshots

LiveFlow

- Reviewers Perspective

"Our company has been using LiveFlow flow for about two years and it's become an important tool in our month-end process, allowing us to extract the financial data necessary and then analyze and compare for leadership review and oversight."

DBDanielle Brecht

General Ledger Accountant

Used for 1-2 years

We analyzed 82 verified user reviews for LiveFlow to find out what actual users really think.

Financial Data

Teams automate extraction and updating of financial data from accounting platforms into spreadsheets. This reduces manual entry errors and supports real-time reporting and analysis.Customer Support

Users receive quick assistance with setup, troubleshooting, and customization. The support team helps organizations adopt new features and maximize platform benefits.Financial Reporting

Organizations automate financial reporting and consolidate multi-entity data. Dashboards update automatically, providing teams with timely, accurate financial information for planning and analysis. - Key FeaturesLiveFlow's scoreCategory average

Accounting

5.04.57 category average

Income & Balance Sheet

4.794.59 category average

Reporting/Analytics

4.834.53 category average

- Screenshots

Sage Intacct

- Reviewers Perspective

"That being said, Intacct does a good job with the core accounting functions of housing the ledger, offering all the modules you might need (even if you have to just import data into them or sync 3rd party applications with them), and providing extensive reporting capabilities and internal controls."

JGJay Griffith

Accounting Specialist

Used for 2+ years

We analyzed 365 verified user reviews for Sage Intacct to find out what actual users really think.

Accounting

Organizations manage records, streamline processes, and maintain audit trails. Automation and internal controls help reduce manual reconciliations and support both simple and complex needs.Ease of Use

Teams access necessary information with minimal training. The intuitive design supports both new and experienced users, helping keep business operations running smoothly.Financial Reporting

Users generate real-time, customizable reports and dashboards. Dimensional tracking and automation streamline audits and reduce manual work for better financial management. - Key FeaturesSage Intacct's scoreCategory average

Accounting

4.664.57 category average

Income & Balance Sheet

4.394.59 category average

Reporting/Analytics

4.574.53 category average

- Screenshots

FreeAgent

- Reviewers Perspective

"Also, it was also helpful that the system would match payments to invoices, therefore the monthly reconciliations only took me a few minutes."

OAOMAR AITSIDIAHMED

Senior Professor

Used for 1-2 years

We analyzed 128 verified user reviews for FreeAgent to find out what actual users really think.

Invoicing

FreeAgent automates invoice creation, sending, and tracking, letting small businesses manage payments and recurring billing efficiently. Automated reminders and payment tracking reduce administrative workload.Accounting

FreeAgent centralizes accounting functions, making it easier for businesses to organize records, collaborate with accountants, and access up-to-date financial insights, even for users without an accounting background.Customer Support

FreeAgent’s support team provides prompt, knowledgeable assistance and comprehensive help resources, allowing businesses to resolve issues and onboard quickly without relying on automated bots. - Key FeaturesFreeAgent's scoreCategory average

Accounting

4.504.57 category average

Income & Balance Sheet

4.784.59 category average

- Screenshots

- Reviewers Perspective

"QuickBooks Online Advanced has all the capabilities which allows me to save time and eradicate discrepancies by automating repetitive accounting tasks."

KMKioko Mutuku

Lecturer

Used for 2+ years

We analyzed 637 verified user reviews for QuickBooks Online Advanced to find out what actual users really think.

Ease of Use

Teams navigate daily accounting tasks with a clean, organized interface. Even those without extensive accounting backgrounds can manage finances and onboard new users efficiently.Reporting

Businesses track financial performance with customizable templates and real-time data. Features like memorized reports and advanced filters support essential reporting needs.Accounting

QuickBooks Online Advanced automates accounts payable, receivable, and project accounting. Both accountants and non-accountants manage finances, while collaboration with external CPAs is supported. - Key FeaturesQuickBooks Online Advanced's scoreCategory average

Accounting

4.574.57 category average

Income & Balance Sheet

4.644.59 category average

Reporting/Analytics

4.564.53 category average

- Screenshots

- Reviewers Perspective

"I can generate reports quickly and have up to date information. Once you get to know Spreadsheet server and how it works, you can get things done."

KSKathryn Siow

Assistant Controller

Used for 1-2 years

We analyzed 76 verified user reviews for Spreadsheet Server to find out what actual users really think.

Report Generation

Finance teams generate reports quickly within Excel, using custom templates and real-time updates. Distribution Manager and Profile Scheduler enhance monthly and quarterly reporting workflows.Data Management

Users pull data from multiple sources and handle large volumes efficiently. Detailed drilldowns support analytics and collaboration, reducing manual entry and errors in daily operations.Financial Reporting

Organizations build and update financial statements directly in Excel, integrating with general ledger systems. This streamlines budgeting, analysis, and routine reporting for accounting teams. - Key FeaturesSpreadsheet Server's scoreCategory average

Accounting

5.04.57 category average

Income & Balance Sheet

4.864.59 category average

Reporting/Analytics

4.794.53 category average

- Screenshots

- Reviewers Perspective

"D365 is a great ERP packed full of features for mid-sized companies."

AVAlexandra Van Ness

People Business Partner

Used for 2+ years

We analyzed 105 verified user reviews for Dynamics 365 Business Central to find out what actual users really think.

Training and Learning Curve

Dynamics 365 Business Central provides templates and videos to support onboarding and system updates. Users note that mastering the system requires significant time and sometimes expert guidance, especially for those new to Microsoft products.Integrations

Dynamics 365 Business Central integrates with Office 365, Power BI, and Outlook, enabling automation of business processes and centralized management of assignments for efficient workflows and data sharing.Data Management

Dynamics 365 Business Central offers secure, cloud-based data storage and reporting. Users can access and customize data views from any location, with compatibility for exporting and managing data in Excel. - Key FeaturesDynamics 365 Business Central's scoreCategory average

Accounting

4.364.57 category average

Income & Balance Sheet

4.204.59 category average

Reporting/Analytics

4.294.53 category average

- Screenshots

Domo

- Reviewers Perspective

"The platform allows me to inspect and transform data easily, enabling me to uncover trends and patterns that inform our business strategies"

JRJaden R

Physical assistant

Used for 6-12 months

We analyzed 254 verified user reviews for Domo to find out what actual users really think.

Data Management

Teams inspect, transform, and combine data from multiple sources. This supports trend analysis and decision-making across business units, with automated reporting and collaboration features.Training and Learning Curve

Organizations leverage Domo University and documentation to train both technical and non-technical staff. Basic functions are easy to learn, though advanced features may require additional training.Data Visualization

Users create interactive dashboards with drag-and-drop tools. This helps present complex data in an accessible format, supporting decision-making even for those with limited data experience. - Key FeaturesDomo's scoreCategory average

Income & Balance Sheet

4.504.59 category average

Reporting/Analytics

4.484.53 category average

- Screenshots

Planful

- Reviewers Perspective

"It allows for detailed analysis in budgeting and scenario planning, thanks to Planful's advanced tools, which even enable integration with various ERP and CRM systems."

IZIvan Zumba

Licenciado en Sistemas de Información

Used for 1-2 years

We analyzed 64 verified user reviews for Planful to find out what actual users really think.

Reporting

Finance teams automate reporting and analysis across multiple entities. Customizable templates, scheduled distributions, and Excel add-ins help maintain data consistency and streamline reporting workflows.Budgeting and Forecasting

Organizations migrate budget creation from spreadsheets to Planful’s cloud platform. Rolling forecasts, detailed analysis, and workforce planning tools reduce errors and save time for budget preparers.Data Management

Users consolidate data from various sources for consistent reporting. Fast data loads and flexible modeling options help reduce manual errors, though large-volume processing may require manual steps. - Key FeaturesPlanful's scoreCategory average

Accounting

4.114.57 category average

Income & Balance Sheet

4.484.59 category average

Reporting/Analytics

4.244.53 category average

- Screenshots

Vena

- Reviewers Perspective

"Vena has integrated harmoniously with our existing SAP and Sales Force CRM, it has greatly assisted us in its financial reporting."

SRShihab Rashid

Network Administrator

Used for 6-12 months

We analyzed 106 verified user reviews for Vena to find out what actual users really think.

Data Management

Vena consolidates data from multiple sources, reducing manual errors and supporting timely reporting. Organizations use it to automate data collection and improve cross-departmental decision-making.Financial Budgeting

Vena supports scenario modeling and customizable templates, allowing finance teams to simplify complex planning and improve accuracy. Collaboration tools help departments coordinate on budgets and forecasts.Integrations

Vena integrates with Microsoft Excel and other business applications, streamlining workflows for both technical and non-technical staff. This reduces manual reporting and facilitates data sharing. - Key FeaturesVena's scoreCategory average

Income & Balance Sheet

4.554.59 category average

Reporting/Analytics

4.444.53 category average

- Screenshots

- Reviewers Perspective

"It is simple enough with a little help from tech support I am able to keep track of my accounting and hand it over to my accountant at years end to close out my books."

JDJay Ditsworth

Preo

Used for 1-2 years

We analyzed 333 verified user reviews for Patriot Accounting to find out what actual users really think.

Ease of Use

Teams can quickly set up Patriot Accounting and navigate its clean interface. SMBs benefit from essential features without unnecessary complexity, making onboarding and training efficient even as business needs evolve.Customer Support

When questions arise, users access live chat, phone, and email support. This is especially useful for small businesses with limited IT resources, as clear documentation and patient staff reduce troubleshooting time.Payroll

Patriot Accounting streamlines payroll with quick employee setup, direct deposit, and government reporting. Small businesses manage payroll efficiently, though customizing reports and handling multiple pay rates may require extra steps. - Key FeaturesPatriot Accounting's scoreCategory average

Accounting

4.424.57 category average

Income & Balance Sheet

4.194.59 category average

Reporting/Analytics

4.644.53 category average

- Screenshots

- Reviewers Perspective

"Its intuitive interface, secure cloud-based platform, and clear visibility into cash flow make it a practical choice for everyday accounting tasks. While customer support and mobile performance could be improved, and customization options are somewhat limited compared to premium competitors, Sage delivers solid value for money."

ALAlain Le Breton

IT

Used for 2+ years

We analyzed 331 verified user reviews for Sage Accounting to find out what actual users really think.

Accounting

Users manage accounts, track transactions, and generate reports from anywhere. The platform supports both beginners and professionals, making bookkeeping and collaboration with accountants straightforward for small businesses.Invoice Management

Sage Accounting lets businesses create and send invoices, track payments, and manage billing. Features like recurring invoices and mobile access support efficient billing, though template customization is limited.Setup

Organizations implement Sage Accounting with clear steps and helpful tutorials. Even those with limited technical experience can configure the system to their needs, reducing complexity during initial setup. - Key FeaturesSage Accounting's scoreCategory average

Accounting

4.474.57 category average

Income & Balance Sheet

4.424.59 category average

Reporting/Analytics

4.034.53 category average

- Screenshots

- Reviewers Perspective

"The ease with which I can produce reports is life-changing for an accountant, but that absolute best thing about Syft is their team."

TDTamryn Dicks

Managing Director

Used for 2+ years

We analyzed 132 verified user reviews for Syft Analytics to find out what actual users really think.

Reporting

Syft Analytics enables users to generate detailed, visually appealing reports and schedule email deliveries. Data from multiple entities can be consolidated, supporting monthly management reporting.Financial Statements

Syft Analytics streamlines the creation of Balance Sheets and Profit & Loss statements, providing dashboards and tools for quick adjustments and professional outputs suitable for financial institutions.Ease of Use

Syft Analytics offers a straightforward design and simple setup, allowing users with limited technical skills to navigate and complete tasks efficiently, enhancing productivity for both new and experienced users. - Key FeaturesSyft Analytics's scoreCategory average

Accounting

4.924.57 category average

Income & Balance Sheet

4.784.59 category average

Reporting/Analytics

4.724.53 category average

- Screenshots

- Reviewers Perspective

"We can turn around our financial results so much faster than we previously could, and then use those values to project out a rolling forecast easily once the initial formulas are set up."

EPEmily Przybysz

Finance Manager

Used for 2+ years

We analyzed 143 verified user reviews for Workday Adaptive Planning to find out what actual users really think.

Forecasting

Finance teams create budgets, rolling forecasts, and scenario models. Integration of actuals streamlines cycles and improves accuracy, supporting multi-department planning.Data Management

Users consolidate financial and operational data for streamlined analysis. Flexible connections and cloud access support uploading, visualizing, and analyzing data from various sources.Ease of Use

Organizations benefit from a user-friendly design that supports collaboration and efficient navigation. Initial training helps users adapt quickly to scenario management and reporting. - Key FeaturesWorkday Adaptive Planning's scoreCategory average

Accounting

4.384.57 category average

Income & Balance Sheet

4.424.59 category average

Reporting/Analytics

4.404.53 category average

- Screenshots

Budgyt

- Reviewers Perspective

"Budgyt accomplishes this by offering the largest number of sub-tiers of any budget SAAS out there, unlimited line-items under each lowest level account category, and line-item notes for expense/income justification."

PRPaul Rice

Treasurer

Used for 2+ years

We analyzed 59 verified user reviews for Budgyt to find out what actual users really think.

Budgeting

Budgyt lets organizations manage detailed line-item budgets, perform variance analysis, and forecast scenarios in real time. Multi-level roll-ups and payroll management support efficient financial oversight.Customer Support

Budgyt’s support team is accessible for setup and ongoing use, providing tutorials and guidance for troubleshooting and feature requests. Personalized help ensures smooth onboarding and continued confidence.Ease of Use

Budgyt’s design simplifies complex budgeting tasks, making it easy for both finance and non-finance staff to learn, enter information, and access reports, saving time and improving productivity. - Key FeaturesBudgyt's scoreCategory average

Accounting

4.804.57 category average

Income & Balance Sheet

4.704.59 category average

Reporting/Analytics

4.504.53 category average

- Screenshots

- Reviewers Perspective

"Accounting Seed is a powerful, flexible, and Salesforce-integrated accounting tool that simplifies finances"

AMAndy Marcheix

Senior Account Executive

Used for 6-12 months

We analyzed 105 verified user reviews for Accounting Seed to find out what actual users really think.

Ease of Use

Users navigate daily tasks easily once familiar with the system. Centralized information and document management simplify workflows for teams working within the Salesforce ecosystem.Salesforce Integration

Accounting Seed manages accounts and financial data directly within Salesforce. This integration enhances data reliability and workflow efficiency without third-party connectors.Integrations

Organizations link accounting functions with CRM, ERP, and other tools. This supports automation and unified management of contacts, programs, and financial data. - Key FeaturesAccounting Seed's scoreCategory average

Accounting

4.564.57 category average

Income & Balance Sheet

4.424.59 category average

Reporting/Analytics

4.104.53 category average

- Screenshots

Methodology

The research for the best financial reporting software list was conducted in October 2025. We evaluated data (user reviews and demand signals) from the past 24 months as of the research date. Read the complete methodology.

Popular Financial Reporting Comparisons

Buyer's Guide

This detailed guide will help you find and buy the right financial reporting software for you and your business.

Last Updated on May 27, 2025Here's what we'll cover:

What you need to know about financial reporting software

What is financial reporting software?

Essential features of financial reporting software

Benefits and competitive advantages of using financial reporting software

How to choose the best financial reporting software for your business

Software related to financial reporting

More resources for your financial reporting journey

What you need to know about financial reporting software

Financial reporting software is a category of accounting software dedicated to supporting strategic business goals. As opposed to basic bookkeeping systems that record daily transactions, financial reporting software is focused on compiling that data into structured reports and dashboards for analysis and decision-making.

It helps business owners quickly gauge everything from historical performance to adherence to tax laws and regulatory requirements. However, choosing a financial reporting solution can be challenging given the variety of options available. With more than 400 financial reporting products listed on our site, there’s no shortage of vendors and features to consider.

Understanding how much to budget should be a top priority. Pricing for financial reporting tools varies widely based on business size, complexity, and features. Entry-level solutions for small businesses can start at around $20 per month. [1] Mid-market systems with more advanced reporting and integration capabilities typically cost a few hundred dollars per month (depending on the number of users and modules included).

You should also involve your finance team and other stakeholders to figure out answers to critical questions about your financial reporting software purchase, such as:

Which reporting features do we need, and which might be redundant with our current accounting system?

How easily does the software integrate with existing systems and data sources? Can it pull data from our ERP, CRM, or spreadsheets without manual effort?

Can we customize reports to fit our business requirements? (E.g., creating custom fields or KPIs specific to our industry or internal metrics.)

Does the system help automate compliance with accounting standards and regulations? For instance, will it produce GAAP or IFRS-compliant financial statements?

What built-in tools, such as analytics and visualization, does the software offer to communicate findings to stakeholders?

With help from our experienced accounting software advisors, Cameron Pugh, Eric Franco, and Bryan Dengler, this buyer’s guide will equip you with the right information to make a confident software purchase decision.

What is financial reporting software?

Financial reporting software pulls data from accounting systems (and other sources) to generate key financial insights and statements for businesses. It helps companies track profitability and ensure compliance with accounting standards. As our advisor, Dengler, mentions, these systems provide more sophisticated capabilities than basic accounting solutions, helping users track performance metrics, identify trends, and make smart data-driven decisions. “They are designed to address scenarios where businesses say, ‘I don't like the reporting in my accounting program,’” says Dengler.

Common features of financial reporting software include automated report generation, customizable dashboards, financial analysis, and data visualization tools.

Essential features of financial reporting software

Almost all financial reporting software systems offer core features like automatic data import or export, drill-down financial analysis, and customizable reports. Beyond this, the features offered can be almost endless, as vendors will differ in the depth of financial reporting they want their product to focus on.

Based on our analysis of common requests from buyers and themes in user reviews, these are the most important financial reporting features and capabilities to consider. [2]

Core financial reporting software features

Data import or export | Import and export data to and from software applications. 85% of our reviewers rate this feature as critical or highly important. |

Self-service reporting | Allow users to create their reports and financial statements. 63% of our reviewers rate this feature as critical or highly important. |

Financial analysis | Evaluate units, projects, budgets, and other finance-related data to gauge performance and potential risk. 53% of our reviewers rate this feature as critical or highly important. |

Common financial reporting software features

Reporting or analytics | View and track pertinent metrics to find patterns and gain insights from data. 95% of our reviewers rate this feature as critical or highly important. |

Income and balance sheet | A statement detailing a business's financial position, including assets, liabilities, and equity, at a certain point in time. 93% of our reviewers rate this feature as critical or highly important. |

Profit or loss statement | A type of financial statement used to record and report an organization's revenues, costs, and expenses over a specific period of time. 93% of our reviewers rate this feature as critical or highly important. |

General ledger | A centralized accounting record that tracks all financial transactions. 86% of our reviewers rate this feature as critical or highly important. |

Billing and invoicing | Create, manage, and send invoices or bills to customers. 82% of our reviewers rate this feature as critical or highly important. |

Budgeting and forecasting | Create budgets based on historical data and future projections. 78% of our reviewers rate this feature as critical or highly important. |

In addition to the standard reports, companies with more complex structures often ask for roll-up reporting, which aggregates data from multiple analytics units and lets you see that data together in one report. Franco highlights that “roll-up reporting” is frequently requested by businesses that manage multiple entities, “like those with five or six different types of revenue streams,” that need consolidated financial views. This is especially valuable to companies that have outgrown basic accounting solutions.

Benefits and competitive advantages of using financial reporting software

Companies that keep a keen eye on their financial health have a distinct advantage in their industry. They are able to spot trends in time that affect profitability, plan for taxes, and ensure they’re meeting regulatory reporting standards.

Every business knows the importance of good financial data, but only those leveraging the right tools reap the full rewards. Dengler, who has been advising software buyers for nearly a decade, says this is one of the key benefits of adopting financial reporting software. “Many businesses adopt financial reporting tools to replace time-consuming manual bookkeeping with automated workflows and bring accuracy and speed in day-to-day financial reports,” Dengler says.

Some benefits that reviewers say financial reporting software brings include:

Geographic and regulatory flexibility: Companies that operate in multiple states can manage different tax jurisdictions and regulatory requirements with advanced reporting tools. This helps simplify compliance and supports smoother expansion into new projects, locations, or markets without losing financial clarity.

Streamlined expense reporting: Features like receipt scanning, data capture, and approval workflow management help automate expense management and reporting, eliminating paperwork and manual data entry and giving owners real-time visibility into where money is going.

Improves accounting and bookkeeping: Financial reporting software ties directly into core accounting ledgers (like general ledger and accounts receivable or payable), reducing duplicate work and errors. This results in more effortless month-end closings and simplified tax compliance, enabling finance teams to focus on analysis rather than data collection.

Unified view of finances: Financial reporting tools allow businesses to consolidate information from multiple units and companies to provide a unified view of finances across organizational structures.

How to choose the best financial reporting software for your business

Step 1. Define your requirements

We surveyed 3,500 software buyers and found that the most common thing regretful software buyers would do to avoid regret on their next purchase is clearly defining their goals and desired outcomes. [3]

Meeting with stakeholders and outlining the specific needs and goals for your financial reporting software is critical at the outset. This ensures everyone is aligned on what kind of software to look for and also gives you a measuring stick to declare whether your purchase is ultimately successful.

Here are some things to keep in mind as you define your requirements.

Understand your industry-specific requirements

Every business has unique financial reporting requirements based on its industry and operations. Identify what reports and features are critical for your field. For example, a construction firm might need project-level cost tracking, while a nonprofit needs fund-specific ledgers. In some cases, specialized regulatory demands come into play, like banking firms must adhere to certain capital adequacy ratios.

Make sure any tool you consider can handle these industry or location-specific needs. Franco notes that companies operating in multiple states often require “something a little bit more granular” in their reporting for tax purposes,” a reminder that if your business spans regions or tax jurisdictions, your reporting tool should be able to support the necessary level of detail.

Plan for future business growth and scalability

Think beyond your current needs and ensure the software will scale with you. A solution that fits a small business today may falter as you expand to new locations, add business units, or increase transaction volume.

Franco, who has been advising business owners on technology needs for several years, has seen growing companies outgrow basic accounting tools. For instance, firms with multiple entities under one umbrella often struggle to “roll up” consolidated reports in their entry-level software.

Choosing a platform that accommodates multi-entity consolidations, multi-currency, and a higher workload from the start will save you from needing another upgrade in a few years.

Budget for your entire financial stack

When budgeting for financial reporting software, look beyond the sticker price. Consider how costs will scale as your business grows: adding users, more data, or advanced features often drive up costs. Based on advisor conversations, 52% of buyers spend under $210 per month on financial reporting software, while 31% invest over $630. This difference reflects the range of available products and varying business needs, from small to large enterprises.

Most small businesses are well-served by purchasing financial reporting software in-suite, as one application included in a larger accounting platform. This helps ensure that financial reporting is fully integrated with other key accounting processes, such as budgeting and forecasting, payroll, and billing and invoicing. Examples of this type of system include Xero and QuickBooks Online.

Midsize and growing businesses that outgrow the reporting capabilities offered by basic accounting solutions might consider supplementing their existing system with a stand-alone financial reporting software. This could help curb the costs of an entire accounting system upgrade while meeting more advanced reporting needs.

But this isn’t the only cost you need to budget for. Don’t ignore hidden costs such as implementation, data migration, training, integrations, and support fees. Our advisors recommend determining all the features you need before locking in a rigid budget. If a cheaper system lacks key functions, you might spend more later on add-ons or lose productivity to manual work. In short, budget with flexibility so you can invest in a solution that will grow with your business and prevent expensive surprises down the road.

Consider regulatory compliance and standards

Financial reporting software must align with the accounting standards and compliance requirements relevant to your business. Public companies and global firms will require IFRS or GAAP-compliant statements out of the box, but even smaller businesses benefit from compliance-ready tools. For instance, many lenders and investors demand GAAP-standard financials for transparency.

Verify that any system on your radar supports Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) as needed. Choose a platform that stays up to date with tax law changes and regulatory reporting requirements to avoid compliance gaps. Your software should make it easy to produce accurate, audit-ready reports that meet applicable regulatory standards.

Optimize integration with existing systems

Evaluate how well each software option will integrate with your current tech stack. Your financial reporting tool will pull data from systems like your accounting general ledger, ERP, CRM, payroll, or ecommerce platforms. So, seamless data flow is vital to prevent manual work. In fact, according to our survey, 31% of buyers who ended up with “buyer’s remorse” cited poor compatibility with existing systems as a major issue. [3]

To avoid that, check for pre-built integrations or APIs for your key systems and involve your IT team early to assess fit. As Cameron Pugh, our advisor, puts it, it’s often best to choose a reporting solution that’s “integrated with [your] general ledger, accounts receivable, and accounts payable” rather than a bolt-on solution. Also, consider other connections you might need, say, integration with banking feeds or credit card systems, which can streamline data import. The easier your new reporting software meshes with your existing tools, the more time and errors you’ll save in the long run.

Step 2. Make your financial reporting software shortlist

Once you’ve figured out your requirements, it’s time to research your options and come up with a shortlist of 2-3 systems to evaluate further.

Here are some ways to easily narrow down your financial reporting software options and create a reliable shortlist.

Get qualified help from our advisors

At Software Advice, our advisors, such as Cameron Pugh, Eric Franco, and Bryan Dengler, have experience helping organizations identify financial reporting systems that match their needs and budgets.

If you need help, you can either schedule a phone call with an advisor or chat online with one right now. In just a few minutes, your advisor will help you identify a shortlist of financial reporting software options that best align with your requirements.

Explore our list of talent management FrontRunners

If you’d rather do the research yourself, a good place to start is our financial reporting FrontRunners report. Using reviews data, we map the top products in the category based on customer satisfaction and usability.

Step 3. Pick the best option

Now it’s time to see those shortlisted solutions in action. This means talking to vendors, scheduling demos, and getting some hands-on time through free trial periods.

Here are our tips at this stage.

Be ready with the right questions during demos

To get the most value, come prepared with a list of questions and scenarios to guide the demo; don’t just passively watch a sales presentation. Going in with clear questions will help you cut through the sales pitch and reveal how the software really works. A few key questions to ask during demos:

If I wanted to generate a specific report, how would I do it?

How does this feature work on mobile devices?

What will be needed to integrate the software with my other systems? (Confirm whether the integrations you need are “plug and play” or need to be built from scratch.)

What kind of user training resources and support do you offer?

Do you charge for implementation and data migration?

Also consider asking about the product roadmap (to ensure the vendor is actively improving the software), the frequency of updates, and how data backups or security are handled. You can take multiple demos. By the end of each demo, you should have a clear picture of how well the solution fits your business and what working with a vendor entails (e.g. support responsiveness, implementation process).

Take advantage of our ultimate software vendor comparison chart to keep track of the answers and how your team is scoring different products.

Take advantage of free trials

Whenever possible, get hands-on with the software through a free trial. A live demo is useful, but there’s no substitute for testing the system yourself with real-world tasks. Many vendors offer a trial environment or sandbox. Use it to run a few typical reporting processes (for example, try importing some of your data and generating a report or two).

During the trial, involve the team members who will be daily users of the system and gather their feedback. This will quickly highlight the user experience, learning curve, and any technical hiccups in a way demos might not.

Make a purchase decision in a timely manner

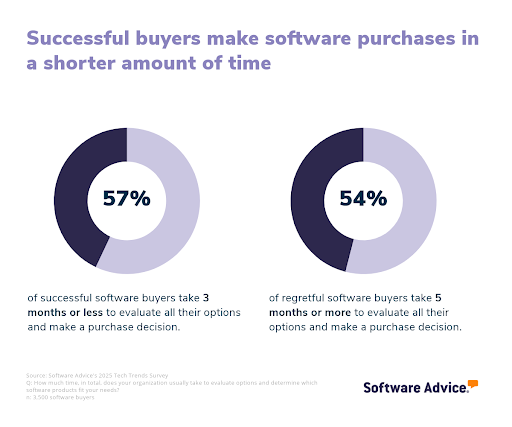

With demos and trials completed, gather your team’s input and make a decision while the insights are fresh. Dragging out the selection process too long can stall your business objectives and lead to “analysis paralysis.” We find that most successful buyers (57%) take three months or less to evaluate software options, while most regretful buyers (54%) take five months or more.

To avoid getting stuck, set a firm timeline or deadline for the final decision and stick to it. If you’ve done your homework in the earlier steps, you should have all the data you need (feature checklists, cost comparisons, user feedback from trials) to choose the best-fit solution.

Step 4. Make the most of your financial reporting software

Here are some best practices to maximize the value of your new financial reporting system:

Develop a detailed implementation plan and assign a champion. Assemble a capable implementation team and designate an internal adoption champion, someone in your organization who will lead the charge, help colleagues learn the system, and liaise with the vendor as needed.

Don’t skimp on training. Arrange comprehensive training sessions for all users and consider diverse formats to suit different learning styles (online tutorials, live workshops, hands-on labs, etc.).

Continuously optimize and educate. To truly reap the benefits of your financial reporting software, plan for a staggered rollout. Start with the most important use case, do tests, gather user feedback, squash bugs, then move on to the next most important use case, and so on. Schedule periodic check-ins (say, after 3 months, 6 months) to gather user feedback to help users leverage the full system’s capabilities.

Our five critical steps to a successful software implementation can help guide you through this process.

Software related to financial reporting

During your search, you may come across other tools that provide complementary features to financial reporting systems. Some of these tools can combine to help you build a tech stack that best addresses your specific needs.

Accounting software: Accounting software helps businesses track income, expenses, and overall financial performance. Most financial reporting software integrates directly with accounting platforms to pull key financial data.

Business intelligence software: Business intelligence (BI) software focuses on data analysis, visualization, and reporting. Integrating BI tools with financial reporting software improves strategic decision-making.

Budgeting software: Budgeting tools help businesses forecast revenue and expenses, compare actual vs. planned performance, and generate financial models. Some financial reporting systems include budgeting features, but standalone budgeting tools offer more sophisticated planning capabilities.

Audit software: Audit management tools assist in tracking internal controls, financial accuracy, and regulatory compliance.

Sales tracking software: These systems monitor and analyze sales performance metrics that directly impact financial reporting, providing visibility into revenue pipelines.

Compliance software: These systems help ensure your financial reporting meets relevant industry regulations and standards, reducing risk and ensuring accuracy.

More resources for your financial reporting journey

6 Accounting Reports To Analyze Your Small-Business Operations

Small Business Guide To Set Up an Effective Accounting Function: 5 Essentials

About our contributors

Author

Amita Jain is a senior writer for Software Advice, covering finance technology with a focus on expense management and accounting solutions for small-to-midsize businesses. After completing her master’s in policy studies from King’s College London, she began her career as a journalist in New Delhi, India, where she garnered first-hand knowledge of the startup space and the education sector. She spent nearly half a decade covering high-level events hosted by the United Nations and the Government of India. Her work has been featured in Careers360, among other publications.

Amita’s research and writing for Software Advice is informed by more than 130,000 authentic user reviews and over 30,000 interactions between Software Advice software advisors and software buyers. Amita also regularly speaks to leaders in the finance and accounting space so she can provide the most up-to-date and helpful information to small and midsize businesses purchasing software or services.

When she’s not contemplating tech solutions for SMBs, Amita finds her zen in swimming, doodling, and indulging in animated sitcoms and science fiction.

Editor

Parul Sharma is a content editor at Software Advice with expertise in curating content for various niches, including SaaS, digital marketing, and search engine optimization. With over half a decade of experience in content writing and editing, Parul has the expertise to simplify complex terms into engaging, valuable content for targeted audiences. She completed her graduation and post-graduation in English literature from Delhi University and was awarded the Dr. Asha Sahni Memorial Award for being the highest scorer in her graduating class.

Parul has contributed to the news, lifestyle, education, and health verticle of DNA India, India’s premier media channel. Outside of work, she can be found curating healthy recipes, coloring in mandala books, and spending quality time with her family.

Contributors

Cameron Pugh is a senior advisor. He joined Software Advice in 2022, and he is based in Austin, TX.

Cameron works directly with small-business leaders to connect them with best fit software providers. He assesses the technology needs of small businesses seeking tools such as CMMS, inventory management, call center, and facilities software through one-to-one conversations and provides a short list of potential matches.

His favorite part of being a software advisor is experiencing the buyer’s gratitude and relief when he finds the best software solution for their needs.

Eric Franco is a senior advisor. He joined Software Advice in 2019, and he is based in Austin, TX.

Eric works directly with small business leaders to connect them with best fit software providers. He assesses the technology needs of small businesses seeking accounting, manufacturing, learning management, and supply chain software through one-to-one conversations and provides a short list of potential matches.

His favorite part of being a software advisor is hearing the sense of relief in a stressed buyer’s voice when they realize he can help them find the right software for their needs.

Bryan Dengler is a senior advisor. He joined Software Advice in 2022, and is based in Austin, TX.

As part of the software advisor team, Bryan helps professionals from a wide range of industries who are seeking accounting, project management, manufacturing, learning management, and supply chain software. He provides a shortlist of personalized technology recommendations based on budget, business goals, and other specific needs.

Bryan’s favorite part of being a software advisor is knowing he’s made a valuable difference in a buyer’s life with each advising session he holds.

Sources

Software Advice software pricing data: Only products with publicly available pricing information and qualified software products within the category, as of the production date, are included in the pricing analysis. Read the complete methodology.

Software Advice reviews data: Software Advice reviews are collected from verified users for individual software products. For this report, we analyzed reviews from the past year as of the production date. Read the complete methodology.

Software Advice’s 2025 Tech Trends Survey was conducted online in August 2024 among 3,500 respondents in the U.S. (n=700), U.K. (n=350), Canada (n=350), Australia (n=350), France (n=350), India (n=350), Germany (n=350), Brazil (n=350), and Japan (n=350), at businesses across multiple industries and company sizes (five or more employees). The survey was designed to understand the timeline, organizational challenges, adoption & budget, vendor research behaviors, ROI expectations, and satisfaction levels for software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.

Software Advice advisor call notes: Findings are based on data from telephonic conversations that Software Advice’s advisor team had with small-to-midsize businesses seeking HR software. For this report, we analyzed phone interactions from the past year as of the production date. Read the complete methodology.

Financial Reporting FAQs

- What is the best financial reporting software?

According to our analysis of products with high market demand and reviews, Phocas is the best-rated software for functionality from verified reviewers of financial reporting software on Software Advice. Our analysis of user reviews in the past year finds dashboard, visualization, and data import or export as the most frequently top-rated features.

- What is the most used financial software?

According to our analysis of products with high market demand and reviews, Fathom had the highest overall rating from verified reviewers on Software Advice. Our analysis of user reviews in the past year finds that it’s highly rated for ease of use, with an average rating of 4.6 out of 5.

- Which software is best for financial analysis?

According to our analysis of products with high market demand and reviews, QuickBooks Online had the highest overall rating from verified reviewers on Software Advice for financial analytics.

- Which software can you use for financial records?

Businesses typically use accounting software to maintain financial records, serving as the company’s official books. The most suitable software depends on the size and complexity of your operations. But all options serve the same core purpose: recording financial transactions in an organized way, so you can produce accurate ledgers, trial balances, and financial statements. In addition, some businesses (especially very small ones or startups) might start out using spreadsheets for basic financial record-keeping. However, spreadsheets can become error-prone and hard to manage as transactions increase, so it is recommended that they move to dedicated software.

- What are the four types of financial reporting?

The four primary types of financial reporting are income statement, also called profit & loss statement (illustrates profitability over a period), balance sheet (shows the financial position at a point in time), cash flow statement (details cash inflows and outflows), and statement of changes in equity (explains movements in owners’ equity over the period). Virtually all other financial reports or metrics draw from them. They each provide unique insights, profitability, stability, liquidity, and shareholder value changes, which together give a 360-degree view of the company’s financial condition. Our analysis of user feedback shows that 93% of users rate both balance sheet and profit/loss statements as critical or highly important features of financial reporting software.

- What are the 4 pillars of financial reporting?

The four pillars of financial reporting are relevance, reliability, comparability, and understandability. Relevance means the information is useful and helps in decision-making. Reliability ensures that financial data is accurate, unbiased, and can be verified. Comparability allows businesses to track financial trends over time or compare reports with other companies. Understandability means final reports should be clear and easy to interpret, even for those without deep accounting knowledge.