Find the best Human Resources Software

Compare Products

Showing 1 - 20 of 3904 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Asure Payroll & Tax Management

Asure Payroll & Tax Management

Asure’s end-to-end Payroll, HR, and Time and Attendance solutions were developed specifically for small to mid-sized businesses. With the modern Asure platform, remain compliant, support your employees, and free up time to focus o...Read more about Asure Payroll & Tax Management

Rippling

Rippling

FrontRunners 2024

Rippling gives businesses one place to run HR, IT, and Finance. It brings together all of the workforce systems that are normally scattered across a company, like payroll, expenses, benefits, and computers. So for the first time e...Read more about Rippling

TimeClock Plus

TimeClock Plus

TimeClock Plus is a cloud-based workforce management solution designed to make the day-to-day of your organization more efficient. TimeClock Plus also offers dynamic scheduling and job costing features that can be configured to an...Read more about TimeClock Plus

Justworks

Justworks

FrontRunners 2024

Justworks makes it easier to start, run, and grow a business. With Justworks, entrepreneurs and their teams get access to big-company benefits, automated payroll, compliance support, and HR tools - all in one place. Justworks PEO...Read more about Justworks

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many employees are in your company?

isolved

isolved

isolved is the most-trusted HCM technology leader, providing the best combination of software and services to meet the needs of today’s People Heroes – HR, payroll, and benefits professionals. From talent acquisition to workforce ...Read more about isolved

Paycom

Paycom

Paycom offers user-friendly HR and employee-driven payroll technology to enhance the employee life cycle, in a single software. Paycom drives efficiencies, increases data integrity and gives employees power over their HR informat...Read more about Paycom

Paycor

Paycor

Paycor empowers leaders to build winning teams. Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding and payroll to career development and retention, but what r...Read more about Paycor

Keka

Keka

Keka is a cloud-based human resource (HR) solution, which helps businesses manage staff profiles, track attendance, process recruitments and analyze performance. Features include GPS, pulse surveys, document storage, helpdesk, rol...Read more about Keka

WorkforceHub Time & Attendance

WorkforceHub Time & Attendance

WorkforceHub is a cloud-based time, attendance, and leave management system for small to mid-size businesses. This software can capture time data from web-based clocks or physical clocks for employees onsite, mobile, and working a...Read more about WorkforceHub Time & Attendance

WorkforceHub

WorkforceHub

WorkforceHub is a cloud-based time, attendance, and leave management system for small to mid-size businesses. This software can capture time data from web-based clocks or physical clocks for employees onsite, mobile, and working a...Read more about WorkforceHub

ClearCompany

ClearCompany

Since 2004, ClearCompany’s end-to-end Talent Management platform has enabled thousands of companies to maximize talent by empowering people at every stage of the employee journey. ClearCompany integrates data-driven best practices...Read more about ClearCompany

BambooHR

BambooHR

FrontRunners 2024

Instead of using fragmented spreadsheets, limited or clunky software, and physical paper, BambooHR helps you centralize your data and automate the way you complete key HR tasks. As you hire, onboard, and pay your employees, every ...Read more about BambooHR

Centrally HR

Centrally HR

HCM solution that helps manage and automate onboarding, benefits management, employee database, timekeeping and more....Read more about Centrally HR

GoCo

GoCo

GoCo is a cloud-based human resources, benefits and payroll solution designed for small businesses. The platform automates the process of collecting required documents for newly hired talent, enrolling new employees in benefits pl...Read more about GoCo

ITCS-WebClock

ITCS-WebClock

ITCS-WebClock is a cloud-based human resources solution that caters to HR, payroll and finance teams in businesses of all sizes across various industries. Key features include time and attendance tracking, absence management, expe...Read more about ITCS-WebClock

Paylocity

Paylocity

Paylocity is a cloud-based human capital management (HCM) platform that provides human resources and payroll management tools to help businesses manage core HR functions. Key features include payroll processing, benefits administr...Read more about Paylocity

Workable

Workable

Workable simplifies HR with a suite of products for recruitment and employee management: Workable Recruiting is the leading Applicant Tracking System, enhancing hiring with AI, powerful sourcing tools, and seamless integration wi...Read more about Workable

Replicon

Replicon

Replicon's advanced timesheet functionality lets businesses track valuable information including check-ins/outs, task progress, and billable/non-billable hours. The invoice module allows users to build custom invoices, examine pay...Read more about Replicon

Dayforce HCM

Dayforce HCM

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on improving work for thousands of customers and millions of employees around the world. Our single, global people platform for HR, ...Read more about Dayforce HCM

Humanity

Humanity

Humanity Scheduling, powered by TCP Software, is a cloud-based employee scheduling solution that can save valuable time and resources for your organization. With a focus on automation, accessibility, compliance, and user experienc...Read more about Humanity

Popular Comparisons

Buyers Guide

Last Updated: November 07, 2023In this buyers guide, we'll cover:

What is human resources (HR) software?

Human resources (HR) software is designed to help business leaders and human resource personnel recruit, hire, manage, and develop employees. Core HR applications for payroll and time and attendance can help streamline operational needs, while more strategic talent management applications (such as performance management systems) can optimize employee productivity.

Benefits of HR software

Efficient personnel management: Human resource information systems (HRIS) store a complete record of employee data, includinggeneral personal information, job and salary history, benefits and insurance plans, banking details, performance information, and often other custom data relevant to a company. This keeps all information linked and stored together for ease of tracking and management.

Enhanced reporting and analytics: HR systems collect swathes of employee data such as compensation numbers, recruiting data, performance information, and much more. Human resource personnel can use these systems to analyze key workforce metrics and insights in order to make strategic business decisions.

Repetitive task automation: The automation of specific and repetitive HR functions saves businesses time on human resource management (HRM) tasks, allowing human resource departments to focus on more strategic needs. HR processes such as expense reporting, employee onboarding, and payroll can all be automated by HR software.

Employee life cycle management: HR technology helps businesses manage employees from the moment they apply for a position within the organization to the moment they leave. This is key to attracting and retaining top talent. HR applications such as talent management, applicant tracking, and employee engagement contribute to life cycle management.

Competitive advantages of using HR software

Your employees are the most important resource you have, and your company's success hinges on your ability to hire and manage them effectively. HR software can give you a competitive advantage in getting the most out of your workforce by helping you:

Improve data insight: Using HR tools to analyze your workforce helps you make data-driven business decisions. As well as storing accurate historical data, data within an HR software solution is constantly updated,which helps managers detect and analyze trends and issues in the workforce. Creating standardized reports is also vital for compliance purposes and keeping stakeholders in the know.

Increase employee engagement and productivity: Captured employee feedback can gauge engagement and productivity levels, but it can also be analyzed alongside workforce trends to determine the impact of employee engagement on business outcomes. This helps to curate career paths, make employee development decisions, and strengthen company culture initiatives to boost engagement and bolster retention efforts.

Source and hire the right talent: Talent management features help HR managers find talent from the right places in order to grow and remain competitive. A company's true competitive differentiator is its employees, so making the right investments in people with the help of HR tools is imperative in order to stay ahead.

Business sizes using HR software

HR tools are used by all types of businesses across a broad spectrum of industries for HR management needs. While there's no “standard" buyer type, there are a few categories in which your business will likely fall:

Small business buyers: These buyers tend to be new businesses with anywhere from 1-50 employees that don't have any dedicated HR personnel.

Midsize business buyers: These buyers have anywhere from 51-500 employees and typically have an HR team consisting of an HR generalist and a recruiter Because of rapid growth, these buyers need software for things like applicant tracking and benefits administration.

Enterprise business buyers: These buyers are established businesses with more than 500 employees. They have a sizable HR department, dedicated IT personnel, and are generally looking to optimize their workforce with compensation and learning management systems.

Categories of HR software

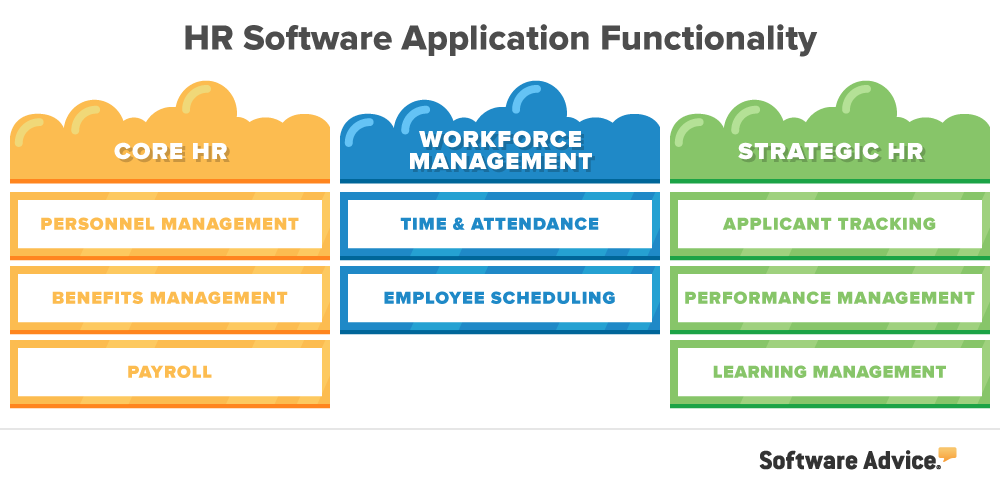

HR software is broken down into three main categories: Core HR (HRIS) Workforce Management, and Strategic HR.

Features Guide

A list of common HR software features

When comparing HR software, it's important to understand the functionality included in each, as this will help you decide what size and type of HR solution is right for your business. We've listed the most common functions of these systems in the tables below.

Core HR features:

Core HR consists of four traditional HR management functions: personnel tracking (HRIS), applicant tracking, benefits administration,and payroll. Every business will require these functions once it has reached a critical mass of employees.

Personnel tracking (HRIS) | Centralizes employee data such as SSN and banking details, contact information, job and salary history, and benefits and insurance plans. |

Applicant tracking | Centralizes applicant information and manages the application process. Includes customized hiring workflows, resume management, and applicant scoring. |

Manages employee benefits such as paid time off, medical/dental/life insurance policies and 401(k) participation. | |

Tracks employee salaries, bonuses, 401(k) contributions, health and other deductions; calculates withholding for taxes; and cuts paychecks. |

Workforce management features:

Workforce management encompasses applications that track your workforce, including scheduling and time and attendance tracking functionality.

Tracks employee attendance and absences, and enables employees to clock in and out. Many solutions also track PTO and sick days. | |

Creates, tracks and manages employee schedules. Systems can schedule employees across departments, locations and projects. |

Strategic HR features:

Strategic HR involves HR applications that support long-term talent management goals such as engaging and developing employees. Applications here include those that provide performance management, learning management, or employee engagement functionality.

Performance management | Centralized systems where managers can conduct and track reviews with employees. Features include performance measuring, tracking, and goal management. |

Manages the ongoing skills development and training of employees. Includes content authoring, curriculum and certification path definition, testing and reporting. | |

Employee engagement | Administer pulse surveys on work conditions, recognize employees’ work, and track the engagement of your workforce over time. |

Feature details and examples

Personnel tracking: Sometimes referred to as a human resources information system (HRIS), this feature centralizes and manages important employee information including personal information, contact details, salary rates and more. Users can attach documents to employee profiles, run reports and see a top-down view of their organization as a whole.

![]()

Personnel tracking in Namely

Applicant tracking: This allows you to track where all of your candidates are in the hiring process for different positions in your organization. You can post job openings online, store job applications and resumes, collaborate with hiring managers on talent assessment and generate reports. Embedded analytics can tell you where to focus your efforts to improve your recruiting processes.

![]()

Applicant Tracking in JazzHR

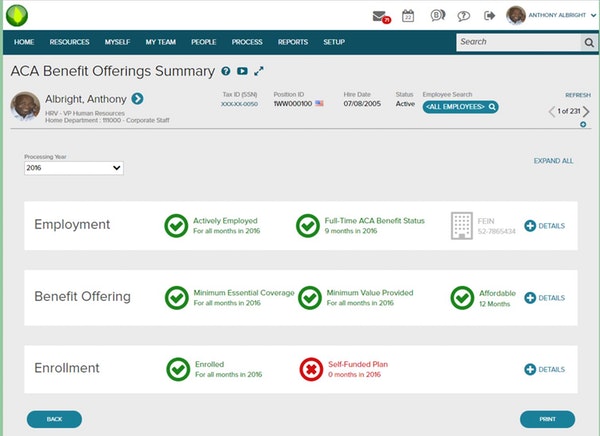

Benefits administration: This feature helps manage employee benefits such as paid time off, medical/dental/life insurance policies and 401(k) participation. It provides details such as enrollment and allows organizations to ensure compliance with the ACA and file necessary paperwork and reports.

Benefits management in ADP Workforce Now

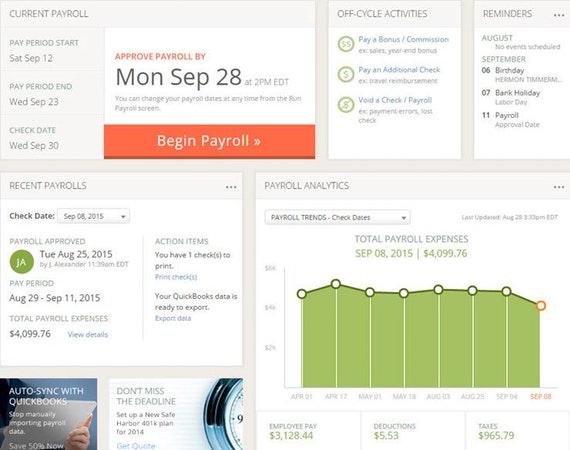

Payroll: This functionality helps you compensate your employees accurately and on-time, allowing users to manage employee salary and wage rates, set a pay schedule, input hours worked and automate payroll runs. Most systems allow you to print checks or do direct deposits, and you can even generate important tax forms for employees (e.g., W2s and 1099s).

Payroll dashboard in SurePayroll

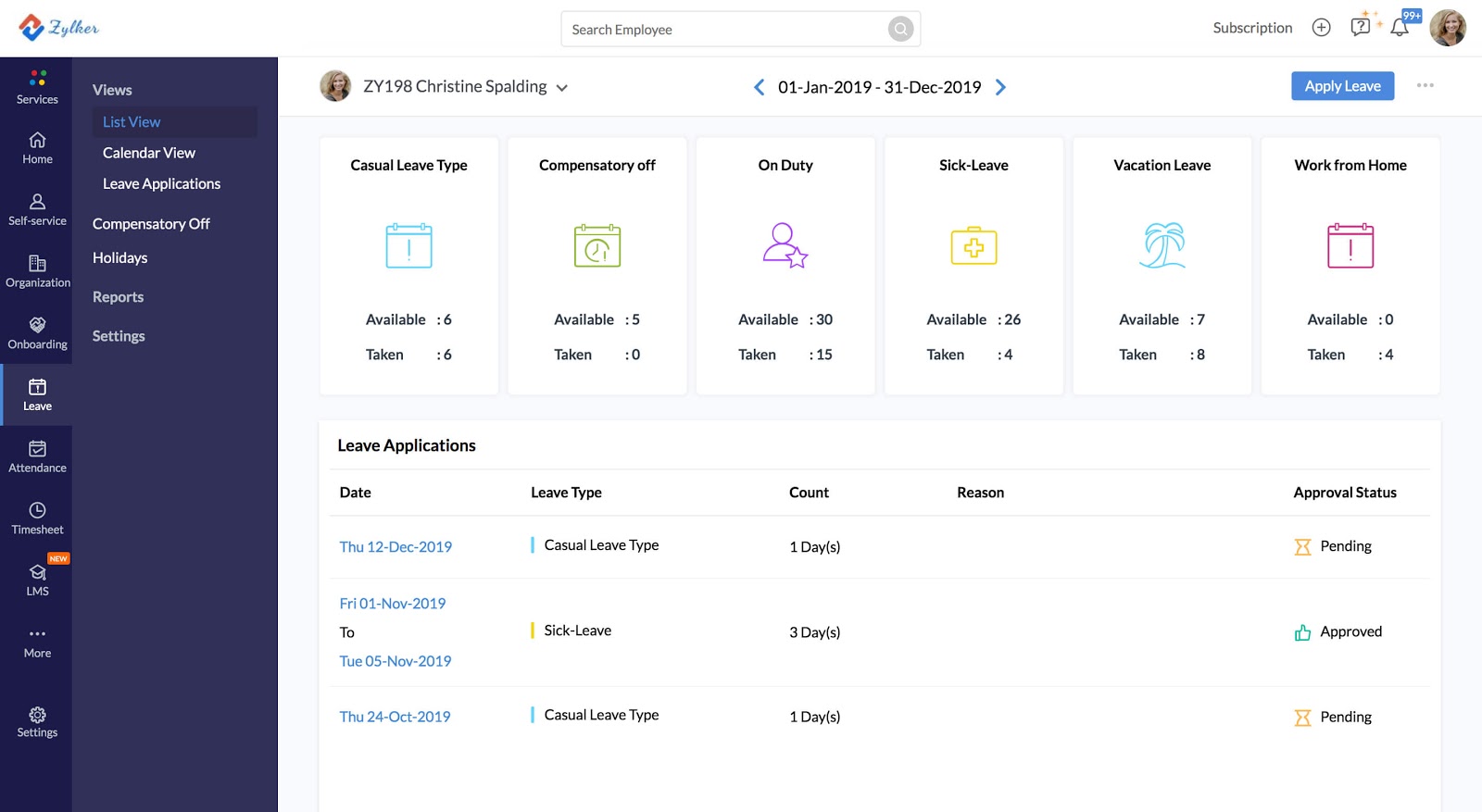

Time and attendance: This allows you to accurately capture how many hours your people are working. Employees can use time and attendance software to clock in and out of work through their computer or smartphone and request time off, while managers can use the system to approve requests, monitor overtime hours and manage paid time off (PTO) allotments.

Time and attendance in Zoho People

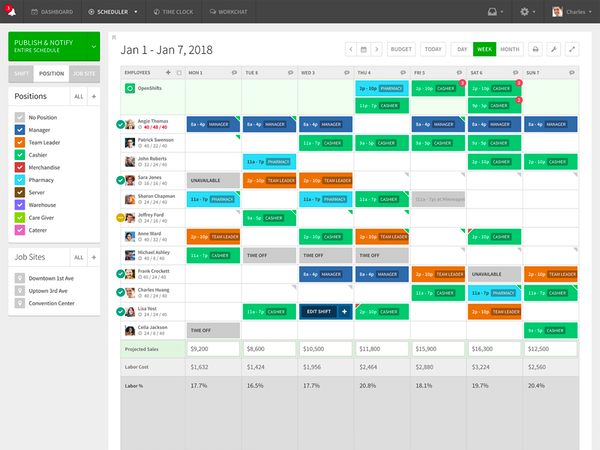

Employee scheduling: This lets managers create, track and manage employee schedules. This can include employee tracking, integrated time clock functionality, and report generation. This feature also makes it easy to record hours and payroll data.

Employee scheduling in When I Work

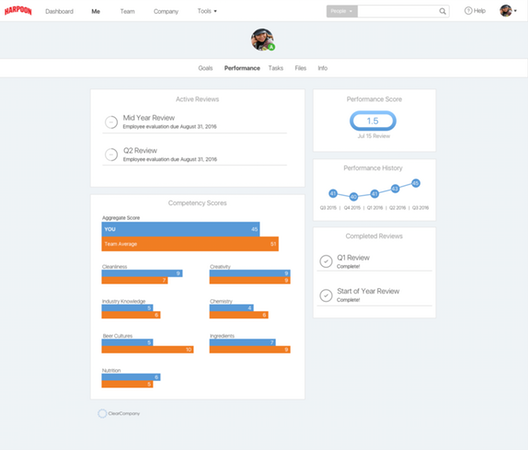

Performance management: This helps you schedule, execute and document employee performance reviews. The criteria on which employees are graded can be customized, and the software can automatically notify users throughout your organization when they have a pending task to complete in the performance review workflow.

Performance management in ClearCompany

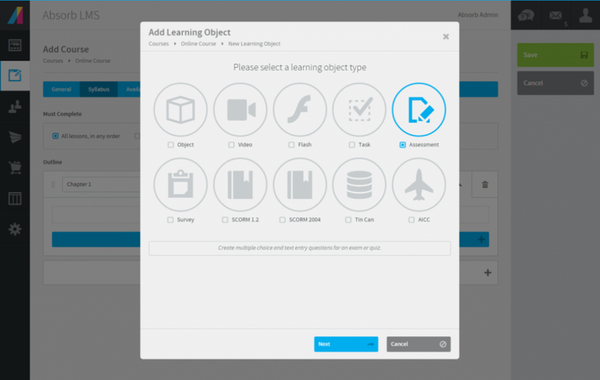

Learning management: This feature helps businesses better manage their online learning and employee skill programs. Rather than having to manually manage and track all of the workflows that are involved with ensuring employees have access to and complete learning programs, this functionality helps automate the entire process, from start to finish.

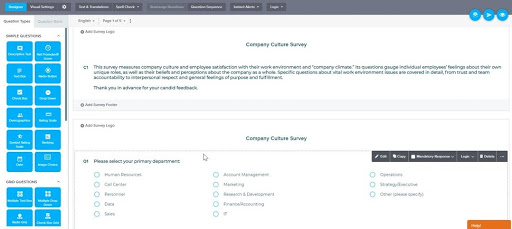

Employee engagement: This helps you monitor employee engagement over time through small, informal pulse surveys. You can also improve engagement through features like social employee recognition.

Employee engagement in SoGoSurvey

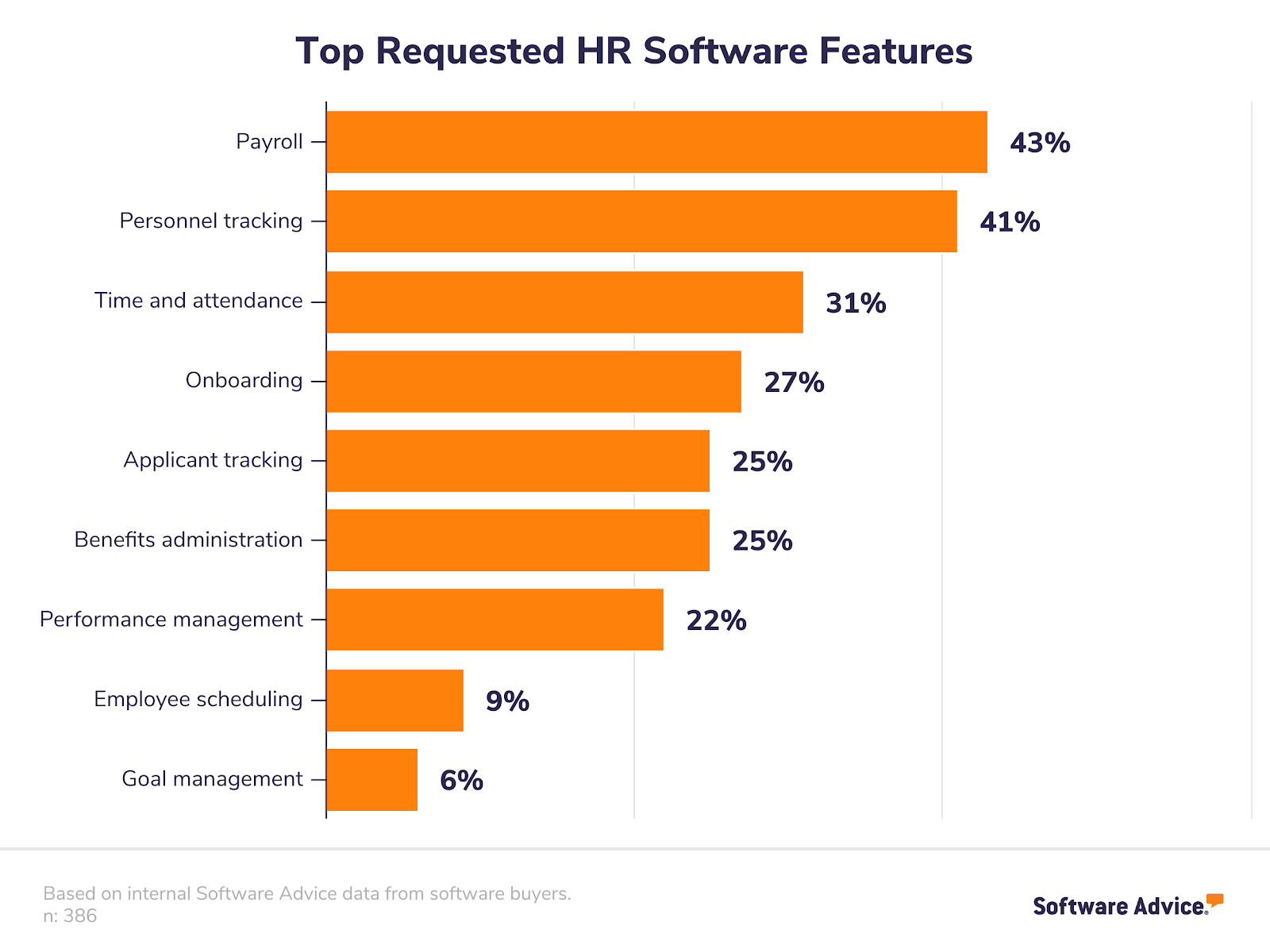

HR buyers' top-requested features

The HR software buyers our advisors have helped tend to be seeking core HR features such as payroll and personnel tracking, followed by workforce management features. Some of the more strategic features such as performance and learning related features are less requested by prospective buyers.

Pricing Guide

How HR software is priced and hosted

There are typically two pricing models that HR software vendors offer customers: subscription packages and perpetual licenses.

Subscription models:

Subscription pricing models are more commonly associated with cloud-based HR tools. Some examples include paying per employee/per month, or per user/per month:

Per employee/per month: This model allows you to pay a monthly fee for each of your employees. There are also often one-time implementation fees on top of this, and the per employee cost tends to decrease as the total number of employees increases. This pricing structure lends itself well to smaller businesses due to its affordability and scalability.

Per user/per month: Users pay a monthly fee for users—normally administrative users—rather than all employees. However, be aware that vendors may try to class all of your employees as users if they're also offering an employee self-service portal, which will drive up costs significantly. There may also be a one-time implementation fee on top of the per user, per month price.

Perpetual license:

This involves paying an upfront sum for the license to own the software and use it indefinitely. This is the more traditional model and is most common with on-premise applications and with larger businesses. The upfront costs are usually high, but vendors typically offer a period of technical support within the price, along with software update costs. However, software updates and technical support may not be provided for free in perpetuity.

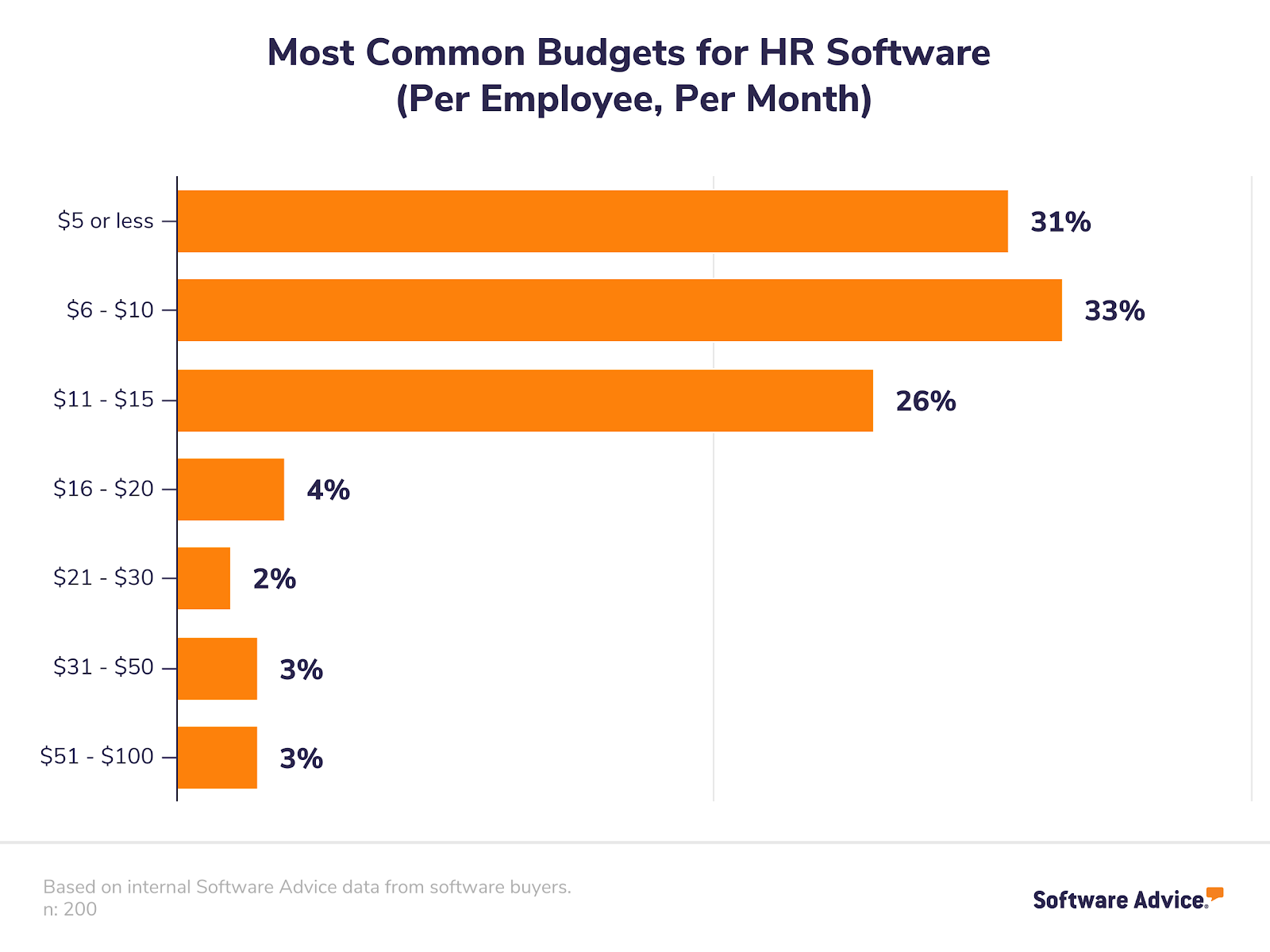

What businesses typically budget for HR software

Based on an analysis of the HR software buyers our advisors speak to, businesses tend to budget for HR software on a per employee, per month basis. The highest percentage of buyers (almost 33%) budget for $6-$10 per employee/per month, followed by 31% of buyers who only want to spend $5 or lower per employee/per month. Only around 11% are willing to budget more than $16-$20 per employee/per month.

(Please note that these prices are based on a 'per employee, per month' basis, and do not include any potential up-front fees, such as installation/setup or training.)

Hidden costs of HR software

No matter what type of business or buyer you are or whether you choose a subscription package or a perpetual license, it's unlikely that you won't encounter other costs necessary to the HR software you've invested in.

For example, if you're moving from a legacy system to a cloud-based platform, data cleansing and migration may incur an extra cost. Likewise, system upgrades, maintenance costs and staff training may also incur a fee, so make sure you check with vendors about these potential extra costs.

FAQs

What are the key functions of HR software?

As listed in the “Common Features" section above, the following are the key functions of HR software:

Core HR functions:

Personnel tracking: Manages employee data such as SSN and banking details, contact information, job and salary history, and benefits and insurance plans.

Applicant tracking: Manage the hiring process, automate candidate assessment tasks, and track the status of job applicants through the candidate pipeline.

Benefits management: Manages employee benefits such as PTO, medical/dental/life insurance policies and 401(k) participation.

Payroll: Tracks employee salaries, bonuses, 401(k) contributions, health, and other deductions; calculates withholding for taxes; and cuts paychecks.

Workforce management functions:

Time and attendance tracking: Tracks employee attendance and enables employees to clock in and out. Many solutions also track PTO and sick days.

Employee scheduling: Creates, tracks and manages employee schedules. Systems can schedule employees across departments, locations and projects.

Strategic HR functions:

Performance management: Set up a custom workflow and automate tasks throughout the company related to discussing, assessing and measuring employee performance.

Learning management: Manages the ongoing skills development and training of employees. Includes content authoring, curriculum and certification path definition, testing and reporting.

Employee engagement: Track employee engagement over time and improve engagement through features like social employee recognition.

What questions should I ask vendors when evaluating HR products?

When researching HR software vendors, don't just sit back and receive the sales pitch. Request a demo in which a representative walks you through the software and its various features. More importantly, ask as many questions as you need, as the answers will help you understand whether the system can cater to your unique HR business needs.

Is the solution configurable to my needs?

If you're not looking for an out-of-the-box solution, you'll need to know whether the system is customizable to your needs as a business. Customization may also come with a higher price tag.

How scalable is the solution?

Although vendors are usually happy to include provisions for scaling up, they may be reluctant to allow customers to scale down. The agreement should be flexible, but the vendor may not offer this option without being prompted.

Which features do users of the software report frequent issues or challenges with?

Vendors may squirm at this question, but you'll need to know what features or functionality tends to be challenging for users. This is also important for gauging whether you can trust the vendor to be upfront with you about the product and its limitations, and also how seriously they take feedback and customer issues.

What systems does your product integrate with?

You may already be using other systems to manage your workforce, and it's working well for your organization. In this case, you'll need to know whether your existing systems can integrate into a specific HR system, or whether you want to invest in an integrated HR system that brings together many key HR modules.

Follow up question: How easily does it integrate with these products?

You'll need to know whether the integration of these systems will require a large-scale data migration project, or whether you'll need to pay extra for a specialist to do this.

Does my small business really need HR software?

Yes. Even if you're managing only a handful of employees right now, it probably won't stay that way forever. If you're worried about the cost of HR systems, you can get your business started with a free system—but be aware of their limited functionality and hidden costs. Our article "What's the Catch?: 10 Free HR Software Systems and Their Catches" takes you through 10 free HR systems and their limitations, such as number of users, geo-specific software and open source options.

However, as you grow, you'll need to consider choosing a more robust HR system to effectively manage the many aspects of the workforce. HR systems and their associated costs used to be geared towards enterprise and midsize businesses and were not cost-effective for new, smaller businesses.

Nowadays, there is an array of HR system options for smaller businesses, with matching functionality. Check out our article “Software Needs Cycle for HR: 9 Types of HR Systems to Adopt as You Start, Grow & Optimize Your Business," which will help you prioritize which features your business needs and when.

HRIS, HRMS, HCM: What's the difference?

It's easy to get caught-up in the many acronyms in the HR software industry, and confusion about what they mean can make the purchase journey even more confusing. We aim to spell out the key differences in our article "HRIS vs. HRMS vs. HCM: What's the Difference?"

What are some drawbacks I should watch out for?

Adopting an HR software system that is not right for your business will lead to a wasted system and a wasted budget. Investing in a huge system with a ton of functionality may seem like the smart thing to do to cover all of your bases, but your focus should be on what the right set of features means for your business.

Not only will your employees likely not use many of the features, but high costs will mean that you're likely to swap the product for something more fitting down the line.

The swathes of data that HR systems produce can also prove difficult to analyze if you haven't chosen the right software. In fact, you may need another system such as a business intelligence tool to help you make sense of data and be able to generate reports.

Many companies also fall into the trap of forgetting the importance of the 'human factor' in the workplace. Often, managers get caught-up in the high levels of automation HR systems provide, and rely too heavily on automating tasks such as employee development steps, appraisals and feedback, which will always require a degree of humanization to be carried-out effectively.

Tips & Tools

Relevant Articles

Here are some recent articles about HR software you should check out:

Popular HR System Comparisons

Recent Events in the HR Software Market

Here are some important recent events concerning HR vendors and the world of HR software:

Kronos and Ultimate Software announce merger. In February 2020, Kronos and Ultimate Software—two market leaders in the HR software space—announced plans to merge. At a combined value of $22 billion and with more than 12,000 employees total, the deal creates one of the largest providers of cloud-based software in the world.

Cornerstone acquires Saba. In February 2020, HR software vendor Cornerstone OnDemand announced they had acquired Saba, another major talent management software provider. Throughout the year, Cornerstone plans to merge and integrate its collective portfolio of products into a suite that delivers the best of what both companies have to offer.

Software Related to HR Market

HR tools include several types of software based on specific applications or functionalities:

Applicant Tracking Software (ATS): Recruiters can use features like customized hiring workflows, resume management, and applicant scoring to lower recruiting costs and hire better employees, faster.

Time and Attendance Software: Helps employees and managers easily input work hours, monitor attendance, and calculate correct wages with features like online clock-in and payroll integration.

Payroll Software: Helps businesses of all sizes compensate their workers accurately and on-time with features like employee time tracking, automatic wage calculation, and payroll run automation.

Performance Management Software: Helps HR personnel, department managers and employees automate processes related to performance reviews. These systems can gather worker feedback with features like survey templates, email reminders, and embedded performance analytics.