Best Payroll Software of 2026

Updated January 14, 2026 at 6:01 AM

Written by Emilie Audubert

Content Analyst

Edited by Parul Sharma

Editor

Reviewed by Steve Burlison

Senior Advisor

Talk with us for a free 15-min consultation

Expert advisors like Jacqueline, who have helped 1,000+ companies, can find the right software for your needs.

- All Software

- Software Advice FrontRunners

- Popular Comparisons

- Buyer's Guide

- Frequently Asked Questions

Payroll software helps HR and finance teams manage pay cycles, taxes, and compliance. With more than 420 products built for different tax rules, integrations, and global needs, choosing the right one can be tough especially for teams handling hybrid staff or cross‑border pay. To help you narrow it down, I worked with our payroll software advisors to curate a list of recommended productsi and a list of the payroll software FrontRunners based on user reviews. For further information, read my payroll software buyer's guide.

Payroll Software

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

BambooHR centralizes your HR data, automating key tasks like payroll, benefits, and employee management. Streamline processes fr...Read more about BambooHR

BambooHR's Best Rated Features

See All

BambooHR's Worst Rated Features

See All

Rippling is an integrated workforce management platform that unifies HR, IT, and finance tools to streamline operations. It cent...Read more about Rippling

Rippling's Best Rated Features

See All

Rippling's Worst Rated Features

See All

Paycom is an HR and payroll software designed to manage the entire employment lifecycle, from recruitment to retirement. It is s...Read more about Paycom

Paycom's Best Rated Features

See All

Paycom's Worst Rated Features

See All

TriNet's HR Plus is outsourced HR services plus HR technology to help your business thrive. Our all-in-one HR platform helps you...Read more about TriNet HR Plus

TriNet HR Plus's Best Rated Features

See All

TriNet HR Plus's Worst Rated Features

See All

ADP Workforce Now is an HR suite that combines all core payroll and HR management processes into a single database-driven platfo...Read more about ADP Workforce Now

ADP Workforce Now's Best Rated Features

See All

ADP Workforce Now's Worst Rated Features

See All

Software Advice FrontRunners 2026

(4506)

(3905)

(1137)

(1614)

(4167)

(3565)

(3095)

(1759)

(3021)

(1079)

Best for Mobile app

Rippling

- Key FeaturesRippling's scoreCategory average

Direct Deposit

4.914.75 category average

Payroll Management

4.834.62 category average

Payroll Reporting

4.804.57 category average

- Screenshots

Best for Usability

Deel

- Key FeaturesDeel's scoreCategory average

Direct Deposit

4.784.75 category average

Payroll Management

4.814.62 category average

Payroll Reporting

4.794.57 category average

- Screenshots

Best for Setup Onboarding Implementation

Paycom

- Key FeaturesPaycom's scoreCategory average

Direct Deposit

4.764.75 category average

Payroll Management

4.544.62 category average

Payroll Reporting

4.484.57 category average

- Screenshots

Highly rated for Automation

Paylocity

- Key FeaturesPaylocity's scoreCategory average

Direct Deposit

4.744.75 category average

Payroll Management

4.524.62 category average

Payroll Reporting

4.344.57 category average

- Screenshots

Highly Rated for User Interface

Gusto

- Key FeaturesGusto's scoreCategory average

Direct Deposit

4.704.75 category average

Payroll Management

4.594.62 category average

Payroll Reporting

4.514.57 category average

- Screenshots

Best for Customer Satisfaction

- Key FeaturesPatriot Payroll's scoreCategory average

Direct Deposit

4.804.75 category average

Payroll Management

4.804.62 category average

Payroll Reporting

4.774.57 category average

- Screenshots

Highly rated for Customization

BambooHR

- Key FeaturesBambooHR's scoreCategory average

Direct Deposit

4.754.75 category average

Payroll Management

4.234.62 category average

Payroll Reporting

4.664.57 category average

- Screenshots

Highly rated for Training and Learning Curve

Paychex Flex

- Key FeaturesPaychex Flex's scoreCategory average

Direct Deposit

4.704.75 category average

Payroll Management

4.274.62 category average

Payroll Reporting

4.324.57 category average

- Screenshots

Most used by Non-Profit Organization Management

Paycor

- Key FeaturesPaycor's scoreCategory average

Direct Deposit

4.624.75 category average

Payroll Management

4.394.62 category average

Payroll Reporting

4.254.57 category average

- Screenshots

Most rated for SMBs

- Key FeaturesRUN Powered by ADP's scoreCategory average

Direct Deposit

4.904.75 category average

Payroll Management

4.704.62 category average

Payroll Reporting

4.734.57 category average

- Screenshots

- Key FeaturesQuickBooks Payroll's scoreCategory average

Direct Deposit

4.724.75 category average

Payroll Management

4.594.62 category average

Payroll Reporting

4.534.57 category average

- Screenshots

Justworks

- Key FeaturesJustworks's scoreCategory average

Direct Deposit

4.904.75 category average

Payroll Management

4.734.62 category average

Payroll Reporting

4.604.57 category average

- Screenshots

SurePayroll

- Key FeaturesSurePayroll's scoreCategory average

Direct Deposit

4.794.75 category average

Payroll Management

4.264.62 category average

Payroll Reporting

4.604.57 category average

- Screenshots

Netchex

- Key FeaturesNetchex's scoreCategory average

Direct Deposit

4.884.75 category average

Payroll Management

4.714.62 category average

Payroll Reporting

4.854.57 category average

- Screenshots

isolved

- Key Featuresisolved's scoreCategory average

Direct Deposit

4.634.75 category average

Payroll Management

4.424.62 category average

Payroll Reporting

4.364.57 category average

- Screenshots

UKG Ready

- Key FeaturesUKG Ready's scoreCategory average

Direct Deposit

4.674.75 category average

Payroll Management

4.534.62 category average

Payroll Reporting

4.684.57 category average

- Screenshots

PrimePay

- Key FeaturesPrimePay's scoreCategory average

Direct Deposit

4.474.75 category average

Payroll Management

4.094.62 category average

Payroll Reporting

4.274.57 category average

- Screenshots

OnPay

- Key FeaturesOnPay's scoreCategory average

Direct Deposit

4.834.75 category average

Payroll Management

4.794.62 category average

Payroll Reporting

4.774.57 category average

- Screenshots

HiBob

- Key FeaturesHiBob's scoreCategory average

Payroll Management

4.674.62 category average

Payroll Reporting

4.244.57 category average

- Screenshots

Fingercheck

- Key FeaturesFingercheck's scoreCategory average

Direct Deposit

4.364.75 category average

Payroll Management

4.584.62 category average

Payroll Reporting

4.604.57 category average

- Screenshots

Sage Payroll

- Key FeaturesSage Payroll's scoreCategory average

Payroll Management

4.134.62 category average

Payroll Reporting

4.334.57 category average

- Screenshots

Hourly

- Key FeaturesHourly's scoreCategory average

Direct Deposit

4.924.75 category average

Payroll Management

4.794.62 category average

Payroll Reporting

4.734.57 category average

- Screenshots

- Key FeaturesWorkforce.com's scoreCategory average

Direct Deposit

5.04.75 category average

Payroll Management

4.294.62 category average

Payroll Reporting

5.04.57 category average

- Screenshots

- Key FeaturesHeartland Payroll+'s scoreCategory average

Direct Deposit

4.514.75 category average

Payroll Management

4.564.62 category average

Payroll Reporting

4.464.57 category average

- Screenshots

Knit

- Key FeaturesKnit's scoreCategory average

Direct Deposit

4.784.75 category average

Payroll Management

4.724.62 category average

Payroll Reporting

4.694.57 category average

- Screenshots

Methodology

The research for the best payroll software list was conducted in October 2025. We evaluated data (user reviews and demand signals) from the past 24 months as of the research date. Read the complete methodology.

Popular Payroll Comparisons

Buyer's Guide

This detailed guide will help you find and buy the right payroll software for you and your business.

Last Updated on March 10, 2025Here’s what we’ll cover:

What you need to know about payroll software

Essential features of payroll software

Benefits and competitive advantages of using payroll software

How to choose the best payroll software for your business

More resources for your payroll journey

What you need to know about payroll software

Payroll software is designed to automate and optimize the administration of employee compensation, in accordance with relevant legal and regulatory frameworks. This solution manages various facets of the payroll process, encompassing the calculation of gross earnings (including salaries, wages, and bonuses), the deduction of applicable taxes, benefits contributions, and other withholdings, and the determination of net pay. In conversations with more than 8,000 HR software buyers over the past year, 50% stated that the ‘payroll’ feature is a requirement when they look for this type of software. [1]

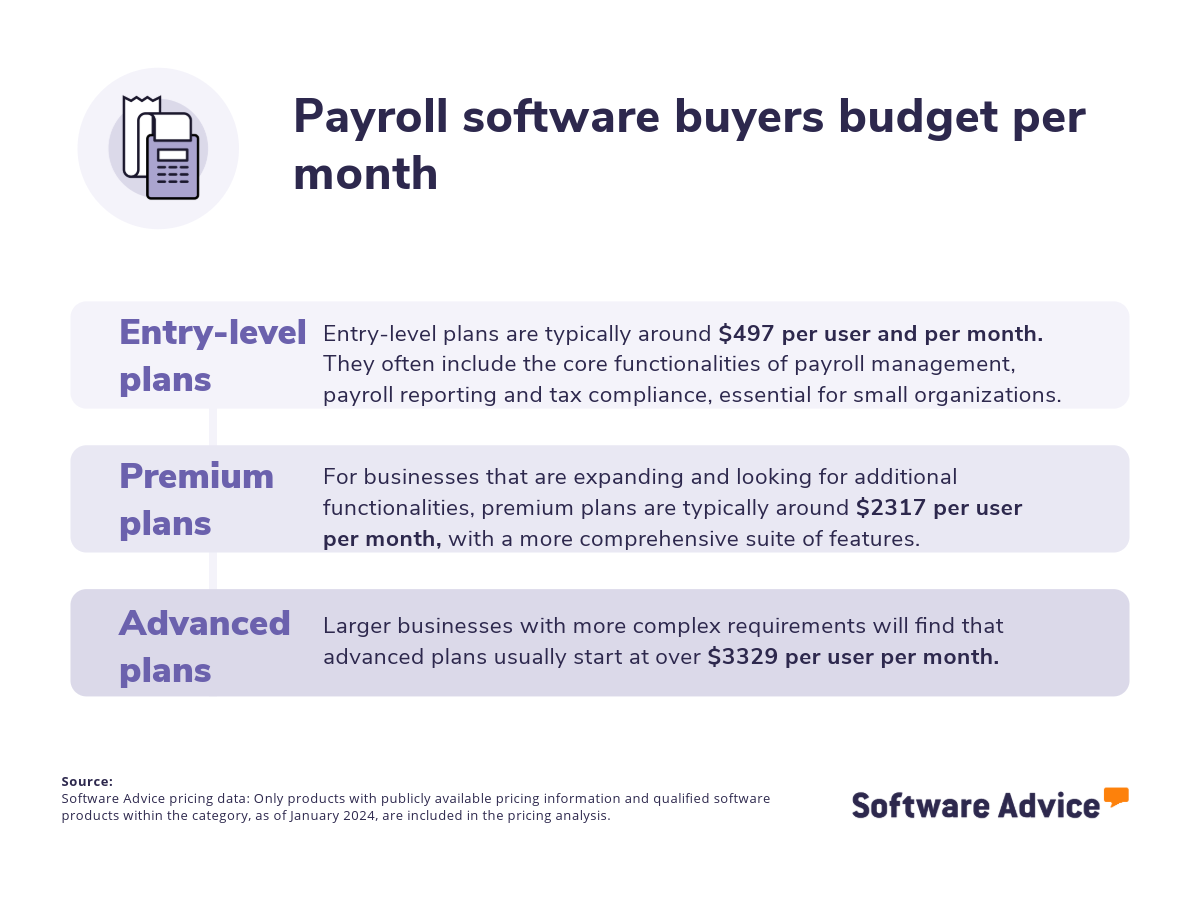

Payroll software pricing is influenced by several factors, including the number of users, the availability of basic or advanced features, and the geographic locations of the business and its employees. Some vendors provide free versions of their software, though these typically have limitations in functionality. Paid subscription costs can vary significantly, with the typical cost of entry-level plans being around $497 per user per month and more comprehensive, high-end plans reaching $3329 or more per month. [2]

When evaluating payroll software, first-time buyers should assess its ability to integrate with existing systems, its scalability for growth, and support for compliance within specific industries. Engaging key stakeholders in the development of targeted evaluation questions is a crucial step in ensuring the chosen system meets specific requirements. Consider the following inquiries:

Does the tool facilitate the tracking and reporting of relevant payroll metrics?

How does the tool automate payroll processes, including leave balance tracking and gross wage/tax calculations?

Does the tool incorporate automatic updates to reflect changes in compliance regulations and tax rates?

What are the available support options to address potential technical issues?

Navigating the 473 available payroll products can be challenging. This guide explains the features and benefits of payroll software and provides a step-by-step process for selecting the appropriate solution for your organization. Additionally, you will gain valuable insights and tips from our experienced software advisor Steve Burlison.

What is payroll software?

Payroll software's core functions encompass payroll management, payroll reporting, and tax compliance and typically include features such as tax calculation, direct deposit, employee self-service portals, and integration with other HR and accounting software. These integrated functionalities offer significant benefits, helping businesses accurately and efficiently manage their payroll processes in compliance with relevant laws and regulations.

Essential features of payroll software

Selecting appropriate payroll software requires a thorough understanding of its core and common features. Core features such as payroll management, payroll reporting, and tax compliance are essential components of all payroll systems. Based on our analysis of reviews and interactions with payroll software providers, we have identified several common features that enhance these core functionalities. [3]

Core payroll software features

Payroll management | Enables users to track and process employee payroll. 93% of our reviewers rate this feature as critical or highly important. |

Payroll reporting | Allows users to view and track metrics such as pay stubs, salary or benefits statements. 89% of our reviewers rate this feature as critical or highly important. |

Tax compliance | Track tax-related transactions, tax remittance and tax reporting for various groups of employees and contractors. 80% of our reviewers rate this feature as critical or highly important. |

Common payroll software features

Benefits management

| Record employee's benefit plans and selections throughout career progression. 65 % of our reviewers rate this feature as critical or highly important. |

Compensation management

| Manages compensation such as salary, bonus, and benefits processes, aligning with policies. 72% of our reviewers rate this feature as critical or highly important. |

Compliance management

| Track and manage adherence to policies for any service, product, process, or supplier. 64% of our reviewers rate this feature as critical or highly important. |

Direct deposit | Digitally deposits correct payroll amounts into individual employee's bank accounts. 88% of our reviewers rate this feature as critical or highly important. |

Employee database | Electronic storage of staff/employee contact information and job status in a centralized repository. 78% of our reviewers rate this feature as critical or highly important. |

Self-service portal

| Online portal through which end users can access the system, manage tasks, or obtain information. 85% of our reviewers rate this feature as critical or highly important. |

Time and attendance.

| Track and manage employee's work hours to improve payroll accuracy. 70% of our reviewers rate this feature as critical or highly important |

W-2 preparation | Facilitates the creation, management, and optimization of business workflows, ensuring smooth operations across various departments. 80% of our reviewers rate this feature as critical or highly important. |

Benefits and competitive advantages of using payroll software

Based on insights from our proprietary data analysis of 4,213 user reviews over the past year, HR management, team management, and tracking capabilities are the top-rated benefits of payroll software.

Optimized operational efficiency: Payroll software automates different time-consuming and repetitive tasks associated with payroll processing, such as calculating wages, taxes, and deductions. This frees up HR staff to focus on more strategic initiatives, such as employee development, recruitment, or talent management.

Improved data management and reporting: Payroll software provides detailed records of employee earnings, taxes, deductions, and time off. This data can be used to generate various reports that provide valuable insights into labor costs, workforce trends, and other key metrics. This data-driven approach supports better decision-making related to budgeting, resource allocation, and workforce planning.

Enhanced employee management: Features like employee self-service portals enable employees to access their paystubs, W-2s, and other payroll information independently. This reduces the administrative burden on HR and promotes transparency within the team. Accurate and timely payroll also contributes to employee satisfaction and morale, fostering a positive work environment.

Enhanced compliance: Payroll software is typically updated to reflect the latest changes in tax laws, labor regulations, and reporting requirements. Automated tax filings and reporting features further simplify compliance efforts. This helps HR departments maintain compliance and avoid legal issues.

How to choose the best payroll software for your business

Step 1: Define your requirements

The first step in choosing the right payroll software is to clearly define the reasons why it is essential for your organization. Consider the specific challenges you hope to solve by automating payroll processes, such as enhancing efficiency, maintaining data consistency, or facilitating business growth. In addition, you should also consider the budget, training assistance, and integrations required. Identifying these key drivers will enable you to select a system that effectively aligns with your operational objectives.

What is the cost of payroll software?

The process of choosing suitable payroll software necessitates a thorough assessment of both the initial investment and the recurring operational expenses. It is crucial to evaluate these costs in the context of the software's capacity to enhance business efficiency and contribute to long-term growth. A breakdown of pricing tiers is provided below to assist in aligning budgetary constraints with essential operational functionalities.

Our analysis suggests that entry-level plans generally range from $497 per month, premium plans are available for $2317 per month, while advanced plans often start at over $3329 per month.

Be aware of software limitations

Although payroll software can significantly streamline business operations, it is essential to consider potential drawbacks that may affect its overall effectiveness. Sentiment analysis conducted on 4,213 verified user reviews over the past year has identified several recurring challenges. These challenges include complexities in leave management related to admin access limitations, difficulties customizing reports, and slow resolution times for technical issues.

These potential issues can have a significant impact on both operational efficiency and the satisfaction of employees and contractors, especially when timely and accurate payroll processing is paramount. The following strategies can effectively address these drawbacks:

Scalability is a key consideration when selecting a payroll system. Choose a system that can accommodate increasing data loads without compromising performance, ensuring seamless operation as your business grows.

Partnering with a payroll provider known for its strong customer support and rapid response times is crucial for minimizing any disruptions during and after the implementation process.

Investing in a payroll system that offers extensive customization options, particularly for reporting features, allows you to tailor the software to your specific business requirements.

Working closely with your payroll vendor to schedule regular updates and providing continuous training for your team will facilitate adaptation to new features and changes, ultimately enhancing both usability and overall efficiency.

Integration considerations for payroll software

If your business is not newly established, you may already utilize existing software systems. In this case, ensuring seamless integration between your chosen payroll software and these legacy systems is crucial. Integrating payroll software with other relevant tools and processes can contribute to improved efficiency, enhanced compliance, and a better employee experience by streamlining workflows and minimizing errors associated with manual data re-entry. Common must-have integrations for payroll software include:

Accounting and finance software: Accounting and finance software enable organizations to manage their financial transactions and generate financial reports. It automates and streamlines traditional accounting processes, replacing manual spreadsheets and ledgers. Integrating payroll software with accounting software is crucial for maintaining accurate financial records and streamlining business operations. This integration automates the transfer of payroll data, such as wages, taxes, and deductions, directly into the general ledger of the accounting system, eliminating manual data entry and reducing the risk of errors.

Time-tracking software: This software enables businesses to monitor and record time spent on various tasks, projects, or activities. It is essential for tracking work hours, managing project progress, and improving productivity. Steve Burlison emphasizes the advantage of this specific integration: “Bundling time and scheduling with payroll is really beneficial because time data automatically flows into the payroll system."

Human resources software: Human resources software is a suite of integrated applications that automates core HR functions across the employee lifecycle. From recruitment and onboarding to performance management, payroll, benefits, time tracking, and learning, these systems provide a centralized platform for managing employee data and streamlining HR processes. Integrating payroll software with this tool provides a holistic view of employee data, combining payroll information with HR data, including performance reviews and benefits elections, enabling better workforce management and strategic decision-making.

Step 2: Pick your best option

After completing the initial selection process, it is recommended to engage in vendor demonstrations. These sessions offer a valuable opportunity to thoroughly explore the functionalities of each product and pose pertinent questions to facilitate a well-informed investment decision. Adequate preparation is essential to optimize the benefits derived from these demonstrations.

How to prepare for vendor demos

Having compiled a shortlist of candidate payroll systems, the next step is to schedule demonstrations with each vendor to facilitate a more comprehensive evaluation of their respective offerings. During these sessions, you can inquire about various aspects of the products, including features, pricing structures, technical support options, training programs, and any other factors pertinent to selecting a system tailored to your organization's needs.

Here are some key questions to consider asking vendors during the demos:

What payroll metrics can your software track and report?

Evaluating the tracking and reporting functionalities of the payroll software during a vendor demonstration is critical to determine if it can effectively support data analysis, compliance efforts, and strategic decision-making, in addition to basic payroll processing. This evaluation should focus on understanding the granularity of the data provided, the availability of standard reports, such as payroll summaries, tax reports, and wage and hour reports, and the capacity to create custom reports aligned with specific metrics and key performance indicators. Comprehensive reporting capabilities are also essential for compliance audits, facilitating the retrieval and provision of detailed documentation regarding payroll processes, including records of wages, taxes, and deductions.

Analyst tip: Before the demo, you should provide the vendor with a sample report that you frequently use to evaluate the software's reporting capabilities effectively. This will allow them to demonstrate how to create the report, giving you practical insight into the software's operation.

Does your software automatically update for compliance and tax changes?

Payroll is submitted to strict regulation, with frequent changes to federal, state, and local tax laws, wage and hour regulations, and other compliance requirements. If the software doesn't automatically update, your team will be responsible for manually tracking and implementing these changes. This is a time-consuming and error-prone process, increasing the risk of non-compliance. Automatic updates can significantly reduce the administrative burden on your payroll and HR staff and minimize the risk of human error in calculating taxes and complying with regulations. Analyst tip: To gain a comprehensive understanding of the payroll software's functionality during the demo, request vendors to provide practical demonstrations. These could include calculating taxes for a hypothetical employee with varying pay rates, deductions, and tax withholding information, or generating W-2 and 1099 forms. It is also crucial to verify that the software can accommodate any industry-specific compliance requirements, such as those related to the Affordable Care Act (ACA) in healthcare, or handle the tax laws and regulations of each state in which you have employees.

What type of support and training is provided?

Effective onboarding and ongoing support are crucial for smooth software adoption and issue resolution. Team adoption can be a significant challenge during implementation, and comprehensive training is a key factor in successful deployment. Inquire about available training formats, such as live sessions or self-paced tutorials, and the scope of customer support services. Understanding these resources will build confidence in the team's long-term ability to utilize the software effectively. For further guidance and additional questions to ask during demos, consult How To Cut Through the Sales Pitch During Software Demos. This guide focuses on preparing for live, personalized software demonstrations from vendors, distinct from initial discussions or online video walkthroughs.

Step 3: Make the most of your payroll software

After selecting and purchasing your payroll software, the next crucial step is implementation. This phase is fundamental to the software's subsequent performance and requires careful attention to several key considerations, such as those detailed below.

Data migration is paramount and demands a focus on accuracy: All existing employee data, including personal information, pay rates, deductions, and year-to-date earnings, must be transferred flawlessly. Data mapping and validation are crucial for this process. Furthermore, data cleansing should be undertaken to eliminate outdated or inaccurate information. Throughout the migration, maintaining data security and confidentiality through secure transfer methods and appropriate access controls is essential.

Training and communication are also essential for a smooth transition: Prioritize staff training to ensure effective system utilization. Plan to leverage the vendor's expertise for comprehensive training sessions and the provision of supporting materials. Allocate sufficient time for this training, anticipating the need for multiple sessions and refresher courses to ensure all team members are proficient and confident in using the new survey software.

Schedule a post-implementation review: For a smooth transition, ensure vendor support is readily available both during and after the go-live period to handle any hiccups. A post-implementation review is then essential to evaluate the success of the rollout and pinpoint areas for optimization. To maintain peak performance, schedule regular system reviews to assess alignment with business objectives and operational efficiency, ensuring the system evolves alongside your business.

For more details on how to ensure a smooth transition, check out our guide - 5 Critical Steps to a Successful Software Implementation Plan.

Related payroll software

When choosing payroll software, consider that some features may require integration with other systems to maximize data insights. While many platforms offer a range of tools, certain functionalities are often better handled by specialized software. The following are examples of software commonly associated with payroll but may not be included:

Attendance tracking Software: Attendance tracking software is a solution designed to record and manage employee work hours, absences, and other time-related data. It replaces traditional manual methods, such as paper timesheets or punch clocks, offering greater accuracy, efficiency, and automation.

Benefits administration software: Benefits administration software streamlines the management of employee benefits such as 401(k) plans, health insurance, and paid time off. This software empowers users to monitor company spending on employee benefits, create and manage benefit programs for new hires, and facilitate communication with vendors offering retirement and insurance services.

Compensation management software: Compensation management software facilitates the comprehensive management of the employee compensation lifecycle, from salary planning and processing to tax deductions and performance-based bonus distributions. This software provides HR departments with a centralized platform for managing and analyzing detailed employee compensation information, including base salaries, bonuses, commission structures, and incentive programs.

Human resources software: Human resources software is a tool designed to facilitate the management and optimization of organizational human resources processes. It typically encompasses a range of functionalities, including recruitment and applicant tracking, employee onboarding, performance management, payroll processing, benefits administration, time and attendance tracking, and employee records management.

Workforce management software: A workforce management software enables organizations to manage and optimize their workforce operations, including scheduling, time and attendance tracking, labor forecasting, and performance management. It enables companies to streamline their workforce processes, reduce administrative burdens, and improve productivity by providing features, such as automated scheduling, real-time attendance tracking, mobile access, and data analytics to inform decisions.

More resources for your payroll journey

About our contributors

Author

Emilie is a content analyst at Software Advice. Always on the lookout for the latest technological and strategic trends for small and midsize businesses, she specializes in human resources topics.

Emilie’s research and analysis is informed by more than 250,000 authentic user reviews on Software Advice and over 20,000 interactions between Software Advice software advisors and HR software buyers. Emilie also regularly analyzes market sentiment by conducting surveys of HR leaders and practitioners so she can provide the most up-to-date and helpful information to small and midsize businesses purchasing software or services.

Her research has been featured in Forbes, CB News, Sud-Ouest, BPI France, and Siècle Digital, as well as on BSMART TV channel, covering topics such the challenges of employee retention or the state of women in the workplace.

Passionate about writing and storytelling in all its forms, she produces audio podcasts. She is fond of pugs and '70s rock.

Editor

Parul Sharma is a content editor at Software Advice with expertise in curating content for various niches, including SaaS, digital marketing, and search engine optimization. With over half a decade of experience in content writing and editing, Parul has the expertise to simplify complex terms into engaging, valuable content for targeted audiences. She completed her graduation and post-graduation in English literature from Delhi University and was awarded the Dr. Asha Sahni Memorial Award for being the highest scorer in her graduating class.

Parul has contributed to the news, lifestyle, education, and health verticle of DNA India, India’s premier media channel. Outside of work, she can be found curating healthy recipes, coloring in mandala books, and spending quality time with her family.

Advisor

Steve Burlison is a senior advisor. He joined Software Advice in 2017 as a software advisor and is based in Austin, TX.

As part of the software advisor team, Steve helps HR and learning management industry professionals who are seeking tools such as recruiting, training, and talent management software. He provides a short list of personalized technology recommendations based on budget, business goals, and other specific needs.

Steve’s favorite part of being a software advisor is partnering with overwhelmed buyers to navigate the confusing software landscape; he enjoys discovering the specific tool a buyer needs and explaining how it will help them.

Sources

Software Advice advisor call notes: Findings are based on data from telephonic conversations that Software Advice’s advisor team had with businesses seeking payroll software. For this report, we analyzed phone interactions from January 10, 2024, to January 10, 2025. Read the complete methodology.

Software Advice software pricing data: Only products with publicly available pricing information and qualified software products within the category, as of January 2024, are included in the pricing analysis. Read the complete methodology.

Software Advice reviews data: Software Advice reviews are collected from verified users for individual software products. For this report, we analyzed reviews from the past year as of the production date. Read the complete methodology.

Payroll FAQs

- What is the best software for payroll?

According to our analysis of the most popular survey software, Rippling is the payroll solution with the highest overall rating. Check out our full methodology description for more details on this selection process.

- What software does a payroll specialist use?

Payroll specialists can rely on a suite of software tools to manage employee compensation and ensure compliance. Core payroll tools automate wage, tax, and deduction calculations, generate payments, and handle tax filings. These often integrate with time tracking, human resources systems with broader HR management capabilities like benefits, and accounting software to maintain accurate financial records.

- What is the best way to do payroll for a small business?

Compared to manual methods, payroll software automates calculations, tax filings, and reporting, saving time and reducing errors. While outsourcing offers hands-off management, it offers less direct control and can come at a higher cost for a small structure. Payroll software provides a cost-effective balance: more control and affordability than outsourcing, with greater accuracy and efficiency than manual payroll, making it a suitable solution for most small businesses.

- How do I choose a new payroll provider?

First, assess your business needs, including the number of employees, pay frequency, complexity of pay structures, and required integrations with other systems like time and attendance or accounting software. Then, evaluate potential providers based on their features, pricing, compliance capabilities (especially regarding tax calculations and filings), reporting options, user-friendliness, and customer support. It's crucial to request demos from multiple vendors to see the software in action and ask specific questions about your unique requirements. Finally, consider factors like vendor reputation, security measures, and implementation support before making a final decision.