Best Expense Report Software of 2026

Updated January 14, 2026 at 5:44 AM

Written by Amita Jain

Senior Content Writer

Edited by Mehar Luthra

Team Lead, Content

Reviewed by Bryan Dengler

Senior Advisor

Talk with us for a free 15-min consultation

Expert advisors like Jacqueline, who have helped 1,000+ companies, can find the right software for your needs.

- All Software

- Software Advice FrontRunners

- Popular Comparisons

- Buyer's Guide

- Frequently Asked Questions

Expense reporting software helps businesses track, approve, and reimburse employee expenses efficiently. Navigating 300 products, each built for different workflows, team sizes, and compliance needs, can be overwhelming. To help you narrow it down, I worked with our expense reporting software advisors to curate a list of recommended productsi and a list of the expense reporting software Frontrunners based on user reviews. For further information, read my expense reporting software buyer's guide.

Expense Report Software

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Emburse Expense Professional is an expense management platform designed to simplify expense reporting while addressing organizat...Read more about Emburse Expense Professional

Emburse Expense Professional's Best Rated Features

See All

Emburse Expense Professional's Worst Rated Features

See All

Rydoo is a business expense management solution. It automates expense flows and reimbursement cycles and enables expense control...Read more about Rydoo

Rydoo's Best Rated Features

See All

Rydoo's Worst Rated Features

See All

Tradogram is a cloud-based procurement management solution. Users can choose from a list of integrated modules such as supplier ...Read more about Tradogram

Tradogram's Best Rated Features

See All

Tradogram's Worst Rated Features

See All

Payhawk is a spend management platform that combines corporate cards, international bank payments, accounts payable, expense man...Read more about Payhawk

Payhawk's Best Rated Features

See All

Payhawk's Worst Rated Features

See All

Software Advice FrontRunners 2026

(4533)

(8328)

(215)

(3250)

(1710)

(4502)

(2233)

(1172)

(1104)

(257)

Best for Usability

Rippling

- Key FeaturesRippling's scoreCategory average

Expense Claims

5.04.59 category average

Expense Tracking

4.634.62 category average

Receipt Management

4.384.58 category average

- Screenshots

Best for Quick Implementation

Of the most popular expense report software, Ramp is the highest-rated application that also offers a free plan.

Ramp is a strong choice for startups and growing businesses that want to control their spending, automate expense reports, and issue employee cards without a subscription fee. The free plan gives beginners access to core expense management features without the overhead of subscription fees. It’s especially useful for finance teams looking to reduce manual work and improve visibility into company-wide expenses.

- Reviewers Perspective

“Ramp cards can be issued in seconds and have all the appropriate triggers to stop cards being abused if there isn't a valid receipt.”

LHLucien Hopkinson

VP of GTM

Used for 1-2 years

We analyzed 208 verified user reviews for Ramp to find out what actual users really think.

Expense management

Ramp simplifies expense tracking and reporting by combining card usage, receipt capture, and categorization in one place. You can monitor spending in real time, assign expenses to departments or employees, and convert them into reports without needing to use spreadsheets or enter data manually.Credit card management

The tool makes it easy to issue and activate both virtual and physical cards. You can set limits, track usage, and automate receipt matching, reducing admin work and fraud risk. Users say credit card management is easy to implement and use in daily operations.Reimbursement

With Ramp, users highlight the ease of managing reimbursements by referencing past expenses and maintaining compliance with company policies. However, a few report occasional difficulties in locating outstanding or paid reimbursements. - Key FeaturesQuickBooks Online's scoreCategory average

Expense Claims

4.274.59 category average

Expense Tracking

4.454.62 category average

Receipt Management

4.484.58 category average

- Screenshots

Most Used By Non-Profit Organization Management

Ramp

- Key FeaturesRamp's scoreCategory average

Expense Claims

4.864.59 category average

Expense Tracking

4.874.62 category average

Receipt Management

4.964.58 category average

- Screenshots

Highly Rated for Automation

Xero

- Key FeaturesXero's scoreCategory average

Expense Claims

4.414.59 category average

Expense Tracking

4.414.62 category average

Receipt Management

4.554.58 category average

- Screenshots

Best for User Interface

Wave

- Key FeaturesWave's scoreCategory average

Expense Tracking

4.404.62 category average

Receipt Management

4.464.58 category average

- Screenshots

Best for Mobile app

FreshBooks

- Key FeaturesFreshBooks's scoreCategory average

Expense Claims

4.434.59 category average

Expense Tracking

4.534.62 category average

Receipt Management

4.554.58 category average

- Screenshots

Highly Rated for Quick Adoption/Easy Adoption

SAP Concur

- Key FeaturesSAP Concur's scoreCategory average

Expense Claims

4.614.59 category average

Expense Tracking

4.564.62 category average

Receipt Management

4.544.58 category average

- Screenshots

Highly Rated for Integrations

Zoho Expense

- Key FeaturesZoho Expense's scoreCategory average

Expense Claims

4.634.59 category average

Expense Tracking

4.724.62 category average

Receipt Management

4.694.58 category average

- Screenshots

Most Rated for SMBs

webexpenses

- Key Featureswebexpenses's scoreCategory average

Expense Claims

4.554.59 category average

Expense Tracking

4.584.62 category average

Receipt Management

4.364.58 category average

- Screenshots

Most Rated for Enterprise

Teampay

- Key FeaturesTeampay's scoreCategory average

Expense Claims

3.04.59 category average

Expense Tracking

4.474.62 category average

Receipt Management

4.564.58 category average

- Screenshots

Sage Intacct

- Key FeaturesSage Intacct's scoreCategory average

Expense Claims

3.174.59 category average

Expense Tracking

4.224.62 category average

Receipt Management

4.444.58 category average

- Screenshots

Payhawk

- Key FeaturesPayhawk's scoreCategory average

Expense Claims

4.574.59 category average

Expense Tracking

4.464.62 category average

Receipt Management

4.474.58 category average

- Screenshots

Procurify

- Key FeaturesProcurify's scoreCategory average

Expense Claims

4.634.59 category average

Expense Tracking

4.664.62 category average

Receipt Management

4.704.58 category average

- Screenshots

Holded

- Key FeaturesHolded's scoreCategory average

Expense Tracking

4.144.62 category average

Receipt Management

4.144.58 category average

- Screenshots

Navan

- Key FeaturesNavan's scoreCategory average

- Screenshots

Elorus

- Key FeaturesElorus's scoreCategory average

Expense Tracking

4.784.62 category average

Receipt Management

4.604.58 category average

- Screenshots

FreeAgent

- Key FeaturesFreeAgent's scoreCategory average

Expense Claims

5.04.59 category average

Expense Tracking

4.724.62 category average

Receipt Management

4.674.58 category average

- Screenshots

TravelBank

- Key FeaturesTravelBank's scoreCategory average

Expense Claims

4.734.59 category average

Expense Tracking

4.754.62 category average

Receipt Management

4.744.58 category average

- Screenshots

Precoro

- Key FeaturesPrecoro's scoreCategory average

Expense Claims

4.04.59 category average

Expense Tracking

4.774.62 category average

Receipt Management

4.524.58 category average

- Screenshots

Coupa

- Key FeaturesCoupa's scoreCategory average

Expense Tracking

4.534.62 category average

Receipt Management

4.294.58 category average

- Screenshots

ExpensePoint

- Key FeaturesExpensePoint's scoreCategory average

Expense Claims

4.834.59 category average

Expense Tracking

4.814.62 category average

Receipt Management

4.704.58 category average

- Screenshots

Veryfi

- Key FeaturesVeryfi's scoreCategory average

Expense Tracking

4.794.62 category average

Receipt Management

4.784.58 category average

- Screenshots

Perk

- Key FeaturesPerk's scoreCategory average

Expense Claims

5.04.59 category average

Expense Tracking

4.554.62 category average

Receipt Management

5.04.58 category average

- Screenshots

- Key FeaturesRevolut Business's scoreCategory average

Expense Claims

3.504.59 category average

Expense Tracking

3.884.62 category average

Receipt Management

4.04.58 category average

- Screenshots

Methodology

The research for the best expense report software list was conducted in October 2025. We evaluated data (user reviews and demand signals) from the past 24 months as of the research date. Read the complete methodology.

Popular Expense Report Comparisons

Buyer's Guide

This detailed guide will help you find and buy the right expense management software for you and your business.

Last Updated on September 30, 2025Here's what we'll cover:

Benefits and competitive advantages of using expense reporting software

How to choose the best expense reporting software for your business

What you need to know about expense reporting software

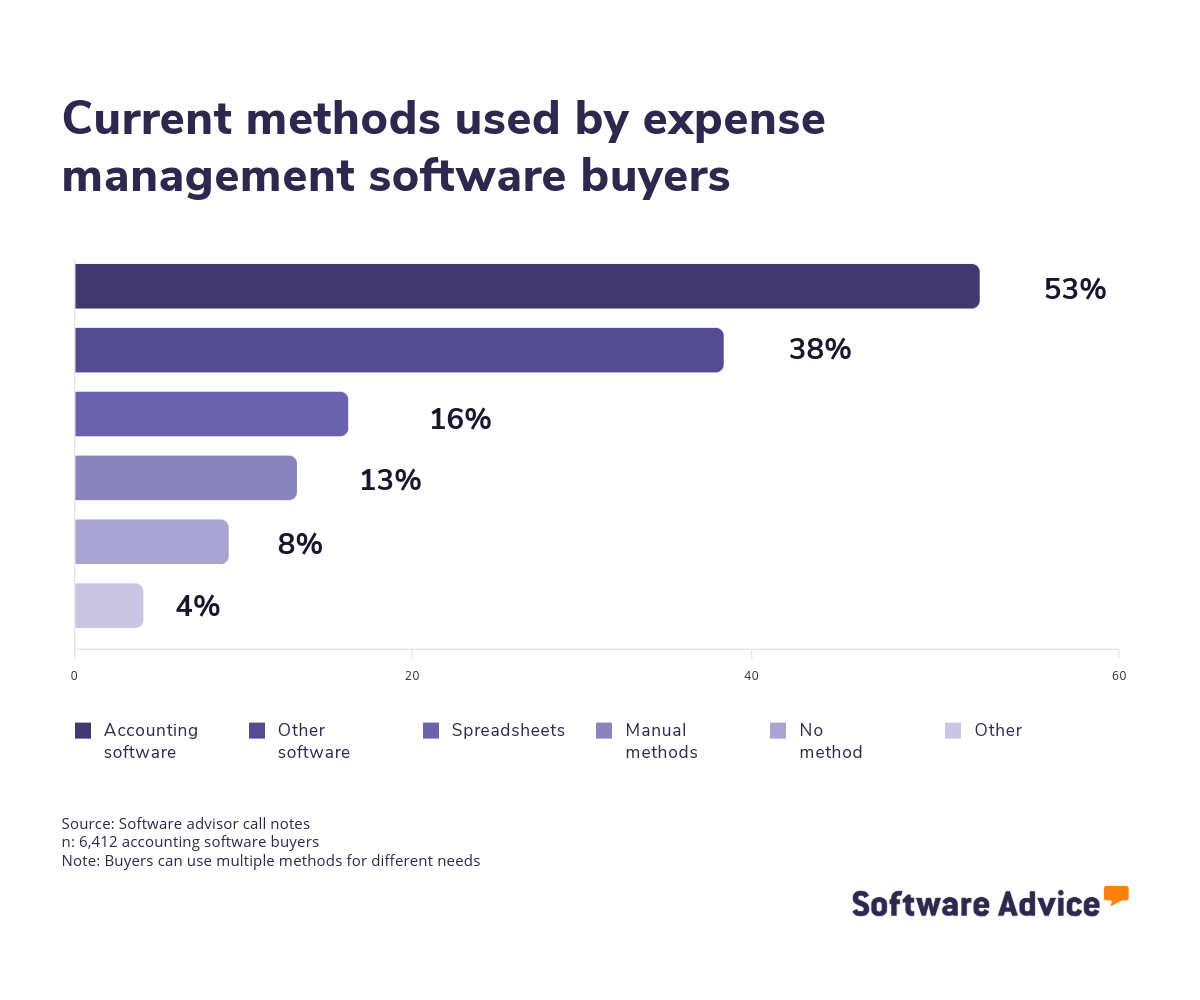

Expense reporting software (also called expense management software) helps businesses automate the tracking, management, and reimbursement of out-of-pocket expenses like meals, mileage, and other purchases made by employees for business purposes. Of the more than 6,500 accounting software buyers our advisors talked to in the past two years, 14% requested software with expense management capabilities. [1] Requests most often came from buyers in industries like non-profits (25%), consulting (9%), manufacturing (8%), and construction (8%), where project or client-related expense tracking is critical to operations.

The expense reporting software market is huge, with over 300 different expense reporting software products on our site and more than 13,000 verified user reviews published in the past two years alone. You know you need expense reporting software, but how do you figure out which platform is the right one for you?

Cost will obviously be a major factor. Although high-end systems can cost upwards of $45 per user, per month and more, entry-level systems average around only $14 per user, per month. [2] Plus, many expense reporting software vendors also offer free versions of their products.

First-time expense reporting software buyers should keep their budget, number of employees, feature needs, and necessary integrations in mind when comparing their options. You should meet with other stakeholders to figure out answers to critical questions about your purchase, such as:

Do we want to track expenses by project, department, or client?

What kind of approval workflows do we need?

Can we integrate it with our accounting system?

Do we need mobile receipt capture capabilities for field employees?

What kind of expense reports do we need to generate?

What types of user training resources are provided?

Researching different products to find the right one can feel like a long and daunting task. That’s why, with help from our experienced expense management software advisors McKenzie Anderson and Bryan Dengler, this guide offers everything you need to know about buying expense reporting software so you can make a quick decision with confidence.

What is expense reporting software?

Tracking expenses is an essential task for every company, and expense report software automates the process of managing business expenses, from recording an expense claim by an employee and routing it through appropriate managers for approval to final reimbursements. Not only does digitizing this process save time, but it reduces errors caused by manual data entry.

While the nuances in a system vary by provider, the key steps typically include:

Submitting a claim. The software allows employees to input their expenses (for example, travel costs, meals, office supplies), attach copies of receipts, and send expense reports for management approval, all through a web or mobile app. It also includes the ability to automatically import expenses from personal and company credit cards, so no expenditures are overlooked.

The software then allows organizations to process expense reports. This includes customizing the approval workflows (like by setting spending limits per expense category or creating rules dictating overall spending overrides as per company expense policies) and automating the routing of filed claims through appropriate managers for approvals.

Once approved, funds are reimbursed to employees, often through direct deposit allowing for quick and easy fund transfers so compensation is available for immediate use.

The software also syncs this data automatically with accounting systems for accurate financial record-keeping and spending analysis. This brings in the ability to track spends by expense category, project, department, or vendor, providing insight into spending trends and potential areas for cost savings.

In short, expense reporting software replaces manual expense spreadsheets and paper receipts with an efficient, transparent digital process that improves oversight into where money is being spent and makes the moving of claims easier.

Essential features of expense reporting software

All expense reporting systems offer core features like receipt capture and expense categorization. Beyond this, systems can have varied features ranging from approval process control, mobile receipt upload, to time tracking.

To help, here are the expense reporting features that reviewers rate as the most important: [3]

Core expense report features

Expense tracking: Maintain a detailed log of all business expenses. 89% of reviewers say this is a critical or highly important feature.

Receipt management: Capture, store, and organize receipts electronically in a centralized portal. 87% rate this as a critical or highly important feature.

Highly rated common expense report features

Mobile receipt uploads: Scan and upload receipt pictures using a mobile device and store them to the central database. 82% of reviewers say this is a critical or highly important feature.

Spend control: Set allowances and ensure employees don't spend more than the allotted amounts. 80% say this is a critical or highly important feature.

Mobile access: Capture and submit expenses on the go via mobile devices. 79% say this is a critical or highly important feature.

Compliance management: Enforce spending rules by flagging out-of-policy expenses (e.g. over budget limits, missing required information) and send managers alerts if a submitted expense violates company policy to catch errors or frauds early. 74% say this is a critical or highly important feature.

Approval process control: Customize routing of expense reports for manager approval and automate multi-level approvals and notifications, ensuring every expense is reviewed properly. 67% rate this as a critical or highly important feature.

Our advisor McKenzie Anderson notes that you may want to check if a system allows syncing expenses from a personal credit card. “A common question I get from buyers is whether they can use their personal cards or if they’ll have to use a company card through the solution.” This is an important feature consideration, especially for small businesses that don’t issue corporate cards.

Benefits of using expense reporting software

Of the buyers who contacted us in the past two years looking for accounting software, including expense management tools, 37% were still using manual methods like pen and paper, spreadsheets, or no methods at all for their accounting needs.

Not only does this lead to a lot of manual work and input errors, but it also ties up your skilled workforce (employees and accounts) on mundane jobs. As one of our advisors, Bryan Dengler, notes, “Many companies coming from manual processes are wanting to streamline and automate their expense management processes.” Dedicated expense management software not only saves time, but automates important tasks like submission, approval, and reimbursement of expense claims; making them much faster and accurate and with far less frustration for everyone involved.

In addition, our reviews data shows that expense reporting software offers other benefits, including:

Reduced processing time: One of the biggest wins of expense reporting software is a reduction in manual work. Automation features like optical character recognition (OCR) technology in receipt capture and automated approval workflows decrease processing time and allows teams to focus on more important tasks. So, instead of typing expenses into a spreadsheet, an employee can simply snap a photo of the receipt, and the software will auto-extract the details.

Improved policy compliance: Expense report software helps companies enforce spending rules consistently, for example, flagging any expense of over $100 or alcohol expense for review. This reduces accidental mistakes and prevents improper claims. As Anderson mentions, “Receipts can get lost,” but with a proper system, digital capture ensures they don’t, and rules can be set so that any out-of-policy expenses are caught upfront.

Better visibility into spending: Many expense tools provide real-time dashboards and automatic reports, giving finance teams and business leaders instant visibility into where the money is going. Also, because all expenses flow through one system, you can see up-to-date totals and breakdowns by category, employee, project, etc., on demand.

Enhanced employee experience: Mobile receipt capture and faster reimbursements improve employee experience. Some systems can even handle the entire planning and execution of travel plans while ensuring bookings only from approved vendors. As our advisor, Dengler, notes, “Many buyers are looking for the travel portion as well where they can book directly through the system for work expenses, whether it be hotel or airline,” adding further convenience for both employees and managers.

Ultimately, with the right expense reporting software, you can gain valuable insights into your spending habits, manage daily expenses and cash flow efficiently, and enhance the overall employee experience.

How to choose the best expense reporting software for your business

Step 1. Define your requirements

According to our 2025 Tech Trends Survey, the top change regretful software buyers would make is to better clarify their goals and desired outcomes right at the beginning [4]. Align all stakeholders in your expense management software purchase on the features you need and the specific metrics you’re trying to improve with a new system.

Keep these things in mind when defining your needs:

Create a list of must-have features and use cases

Identify what you need from an expense reporting solution. Do you need strict policy controls for compliance? Multi-level approvals? Integration with your accounting system or corporate credit card?

Also, consider the volume of expense reports you handle and the number of users (employees as well as managers) who will use the system. A small business with five employees might only need a simple tool for receipt capture and basic reports, whereas a midsize company with more employees could end up needing advanced analytics, multiple approval tiers, and support for international currencies.

Clarifying your requirements will save time and help you narrow down the hundreds of options available to you, providing a guidepost to measure the fit of a tool with your business.

Know how much expense reporting software really costs

The biggest component of expense reporting software is the subscription cost, which most often scales based on the number of users you need and the features offered. For context, over three quarters (78%) of expense management software buyers have budgeted under $50 per user, per month.

Standard entry-level plans often range around $14 per user, per month, while premium and advanced subscriptions can go up to $45 per user, per month. In addition to subscription costs, consider any other costs you may run into like paying extra for add-on features, implementation support, or personalized user training.

Keep necessary integrations top of mind

Expense report software should ideally connect with your existing accounting, enterprise resource planning (ERP), HR, and payroll systems to avoid data silos. Most providers also give access to pre-built integrations or application programming interfaces (APIs) to sync with third-party tools.

Verify that the platform you choose can import credit card transactions or export data to your ledger. Additionally, check the compatibility of the software with your employees’ most-used devices, including laptops and mobiles, and email software. Doing this will make sure you pick a system that fits in well with your business operations.

Step 2. Make your expense reporting software shortlist

With your budget and requirements in mind, it’s time to start researching different systems and create a shortlist of 2-3 products to evaluate further. Luckily, Software Advice has some useful resources, including online reviews and buyers guides, to help you pare down your options quickly.

Get qualified help from an advisor

At Software Advice, advisors like Anderson and Dengler have experience helping organizations identify expense management systems that match their needs and budgets.

If you need help, you can either schedule a phone call with an advisor or chat online with one right now. In just a few minutes, your advisor will help you craft a shortlist of expense reporting software options that best align with your requirements.

Explore our list of expense reporting FrontRunners

If you’d rather do the research yourself, a good place to start is our 2025 expense reporting FrontRunners report. Using reviews data, we map the top products in the category based on customer satisfaction and usability.

Step 3. Pressure test the best options

The next step after putting together your shortlist is to investigate your top options further by talking with vendors, taking part in demos, and getting hands-on experience through free trials. Here’s our advice for this stage.

Ask the right questions during demos

Virtually every vendor will offer a live demo. Software vendors are incentivized to show their product in the best light during a demo. To cut through the marketing clichés and see if a system will fulfil your needs, consider asking a few scenario-based questions, such as:

How would your system handle an expense that exceeds the pre-set limit?

Can it support multi-currency expenses for our overseas team?

Can you show us how to set up approval workflows for the legal department?

How often do you update your software, and what kinds of features are on your roadmap for future updates?

What kind of support do you offer during implementation?

You can also use our ultimate software vendor comparison chart to keep track of your scores and answers.

Take advantage of free trials

The free trial period is another important factor that can guide you in the final software buying decision, according to our research. During this time, have some employees and managers simulate the expense process of your company, submit test reports, approve them, generate reports, etc. This hands-on approach will quickly reveal how intuitive the interface is and if the features you need are implemented well.

Pay attention to things like: does the mobile-app make capturing receipts easy? Can managers easily review and approve or reject with appropriate reasons? Do the key integrations (like syncing of reimbursement data with accounting software) work perfectly?

Also, ensure all types of users (IT administrators, managers, and employees) try out the systems on your shortlist and give their feedback.

Step 4. Make the most of your expense reporting software

Choosing the right software is only part of the process; implementing it effectively is a crucial piece of the puzzle for success. Once you’ve selected a solution, create a detailed plan for a smooth rollout.

Establish an internal point of contact

This person will be your ‘expense champion’ (perhaps from the finance team), who can answer user questions and liaise with the vendor if any problems arise. Your employees should understand why the new system is an improvement over the old process (you can emphasize faster reimbursements and less paperwork). The important part is to aim to get buy-in from all stakeholders involved.

Work with the vendor on an implementation plan

Configure the software to your policies (e.g. set up approval flows, spending limits, integration connections) and migrate any existing expense data if needed. It’s often helpful to roll out the software in phases. You can start with a single department or a small pilot group to iron out any issues and then expand company-wide.

Ensure you provide adequate training to employees and approvers

This could include in-person workshops, video tutorials, or even just a clear one-page cheat sheet on how to submit an expense report and attach receipts. Most modern expense tools are easy to use, but training helps avoid confusion and builds confidence in the new process.

Gather user feedback

During the first few weeks, gather feedback from all involved and be ready to adjust settings and provide additional support. A thoughtful approach to implementation, strong communication, training, and gradual adoption can increase the likelihood of high user adoption and software success.

Software related to expense reporting

Maybe you’re looking for something similar to expense reporting software, yet slightly different. Or maybe you need other software to help with other finance-related needs.

To help, here are some other types of software related to expense reporting software to consider:

Accounts payable software: Accounts payable (AP) solutions streamline the entire process of receiving, processing, and paying vendor invoices. While expense reporting focuses on employee expenses, AP software handles vendor bills.

Travel management software: Helps organizations manage the entire travel process, from booking to expense reimbursement. This is ideal if your primary focus is on managing business travel rather than general expenses.

Policy management software: Enables companies to create, review, approve, and store policies according to the established workflow.

Enterprise resource planning (ERP) software: These help manage all aspects of a business, including accounting, inventory, human resources, and more. Expense reporting is often a module within an ERP system.

More resources for your expense reporting journey

How Automated Expense Management Simplifies Your Financial Workflow

Small Business Guide To Set Up an Effective Accounting Function: 5 Essentials

Double-Entry Bookkeeping 101: A Practical Guide for Small Businesses

Accounting Process Automation: How to Get Started and What to Consider

6 Accounting Reports To Analyze Your Small-Business Operations

About our contributors

Author

Amita Jain is a senior writer for Software Advice, covering finance technology with a focus on expense management and accounting solutions for small-to-midsize businesses. After completing her master’s in policy studies from King’s College London, she began her career as a journalist in New Delhi, India, where she garnered first-hand knowledge of the startup space and the education sector. She spent nearly half a decade covering high-level events hosted by the United Nations and the Government of India. Her work has been featured in Careers360, among other publications.

Amita’s research and writing for Software Advice is informed by more than 130,000 authentic user reviews and over 30,000 interactions between Software Advice software advisors and software buyers. Amita also regularly speaks to leaders in the finance and accounting space so she can provide the most up-to-date and helpful information to small and midsize businesses purchasing software or services.

When she’s not contemplating tech solutions for SMBs, Amita finds her zen in swimming, doodling, and indulging in animated sitcoms and science fiction.

Editor

Mehar Luthra is a team lead at Software Advice and specializes in editing reports that cover the latest trends affecting small businesses. With nearly a decade of experience, she has edited a multitude of research articles, top-rated software reports, and thought leadership articles for diverse markets such as Brazil, Japan, Canada, France, Australia, and India. She finds it particularly rewarding to produce content that provides small-business owners with practical tips and helpful advice on topics such as the digitalisation of small businesses, eCommerce trends, and HR developments.

Armed with a double bachelor’s in law (LL.B.) and business economics from Delhi University, she won a full scholarship to study for a master’s in creative writing at the National University of Ireland, Galway. In addition, she has written blog articles spanning a variety of topics such as fiction and non-fiction books, mental health and anxiety, the latest restaurants, and more. Her articles have been featured in Ireland’s national magazine The Village, among other publications. A die-hard journaling fan, she enjoys watching psychological thrillers, reading fiction books, and drinking iced coffee (even in the winter).

Advisors

Years in role: 3

Location: Austin, TX

As a Senior Advisor, I engage with approximately 25 small and midsize business owners weekly, enabling them to pinpoint the perfect software match. I do this by nailing down their unique requirements and streamlining the selection process from a vast array of options to the top three to five tools in a single consultation. Through personalized consultations, I specialize in understanding the software needs of businesses in my areas of expertise, which include:

Accounting

Manufacturing

Learning Management Systems (LMS)

Supply Chain Management

The software landscape can be daunting, and I often hear the hurdles business leaders encounter in our discussions. It's fulfilling to provide guidance that genuinely impacts their decisions. What I love most about assisting software buyers is reaching the end of a call and realizing I've positively influenced someone's life and work.

Sources

Software Advice advisor call notes: Findings are based on data from telephonic conversations that Software Advice’s advisor team had with small-to-midsize businesses seeking accounting software, including expense management applications. For this report, we analyzed phone interactions from the past two years as of the production date. Read the complete methodology.

Software Advice software pricing data: Only products with publicly available pricing information and qualified software products within the category, as of the production date, are included in the pricing analysis. Read the complete methodology.

Software Advice reviews data: Software Advice reviews are collected from verified users for individual software products. For this report, we analyzed reviews from the past two years as of the production date. Read the complete methodology.

Software Advice’s 2025 Tech Trends Survey was conducted online in August 2024 among 3,500 respondents in the U.S. (n=700), U.K. (n=350), Canada (n=350), Australia (n=350), France (n=350), India (n=350), Germany (n=350), Brazil (n=350), and Japan (n=350), at businesses across multiple industries and company sizes (five or more employees). The survey was designed to understand the timeline, organizational challenges, adoption & budget, vendor research behaviors, ROI expectations and satisfaction levels for software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.

Expense Report FAQs

- What is the best expense reporting software?

Based on our analysis of over 13,000 reviews from verified expense reporting software users, Zoho Invoice had the highest overall rating. Our analysis finds online invoicing, invoice processing, and customizable invoices as its top-rated features. Having said that, the best expense reporting software depends on what you’re looking for. If ease of use is your priority, you might prefer a system with a great mobile app for capturing receipts on the go. If compliance is critical to you, you may want to look for software with automated policy enforcement and multi-level approvals.

- Is there free expense reporting software?

Yes, many expense reporting tools offer free plans, but they usually come with limits, such as a cap on the number of users or reports per month. If you’re a freelancer or a startup with a small team with simple expense tracking needs, a free version could be enough. Among the over 300 expense reporting products we analyzed, Ramp was rated best for free expense reporting software.

- What is the best way to keep track of expenses for a small business?

For small businesses, the easiest way to track expenses is with a tool that integrates with your accounting system. Many small businesses start with an affordable expense tracking app that lets employees submit expense claims and automatically categorize them. If you’re still using spreadsheets, making the switch can save you hours of manual work each month and give you better oversight into your spending habits.

- How to record expenses for a small business?

The best approach is to categorize expenses as they happen. Don’t wait until tax season whether you’re using software or a spreadsheet. Make sure you log every expense (date, amount, category), keep digital copies of receipts (many expense tools let you snap a picture and store it), separate business and personal spending (keep a dedicated business account or card), and reconcile expenses with your accounting software regularly (integrate your expense system with your accounting software for automatic reconciliations). Also, make sure to set clear submission deadlines for employees and configure your software to flag out-of-policy expenses.