Best Payroll Software for Accountants of 2026

Updated January 27, 2025 at 9:57 AM

- Popular Comparisons

- FrontRunners

- Buyers Guide

Compare Products

Showing 1 - 25 of 146 products

Compare Products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

BambooHR centralizes your HR data, automating key tasks like payroll, benefits, and employee management. Streamline processes fr...Read more about BambooHR

BambooHR's Best Rated Features

See All

BambooHR's Worst Rated Features

See All

Rippling is an integrated workforce management platform that unifies HR, IT, and finance tools to streamline operations. It cent...Read more about Rippling

Rippling's Best Rated Features

See All

Rippling's Worst Rated Features

See All

TriNet's HR Plus is outsourced HR services plus HR technology to help your business thrive. Our all-in-one HR platform helps you...Read more about TriNet HR Plus

TriNet HR Plus's Best Rated Features

See All

TriNet HR Plus's Worst Rated Features

See All

RUN Powered by ADP is a smart, simple payroll and HR solution designed to help small businesses pay people confidently and stay ...Read more about RUN Powered by ADP

RUN Powered by ADP's Best Rated Features

See All

RUN Powered by ADP's Worst Rated Features

See All

Paycor’s HR & payroll platform connects leaders to people, data, and expertise. Our comprehensive HR and talent platform combine...Read more about Paycor

Paycor's Best Rated Features

See All

Paycor's Worst Rated Features

See All

ADP Workforce Now is an HR suite that combines all core payroll and HR management processes into a single database-driven platfo...Read more about ADP Workforce Now

ADP Workforce Now's Best Rated Features

See All

ADP Workforce Now's Worst Rated Features

See All

Asure’s end-to-end Payroll, HR, and Time and Attendance solutions were developed specifically for small to mid-sized businesses....Read more about Asure

Asure's Best Rated Features

See All

Asure's Worst Rated Features

See All

Vista is a comprehensive human capital management (HCM) software solution. It is designed for mid-size companies and enterprises...Read more about PDS Vista

Tired of juggling disconnected systems for HR, Finance, and IT? Wasted time and manual work slow your business down. Paylocity i...Read more about Paylocity

Paylocity's Best Rated Features

See All

Paylocity's Worst Rated Features

See All

UKG Pro Human Capital Management (HCM) software is a workforce management solution designed to align people strategy with busine...Read more about UKG Pro

UKG Pro's Best Rated Features

See All

UKG Pro's Worst Rated Features

See All

Patriot Payroll is a cloud-based payroll solution that supports multiple pay rates, enabling businesses to cater to various comp...Read more about Patriot Payroll

Patriot Payroll's Best Rated Features

See All

Patriot Payroll's Worst Rated Features

See All

Dayforce is an AI-powered people platform, delivering simplicity at scale with a full-suite HCM solution. Designed as a single, ...Read more about Dayforce HCM

Dayforce HCM's Best Rated Features

See All

Dayforce HCM's Worst Rated Features

See All

iCIMS is a leading provider of talent acquisition technology that enables organizations everywhere to build winning workforces. ...Read more about iCIMS Hire

iCIMS Hire's Best Rated Features

See All

iCIMS Hire's Worst Rated Features

See All

Payroll Relief is a cloud-based accounting software designed to help human resource (HR) professionals manage and streamline pay...Read more about Payroll Relief

Payroll Relief's Best Rated Features

See All

Payroll Relief's Worst Rated Features

See All

Nowsta is a cloud-based workforce management solution designed to help businesses streamline the entire employee lifecycle, from...Read more about Nowsta

Nowsta's Best Rated Features

See All

Nowsta's Worst Rated Features

See All

Employment Hero is a cloud-based human resource management (HRM) system for small and medium businesses on the up. The solution ...Read more about Employment Hero

Employment Hero's Best Rated Features

See All

Employment Hero's Worst Rated Features

See All

Designed for home care agencies and skilled nursing facilities, Viventium Software is a cloud-based solution that helps organiza...Read more about Viventium Software

Viventium Software's Best Rated Features

See All

Viventium Software's Worst Rated Features

See All

Rise is a cloud-based human resources (HR) solution that helps companies engage with their employees and action all HR functions...Read more about Rise

Rise's Best Rated Features

See All

Rise's Worst Rated Features

See All

WorkforceHub is a cloud-based time, attendance, and leave management system for small to mid-size businesses. This software capt...Read more about WorkforceHub

WorkforceHub's Best Rated Features

See All

WorkforceHub's Worst Rated Features

See All

Darwinbox is a new-age and disruptive mobile-first, cloud-based HRMS platform built for large enterprises to attract, engage and...Read more about Darwinbox

Darwinbox's Best Rated Features

See All

Darwinbox's Worst Rated Features

See All

Umana from Carver Technologies is an integrated human resources (HR), time and payroll management solution designed to serve mid...Read more about Umana

OnPay is a cloud-based payroll solution that helps small businesses automate tax filing and payment workflows. Key features incl...Read more about OnPay

OnPay's Best Rated Features

See All

OnPay's Worst Rated Features

See All

Bright offers a suite of industry-leading software solutions for accountants, bookkeepers and SMEs across the UK and Ireland. Ou...Read more about Bright

Bright's Best Rated Features

See All

Bright's Worst Rated Features

See All

Timesheets.com provides cloud-based time tracking for small and midsize businesses. The service allows employers to track both h...Read more about Timesheets.com

Timesheets.com's Best Rated Features

See All

Timesheets.com's Worst Rated Features

See All

Calamari is a platform with tools for collecting and sharing information about people and their work. Pay only for the tools yo...Read more about Calamari

Calamari's Best Rated Features

See All

Calamari's Worst Rated Features

See All

Popular Comparisons

Your Guide to Top Payroll Software for Accountants Software, August 2022

Software Advice uses reviews from real software users to highlight the top-rated Payroll Software for Accountants products in North America.

Learn how products are chosenExplore FrontRunners

“Usability” includes user ratings for Functionality and Ease of Use.

“Customer Satisfaction” includes user ratings for Customer Support, Likelihood to Recommend and Value for Money.

Reviews analysis period: The reviews analysis period spans two years and ends the 15th of the month prior to publication.

Buyers Guide

This detailed guide will help you find and buy the right payroll software for accountants for you and your business.

Last Updated on January 27, 2025Whether you're a solo CPA or one of many at a large accounting firm, offering employee payroll services to clients can represent a significant boost to your bottom line.

It can also present significant challenges.

Not only do you need to ensure that all of your clients' employees are paid accurately and on time, but there's also the matter of making sure the government gets their correct cut too—something that's often easier said than done. The IRS estimates 40 percent of small to midsize businesses (SMBs) end up paying a payroll penalty each year due to an incorrect filing.

With so much on the line, having the right payroll software is crucial. But which system is best suited to meet your specific needs as an accountant?

This Buyer's Guide aims to provide some guidance. Below, you'll find information about payroll software functionality, pricing and more to help in your software search.

Click a link below to jump to that section:

What Is Payroll Software for Accountants?

Common Functionality Found in Payroll Software for Accountants

Benefits of Payroll Software for Accountants

How Much Does Payroll Software Cost?

What Is Payroll Software for Accountants?

Payroll software for accountants allows CPAs to manage worker wage information, calculate amounts for employee compensation and withheld taxes, do payroll runs, generate reports and more. Many popular payroll software systems cater to both internal accountants and outsourced accounting firms.

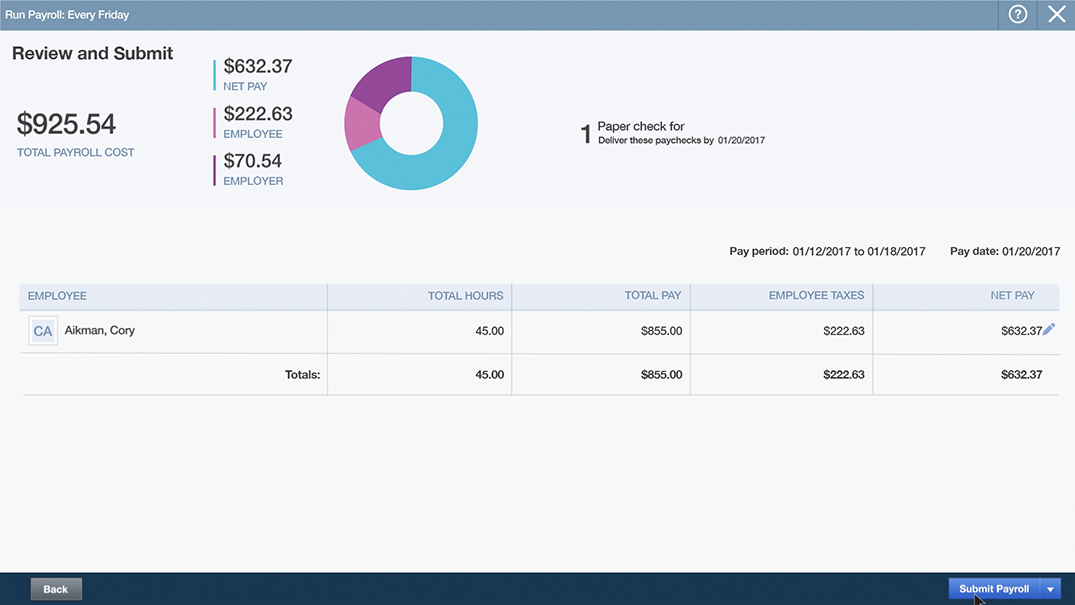

An example payroll run in QuickBooks Full Service Payroll

Payroll software offers accountants a secure digital environment to automate processes, set reminders and manage a vast amount of payroll data over time.

Common Functionality Found in Payroll Software for Accountants

Browsing through payroll vendor websites can quickly become overwhelming if you're not sure what you're looking for. To help, here are some common functions you can expect to find in most systems:

Employee management | Track individual employee pay rates (hourly or salaried), withholding information for benefits and paid time off (PTO). |

Time tracking | Input hours worked, or pull them from an integrated time and attendance system, to calculate correct wages. |

Run payroll | Set a payment period (biweekly, monthly etc.) and calculate the total payroll cost for that period. |

Payroll allocation | Deposit owed payroll amounts to workers in their preferred form (direct deposit, check printing or pay card). |

Tax management | Calculate correct amounts for local, state and federal payroll taxes and file automatically. |

Accounting integration | Automatically log payroll amounts in the company ledger through integrated accounting software. |

Reporting | Generate standardized reports detailing organizational payroll costs. |

There can be small differences in features within these functions between products. For example, some products offer multistate or even multicountry payroll, while others don't. Another example is some payroll platforms can generate W-2s and 1099s for workers come tax time.

One increasingly popular feature is an employee self-service portal where workers can log in to do things such as update their bank accounts or download past pay stubs themselves.

Benefits of Payroll Software for Accountants

In a 2015 report, Software Advice learned that one in every five payroll software buyers still relies on manual methods such as spreadsheets or pen and paper to handle their payroll needs. If you fall into this group, it's time for an upgrade.

Here are some benefits that dedicated payroll software can bring over manual methods:

Fewer errors. Clerical errors can lead to costly overpayments and penalties. Payroll software can calculate accurate wages and highlight any missing fields or strange discrepancies to ensure you don't make any major mistakes.

Less security risk. Features such as multifactor authentication and SSL encryption found in payroll software can mitigate the chances of your sensitive payroll data getting lost or falling into the wrong hands.

More time to focus on other needs. With features such as one-click payroll runs and automatic report generation, you can cut the time it takes to do payroll for a company from a few hours down to a few minutes.

How Much Does Payroll Software Cost?

How much you pay for a payroll software system is going to largely depend on two factors: the breadth of functionality in your system of choice and the number of employees you're doing payroll for. The more advanced the system is and the more employees you need to manage, the greater the cost.

Because most systems are cloud-based (meaning the software is hosted by the vendor on their own servers for you to access via a web browser), payroll software is almost always sold through subscription licensing. In other words, you should expect to pay a flat fee every month, every year or every pay period to use the software.

Software license prices can range from as little as $10/month for one employee all the way up to $3,500/month for 250 employees or more.

Download our payroll software pricing guide to learn specific cost information for popular systems such as Gusto, Xero and QuickBooks.

Final Considerations

We've covered the basics, but there are still a number of factors to consider when deciding which payroll system is right for you or your firm. Here are some last things to keep in mind during your search:

Do you need full service payroll? A number of payroll software vendors offer a “full service payroll" option where all you have to do is enter employee wage information and the vendor's team of experts will take care of the rest: running payroll, submitting tax forms, printing checks etc. This option tends to be geared toward small business owners who don't know a thing about payroll, but accountants can benefit too if they're looking to offload some work.

Pay attention to the UI and workflow. Payroll software products tend to have a lot of the same functions and features due to the payroll process being so standardized. Where they really differentiate is in their user interface (UI) and workflow. Demo systems and find one that's intuitively designed and easy to use.

Ask an expert. If you're overwhelmed by the software options available to you, don't worry. Give us a call at (844) 852-3639 and talk to one of our payroll software experts. We'll ask a few questions about your needs and send you a shortlist of best-fit, highly-rated products. This service is completely free, so don't hesitate.